Press Release

LONDON —August 27, 2024 — ETFGI, a prominent independent research and consultancy firm specializing in providing subscription research on trends in the global ETFs industry, reported today that assets invested in Crypto ETFs and ETPs listed globally reached a new record high of US$91.69 billion at the end of July. During July Crypto ETFs and ETPs listed globally gathered net inflows of US$13.65 billion, bringing year-to-date net inflows to US$59.25 billion, according to ETFGI’s July 2024 ETF and ETP Crypto industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Crypto ETFs and ETPs listed globally reached a new record of $91.69 Bn at the end of July beating the previous record of $84.69 Bn at the end of March 2024.

- Assets have increased 506.4% during 2024 going from $15.12 Bn at end of 2023 to $91.69 Bn.

- Net inflows of $13.65 Bn gathered during July.

- Year-to-date net inflows of $59.25 Bn are the highest on record, the 2nd highest YTD net inflows was $4.05 Bn for 2021 and 3rd ranked YTD net inflows was $794.02 Mn for 2022.

- 3rd month of net inflows.

“The S&P 500 index increased by 1.22% in July and is up 16.70% YTD in 2024. The developed markets excluding the US index increased by 3.37% in July and is up 8.12% YTD in 2024. Ireland (up 6.48%) and Belgium (up 6.42%) saw the largest decreases amongst the developed markets in July. The Emerging markets index increased by 0.57% during July and is up 8.70% YTD in 2024. Greece (up 6.93%) and United Arab Emirates (up 6.18%) saw the largest increases amongst emerging markets in July”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

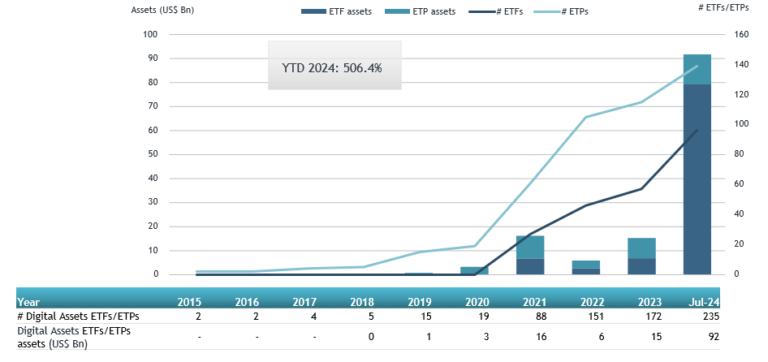

Asset growth in the Global Crypto ETFs and ETPs listed globally as of the end of July

Since the launch of the first Crypto ETP in 2015, the Bitcoin Tracker One-SEK, the number and diversity of products have increased steadily, with 235 Crypto ETFs and ETPs listed globally with 588 listings, assets of US$91.69 Bn, from 52 providers listed on 22 exchanges in 16 countries at the end of July 2024.

Following net inflows of $13.65 Bn and market moves during the month, assets invested in Crypto ETFs and ETPs listed globally increased by 23.9% from $73.98 Bn at the end of June 2024 to $91.69 Bn at the end of July 2024.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $13.78 Bn during July. Grayscale Ethereum Trust (ETHE US) gathered $7.11 Bn, the largest individual net inflow.

Top 20 Crypto ETFs/ETPs by net new assets July 2024

|

|

Name |

Ticker |

Assets ($ Mn) Jul-24 |

NNA ($ Mn) YTD-24 |

NNA ($ Mn) Jul-24 |

||||

|

Grayscale Ethereum Trust |

ETHE US |

6,627.51 |

7,111.97 |

7,111.97 |

|

||||

|

iShares Bitcoin Trust |

IBIT US |

22,582.84 |

20,041.21 |

2,303.47 |

|

||||

|

Grayscale Ethereum Mini Trust ETH |

ETH US |

1,155.33 |

1,170.89 |

1,170.89 |

|

||||

|

Fidelity Wise Origin Bitcoin Fund |

FBTC US |

11,848.19 |

9,979.96 |

778.66 |

|

||||

|

iShares Ethereum Trust |

ETHA US |

621.99 |

633.80 |

633.80 |

|

||||

|

Bitwise Ethereum ETF |

ETHW US |

275.66 |

287.13 |

287.13 |

|

||||

|

Fidelity Ethereum Fund |

FETH US |

277.88 |

283.68 |

283.68 |

|

||||

|

2x Bitcoin Strategy ETF |

BITX US |

1,763.19 |

1,776.42 |

255.07 |

|

||||

|

ARK 21Shares Bitcoin ETF |

ARKB US |

3,227.59 |

2,596.09 |

183.26 |

|

||||

|

ProShares Bitcoin Strategy ETF |

BITO US |

1,926.17 |

42.13 |

118.29 |

|

||||

|

ProShares Ultra Bitcoin ETF |

BITU US |

365.32 |

383.98 |

87.66 |

|

||||

|

Vaneck Bitcoin Trust |

HODL US |

739.54 |

678.26 |

80.77 |

|

||||

|

21Shares Ethereum ETP – Acc |

AETH SW |

518.21 |

15.64 |

78.82 |

|

||||

|

Bitwise Bitcoin ETP Trust |

BITB US |

2,554.01 |

2,090.93 |

70.83 |

|

||||

|

Invesco Galaxy Bitcoin ETF |

BTCO US |

524.76 |

363.25 |

65.32 |

|

||||

|

Vaneck Ethereum ETF |

ETHV US |

60.12 |

61.37 |

61.37 |

|

||||

|

Ether Strategy ETF |

ETHU US |

110.09 |

124.41 |

59.55 |

|

||||

|

Franklin Bitcoin ETF |

EZBC US |

450.70 |

405.53 |

58.37 |

|

||||

|

Hashdex Nasdaq Crypto Index Europe ETP |

HASH SW |

175.18 |

145.50 |

55.04 |

|

||||

|

Franklin Ethereum ETF |

EZET US |

31.20 |

32.17 |

32.17 |

|

||||

|

|

|||||||||

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Please support us by voting for ETFGI here!

A big thank you to all our friends and colleagues who nominated us for the ETF Express US Awards 2024! Based on your support we are happy to announce ETFGI has been shortlisted for the “Best ETF Research Provider” category (Item Number 23).

Cast your final vote for ETFGI here

Voting closes on Friday, 20th September 2024. Your support is greatly appreciated.

|

|

|

|

|