Real-world asset (RWA) tokens can democratize access to investments previously inaccessible to retail traders, similar to how exchange-traded funds (ETFs) expanded retail access to financial instruments when they debuted in 1993, according to Christopher Perkins, president and managing partner of investment firm CoinFund.

“I believe tokens are the new ETFs,” Perkins told Cointelegraph in an interview. The executive said tokenized RWAs, which trade 24/7 on globally accessible markets, reduce the information asymmetry that has typically kept retail investors out of private placements under existing accreditation laws. He added:

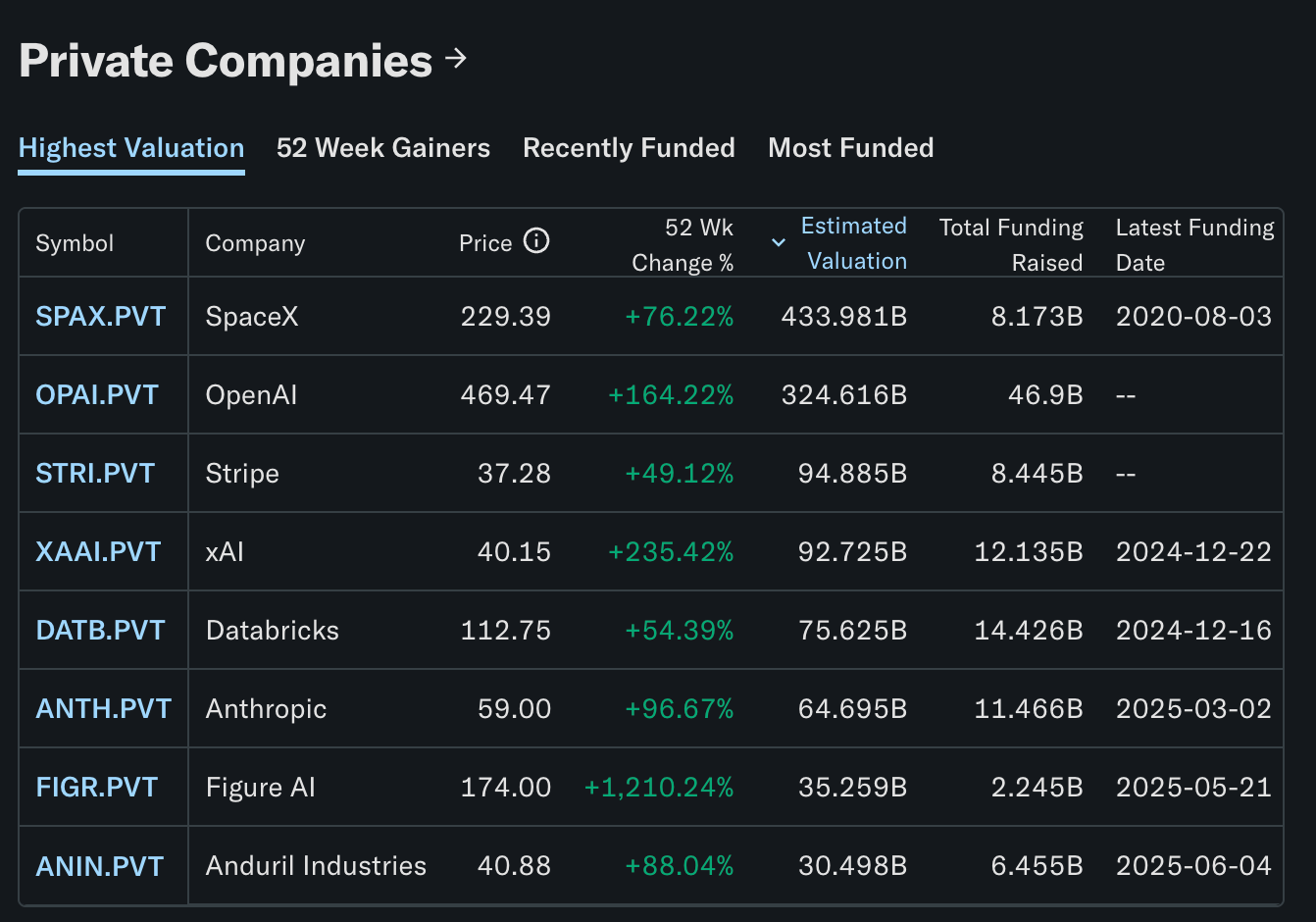

“Ordinary people cannot access private markets. They’re private by their nature. And if you look in the US today, about 81% of companies — this is a BlackRock stat — with $100 million in revenue are private.

Essentially, that leaves ordinary people, normal people, very little access to what are the most exciting, the most innovative companies,” he continued.

Tokenized RWAs offer a compelling use case for blockchain technology that can increase capital velocity, enable equity financing through asset fractionalization, create new kinds of collateral for decentralized finance (DeFi) applications, overhaul current capital formation structures, and democratize investor access to global capital markets.

Related: Tokenized equity still in regulatory gray zone — Attorneys

Public investment opportunities in TradFi drying up

“Our public markets are completely broken right now. The system is not working as it was designed. The number of public companies is decreasing materially,” Perkins told Cointelegraph.

The number of public companies has fallen by about 50% since the 1990s, according to the executive. “We are raising less money in public markets, which makes zero sense,” he added.

Brokerage platform Robinhood recently debuted tokenized stock trading for European customers. As part of the push into tokenized equities, the platform announced it would distribute a small number of OpenAI and SpaceX “private equity” tokens to clients.

The tokens provide retail investors with price exposure to the underlying private companies but no stake in the actual businesses or voting rights.

OpenAI was quick to warn any prospective tokenholders that the tokens do not represent a stake in the AI firm and that the company did not approve the tokens.

Despite this, private companies continue to express interest in being listed on the tokenized platform, according to Robinhood CEO Vlad Tenev.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs: Inside story