Vanguard, the world’s second-largest provider of exchange-traded funds (ETFs) after BlackRock (NYSE: BLK), continues to attract investors with its low-cost, diversified funds.

While broad-market ETFs tracking indices like the S&P 500 remain popular, sector-focused funds often present an opportunity for stronger returns, particularly when certain industries are primed for growth.

This is where Vanguard ETFs shine, allowing investors to focus on specific sectors, themes, or asset classes while maintaining the benefits of diversification. With expense ratios as low as 0.03%, Vanguard’s funds also remain as one of the most cost-effective investment options, ensuring minimal fees eat into returns.

To put its predictive capabilities to the test, Finbold tasked DeepSeek AI with identifying the Vanguard ETFs best positioned to win in 2025—those expected to outperform based on sector strength, historical performance, and macroeconomic trends.

Among the 90 ETFs listed on Vanguard’s platform, two emerged as the top picks for delivering market-beating returns in the year ahead.

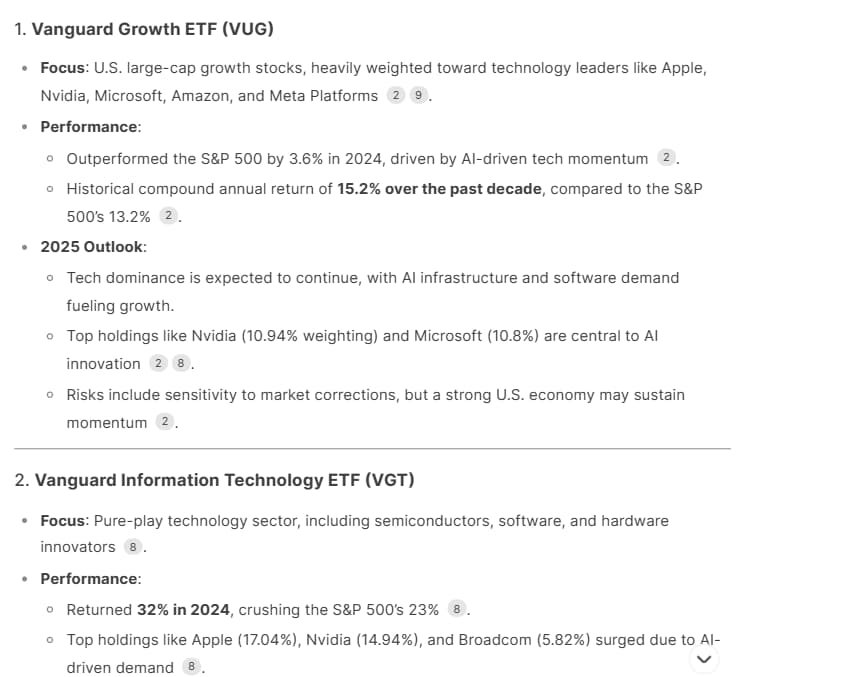

Vanguard Growth ETF (NYSEARCA: VUG)

The Vanguard Growth ETF (NYSEARCA: VUG) is a large-cap growth fund that provides diversified exposure across multiple industries, with a strong tilt toward technology.

With a year-to-date gain of over 4%, the ETF has benefited from the performance of tech and high-growth companies, currently trading at $429.71 per share.

While it is not a pure tech fund, its 57.5% allocation to technology stocks makes it highly sensitive to the sector’s movements, while still maintaining exposure to other growth sectors like consumer discretionary and healthcare.

This concentration has helped VUG outperform during bullish tech cycles, but it also leaves the fund vulnerable to volatility when the sector faces headwinds.

Over the past year, VUG has surged 29.63%, significantly outperforming broader indices. Its 10-year return stands at 16.15%, while since its inception in 2004, the fund has delivered an average annual return of 11.76%.

Despite the risks associated with its tech-heavy weighting, VUG remains one of the lowest-cost options for investors, with an expense ratio of just 0.04%, translating to a minimal $0.20 annual fee for every $500 invested.

Vanguard Information Technology ETF (NYSEARCA: VGT)

For investors looking for a more focused approach, the Vanguard Information Technology ETF (NYSEARCA: VGT) provides direct exposure to the tech sector, tracking the MSCI US Investable Market Information Technology 25/50 Index.

Unlike VUG, which includes a mix of industries, VGT is fully focused on technology stocks, covering large, mid, and small-cap companies in the sector.

Since the start of the year, VGT has gained over 3%, with shares currently trading at $641.50. Over the past decade, the fund has delivered a 21.09% average annual return, significantly outperforming broader indices while averaging a 13.60% annual return since its inception in 2004.

However, VGT carries a higher risk due to its extreme concentration. Its top five holdings, Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Microsoft (NASDAQ: MSFT), Broadcom (NASDAQ: AVGO), and Salesforce (NASDAQ: CRM), make up nearly half of the portfolio. While this concentration has driven strong gains, it also increases vulnerability to sector downturns and volatility.

A low expense ratio of 0.09%, equating to just $0.45 per year on a $500 investment, makes it an attractive choice for investors seeking pure exposure to the tech sector.

Featured image via Shutterstock