- BlackRock surpassed Grayscale in ETFs holdings for the first time.

- BlackRock ETFs hit $21,217,107,987, while Grayscale ETFs stood at $21,202,480,698 at press time.

BlackRock ETFs have made a historical shift, overtaking Grayscale ETFs for the first time. According to an X (formerly Twitter) post by Arkham Intelligence,

” Rocket ETF holdings overtake Grayscale for the first time. BlackRock’s ETFs IBIT and ETHA have just overtaken Grayscale’s ETFs GBTC, BTC Mini, ETHE and ETH Mini in on-chain holdings. Blackrock ETFs now have the largest collective holdings of any provider.”

This development positions BlackRock as the leader in the ETF market after overtaking Grayscale, which has been the dominant player for a long time.

At press time, BlackRock’s total holdings hit $21,217,107,987, while Grayscale ETF’s total holdings followed closely behind at $21,202,480,698.

Implications for Ethereum, Bitcoin

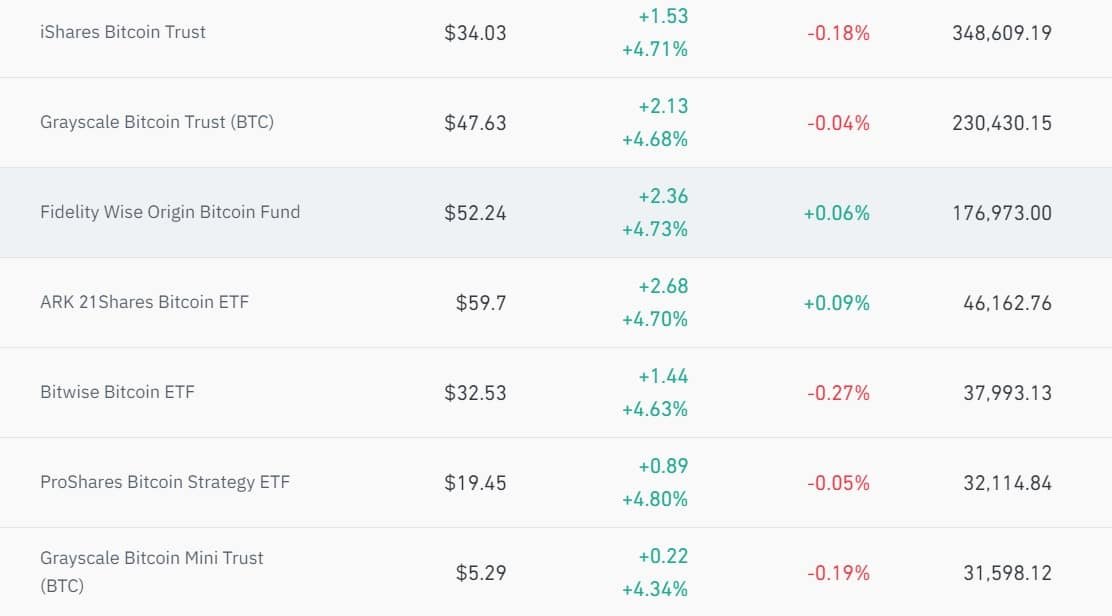

The cryptocurrency market experienced significant movements in ETF flows since this news broke.

Notably, spot Bitcoin [BTC] ETFs saw a net inflow of approximately $35.9 million, with notable contributions from Fidelity ($61.3 million) and BlackRock ($20.4 million).

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) saw an outflow of $72.9 million.

Ethereum [ETH] ETFs saw major activities as well. Spot Ethereum ETFs recorded a net outflow of $15 million.

Within the Ethereum ETFs, Grayscale’s ETHE had an outflow of $27.743 million, while BlackRock’s ETHA and Fidelity’s FETH had inflows of $10.33 million and $7.21 million, respectively.

Therefore, the total net flow for ETH spot ETFs was $7.352 billion at press time.

The shift in preference between BlackRock and Grayscale may significantly impact crypto, especially regarding investor confidence.

Increased demand for ETFs

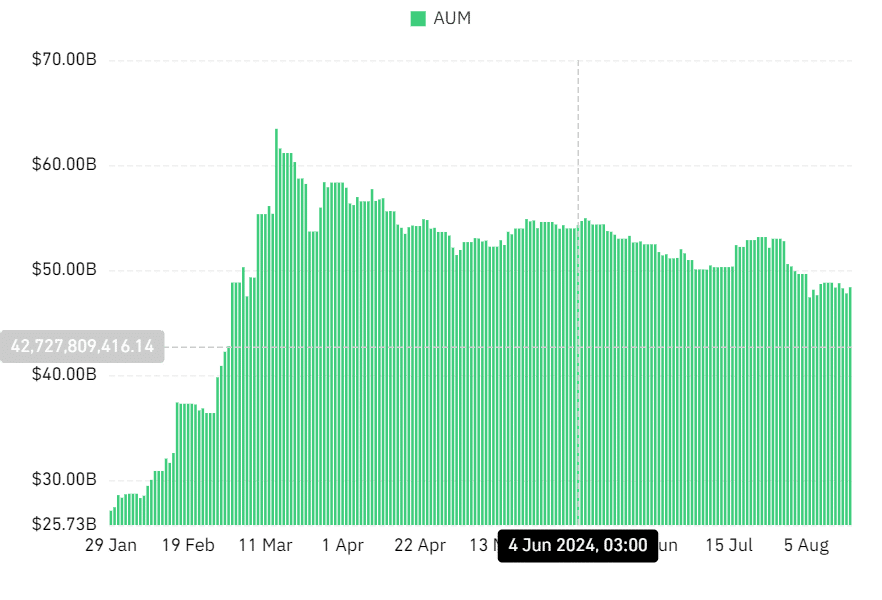

The demand for ETFs has experienced exponential growth YoY. For instance, in 2022, the net share issuance of ETFs was $609 billion. In 2023, it was $597 billion.

However, there has been a drastic surge in demand in 2024 since the approval of Bitcoin spot ETFs in January, and Ethereum spot ETFs in July.