Bitcoin has gained more than 3.10% to a level of $64,790. Over the weekend, we saw increases on Saturday followed by a slight correction on Sunday. However, at the opening of the cash session in the Asia-Pacific region, Bitcoin’s price rebounded significantly and resumed its upward trend.

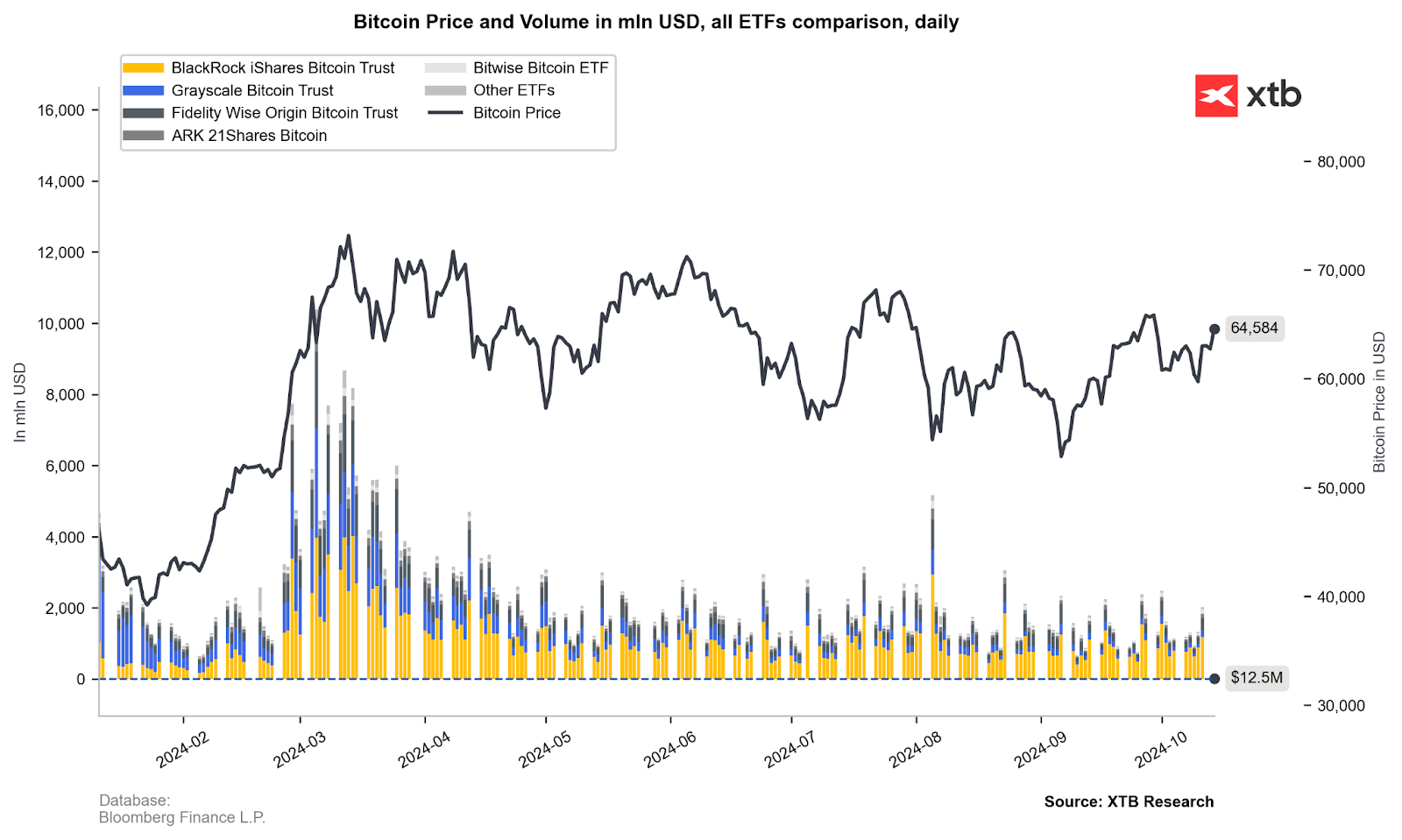

Better sentiment is also supported by inflows into spot ETFs. Friday’s data showed net inflows of as much as $253 million, matching the net inflows from last Monday. In total, ETFs now hold Bitcoin worth $18.4 billion.

Despite the high net inflows in recent days, volumes remain relatively low, around $2 million, suggesting continued low interest in the crypto market. In the first quarter of this year, volumes reached as high as $8-10 billion alongside the dynamic price rise of Bitcoin. Currently, we are in a long-term sideways trend, which explains the low volume.

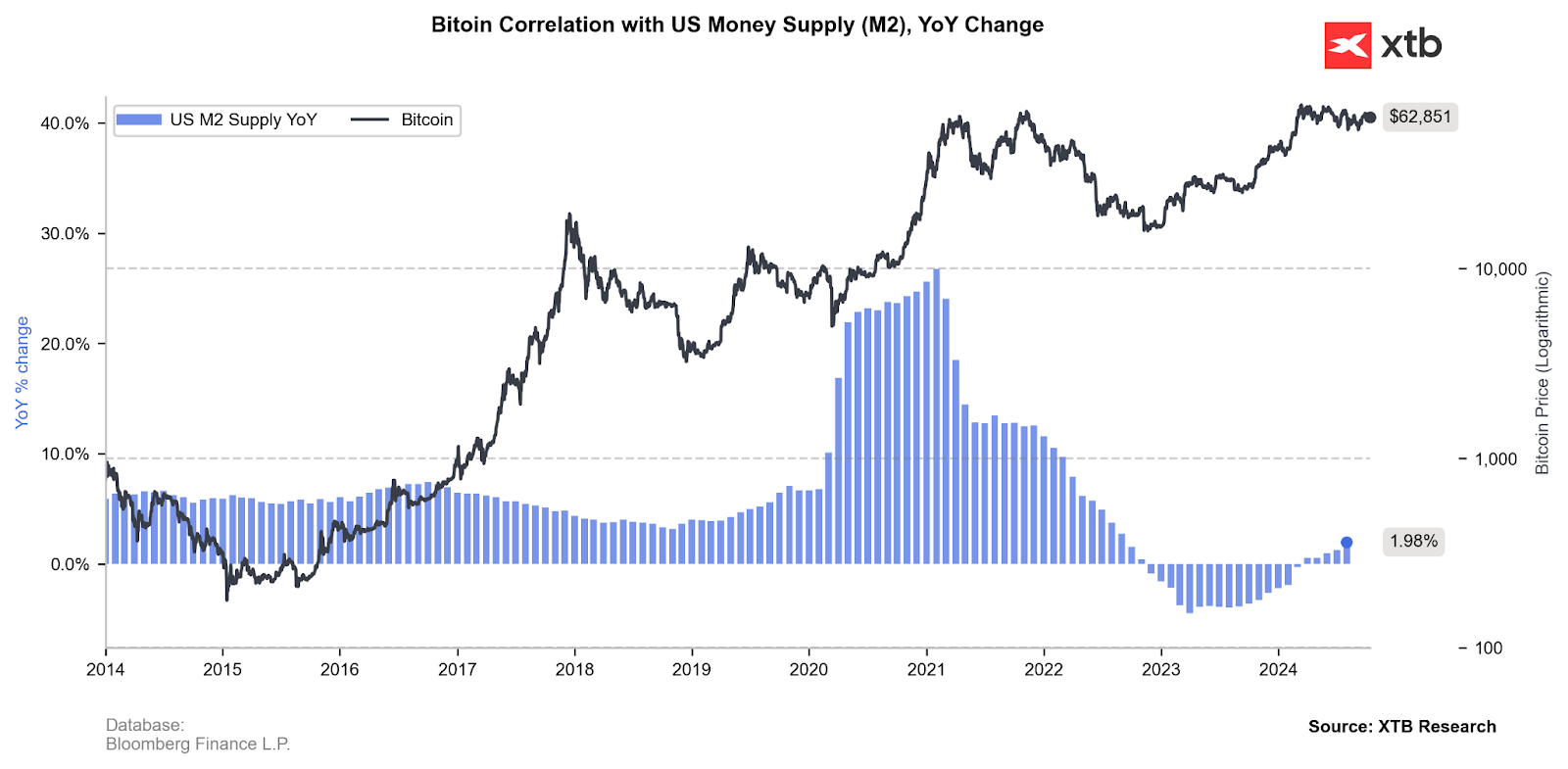

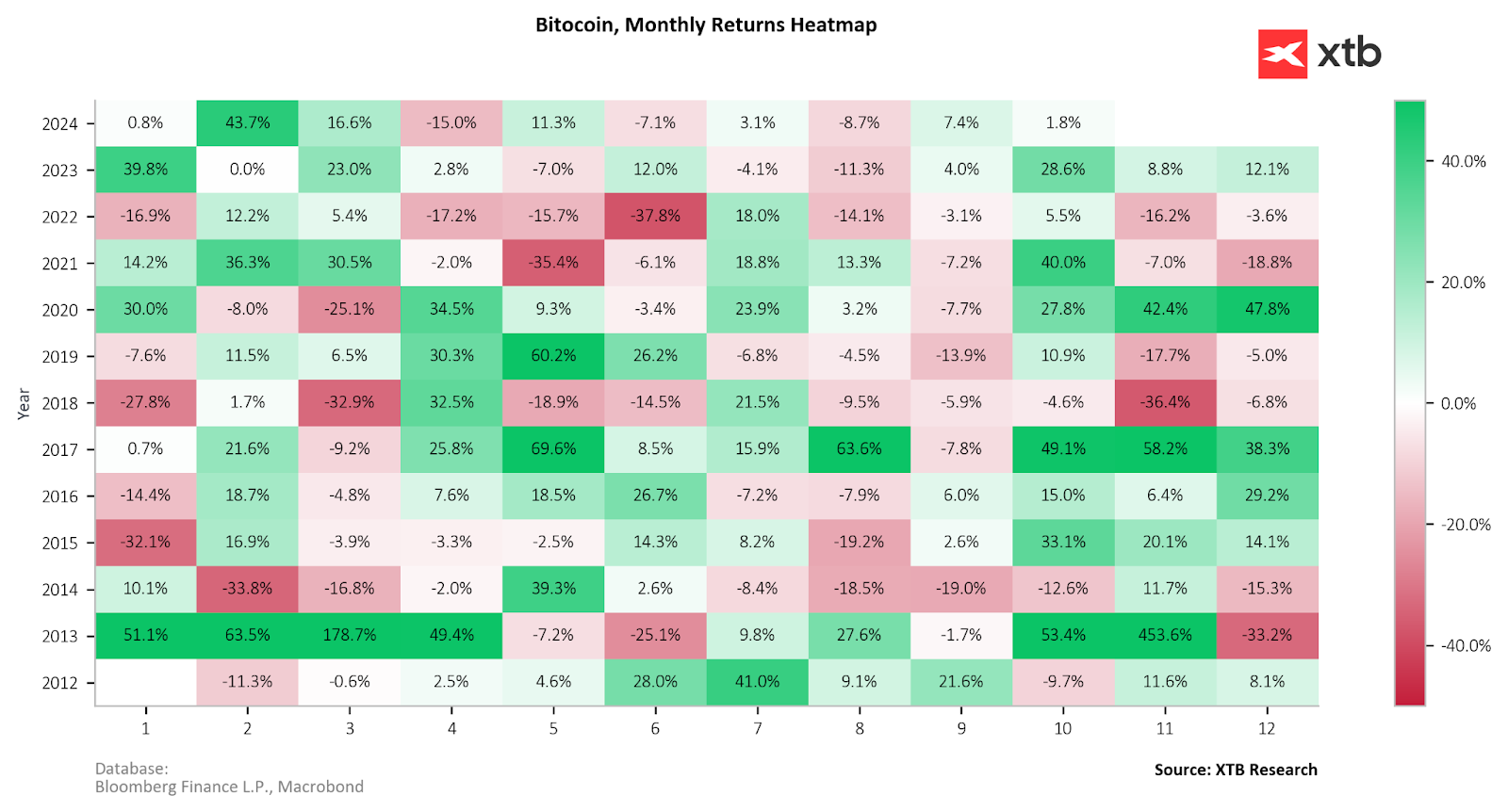

After a seasonally weak September, which ultimately turned out to be relatively strong, we are now entering two of the best seasonal months—October and November. October returns have often reached double-digit values. Looking at previous years, it is worth noting that 9 out of the last 12 Octobers have been positive. However, it is important to remember that the most crucial factor that could determine sentiment in the crypto market remains the macroeconomic situation in the US and Wall Street.