Solana ETFs have now extended a twenty-day inflow streak during a turbulent crypto market with nearly $400 million in inflows.

Solana ETFs keep drawing new money into the market even as the crypto space faces swings.

The steady flow of capital into these funds shows that investors still have a strong interest in Solana during such a difficult period for digital assets.

Recent data shows how this trend has held firm for twenty straight trading days, which places Solana ETFs among the most consistent performers in the market right now.

Solana ETFs See Persistent Buying Interest

Solana ETFs in the United States posted their twentieth consecutive day of inflows on Monday.

This streak started when the products launched near the end of October. Since then, they have attracted fresh investment almost every single day. So far, heavy selling across the crypto market has not slowed the demand.

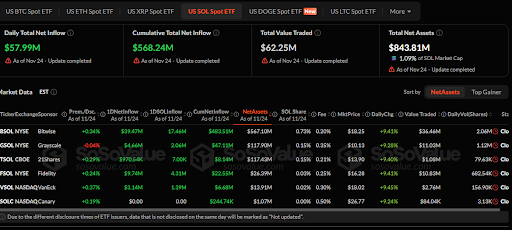

Farside Investors recently reported that Solana spot ETFs brought in another $58 million at the start of the week. Bitwise’s BSOL took in $39.5 million alone and that figure marks the strongest daily intake since early November.

It also ranks as the third-largest since the launch.

Total inflows for all Solana ETFs have now crossed $568 million, with nearly $400 million coming in in November alone. Combined net assets across the six funds now stand at about $843.8 million and this represents a little more than 1% of Solana’s total market value.

Strong Buying Spreads Across XRP ETFs

Other areas of the market also saw active buying. XRP-focused ETFs recorded $164 million in inflows on Monday. It was their second-strongest day since setting a record on November 14.

Grayscale and Franklin Templeton each brought in more than $60 million. Bitwise and Canary also saw new activity, which helped lift the group’s total for the day.

The interest in XRP ETFs shows that investor demand is not only centred on Solana.

Instead, it spreads across several assets even during market stress. Even though prices in the spot market remain under pressure, the current ETF flows are showing that certain segments of the investment community continue to add exposure.

New Dogecoin ETF Launches on the NYSE

Grayscale launched a new Dogecoin ETF on Monday under the ticker GDOG on the New York Stock Exchange.

Trading volume reached $1.41 million on its first day but the debut did not lead to net inflows. Instead, the activity shows that interest in new crypto funds remains healthy.

Grayscale Dogecoin Trust ETF (Ticker: $GDOG) offers investors direct exposure to $DOGE. $GDOG starts trading on @NYSE Arca tomorrow. pic.twitter.com/AJUFAnY4K1

— Grayscale (@Grayscale) November 24, 2025

The launch adds another product to the growing list of single-asset crypto ETFs available to US investors.

The performance of GDOG over the coming weeks will likely depend on market conditions and retail demand, even though early volume is showing signs of awareness.

Related Reading: New Solana Proposal Could Shift SOL Dynamics – ETFs Hit 19-Day Streak as Price Holds $130

Growing Institutional Use of Solana Technology

Solana’s presence in real-world finance is one of the most important parts of its growth lately. Interest in tokenization is expanding across several industries and firms see Solana’s network design as suitable for experiments.

This is especially true for experiments involving tokenised stocks, funds or other assets.

Projects like xStocks are attempting to use Solana to make access to United States equities easier. This type of activity is what sets up Solana as a network used for more than trading.