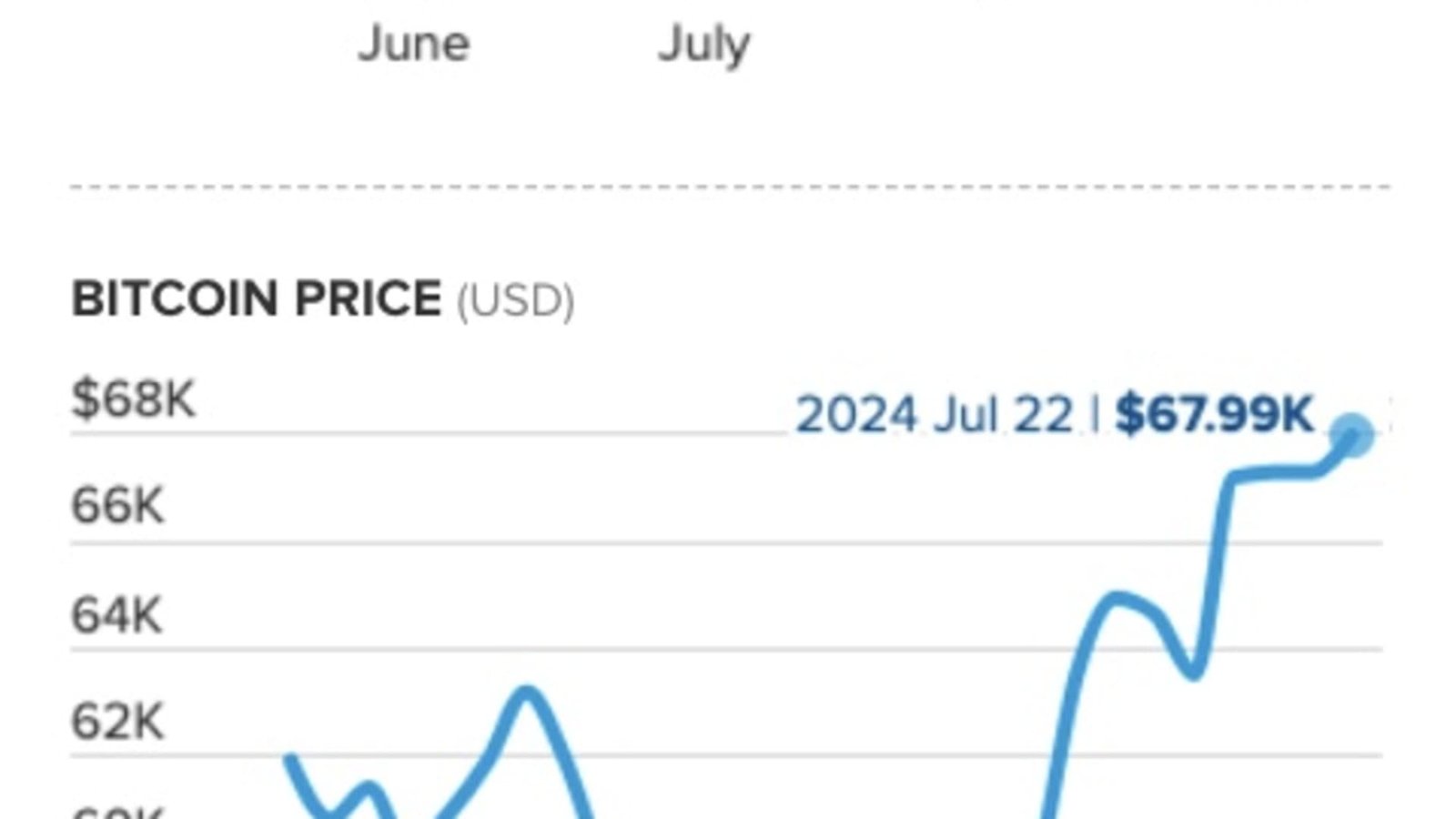

Bitcoin led the crypto market lower on Tuesday – the first trading day for ether ETFs – as Mt. Gox transferred more bitcoin to creditors and investors took profits following the cryptocurrency’s best week since March.

The price of bitcoin was last lower by 3% at $65,891.50 according to Coin Metrics. Ether, was down more than 1% at $3,445.10. Investors and analysts attribute the moves to profit taking after their 22.85% and 12.75% gains, respectively, last week.

Additionally, Bitcoin network activity shows Mt. Gox has moved about 5,000 bitcoins off the exchange, likely as part of the creditor repayment process it began this month. The exchange, which went bankrupt after a major hack 10 years ago, has until October to return more than 140,000 bitcoins to victims of the event.

The market is expected to absorb the negative impact, thanks to long-term optimism on the success of ether ETFs as well as the U.S. presidential election.

“We are aligned with the market consensus that the adoption out of gate here will likely be relatively slow and modest compared to the bitcoin ETF adoption,” said Devin Ryan, analyst at JMP Securities. “Part of that is the bitcoin ETF adoption is in the early innings – a lot of the largest pools of money for that ETF have not even been turned on yet,” he added.

In the meantime, however, ether could be volatile, according to Nexo co-founder Antoni Trenchev. He pointed to the launch of bitcoin ETFs in January, when bitcoin surged to a record before plummeting 20% and then advanced to another new high.

“Much like the bitcoin ETF, it will take time for inflows into the ETH ETF to create enough supply shock to significantly move the markets,” said Ben Kurland, CEO at crypto research platform DYOR.

Additionally, he added, the decision by President Joe Biden to drop out of the presidential race introduces uncertainty into the market.

“Investors [are] waiting for more concrete developments about [Vice President Kamala] Harris, her stance on crypto, and the likelihood of her taking back any ground in the polls,” he said.

Trenchev echoed that sentiment.

“Bitcoin’s drop from recent highs reflects the sudden arrival of Kamala Harris into the U.S. presidential election, which adds uncertainty to a race which seemed to tilt in favor of Donald Trump and his new pro-crypto stance,” he said.