Defiance ETFs has unveiled the Defiance Daily Target 1.75x Long MSTR ETF (MSTX), the first single-stock leveraged ETF tracking MicroStrategy, the technology company known for its massive bitcoin holdings.

The MSTX fund seeks to deliver 1.75 times the daily percentage change in MicroStrategy’s share price, according to an Aug. 14 press release announcing the fund. This structure allows investors to gain amplified exposure to the company without using a margin account. The fund also offers an alternative avenue to invest in a crypto-centered product.

MicroStrategy, which was initially known for its enterprise analytics software, has gained attention in recent years by pivoting its focus to bitcoin. As of July 31, the company held 226,331 bitcoins at a market value of more than $14 billion, according to its second quarter filing.

Bitcoin was trading at about $59,660 on Thursday, up 0.2% over the past 24 hours, according to data provider CoinMarketCap.

But the largest cryptocurrency by market value has also been known for its wild fluctuations throughout its 15-year history, which has buffeted MicroStrategy’s fortunes.

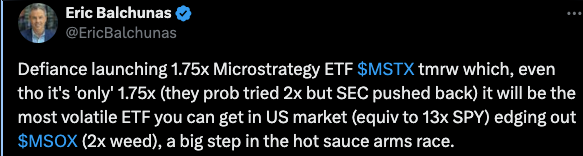

“[It] will be the most volatile ETF you can get in US market ([equivalent] to 13x SPY),” noted Eric Balchunas, Bloomberg senior ETF analyst, in an X post. He added that “there is a market for extreme volatility/packaged adrenaline,” pointing out that the 2x Nvidia ETF, GraniteShares 2x Long NVDA Daily ETF (NVDL), has already amassed nearly $5 billion in assets.

MSTX Volatility and Risk Considerations

The fund’s prospectus emphasizes that MSTX is designed for investors who actively monitor and manage their portfolios. Due to its leveraged nature, the ETF carries higher risk than non-leveraged alternatives.

“Given MicroStrategy’s inherent higher beta compared to Bitcoin, MSTX offers a unique opportunity for investors to maximize their leverage exposure to the Bitcoin market within an ETF wrapper,” Sylvia Jablonski, CEO of Defiance ETFs, said in the announcement.

According to ETF.com data, Defiance ETFs currently offers nine ETFs, with total assets under management of $1.24 billion. Its largest fund is the Defiance Connective Technologies ETF (SIXG), which holds $521 million in assets and is up 20.8% over the last year.

MSTX’s introduction underscores issuers attempts to address surging demand for crypto-focused assets. Eleven spot bitcoin ETFs, which debuted earlier this year, have generated more than $17.3 billion in inflows, according to U.K. asset manager Farside Investors. Spot Ethereum ETFs based on the price of ether, the second largest crypto by market capitalization, have started promisingly since they began trading in July.

Balchunas mentioned that Defiance beat Tuttle Capital Management to market with this product, though Tuttle is attempting to debut a 2x MSTR ETF.

“Will be interesting to see if they can get 2x out or if SEC makes them come down to 1.75x,” he wrote.

Prior to MSTX, Defiance’s most recent ETF unveiling was the Defiance Treasury Alternative Yield ETF (TRES) on Jan. 24.