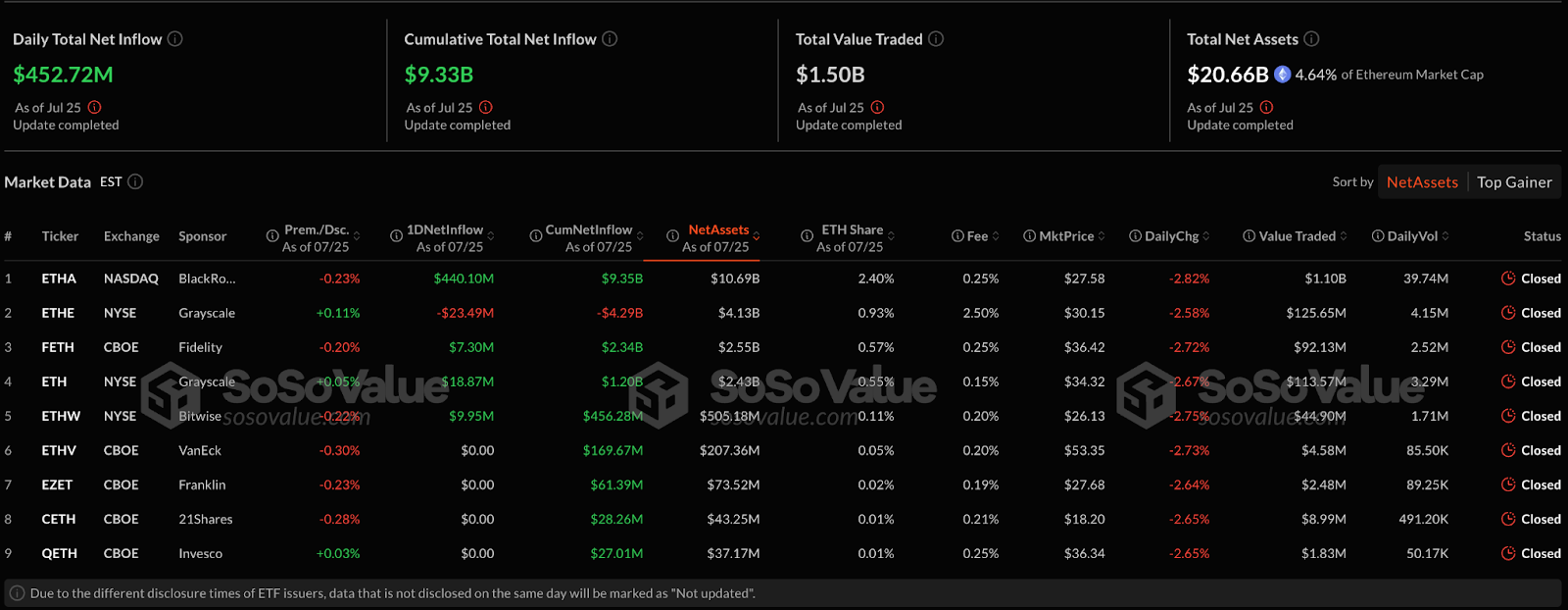

Ethereum spot ETFs have achieved a historic 17-day consecutive inflow streak, recording $453 million on Friday alone and pushing total assets to $20.66 billion.

BlackRock’s ETHA led with $440 million in daily inflows, making it the second-highest flowing US ETF this week.

The sustained institutional demand has generated $9.33 billion in cumulative inflows, with weekly net inflows reaching $1.8 billion compared to just $71 million for Bitcoin ETFs.

Bitwise CIO Matt Hougan projects that ETH ETF demand could reach $20 billion within the next year, equivalent to approximately 5.33 million ETH at current prices.

With Ethereum expected to issue only 0.8 million ETH during that timeframe, demand could outpace supply nearly sevenfold.

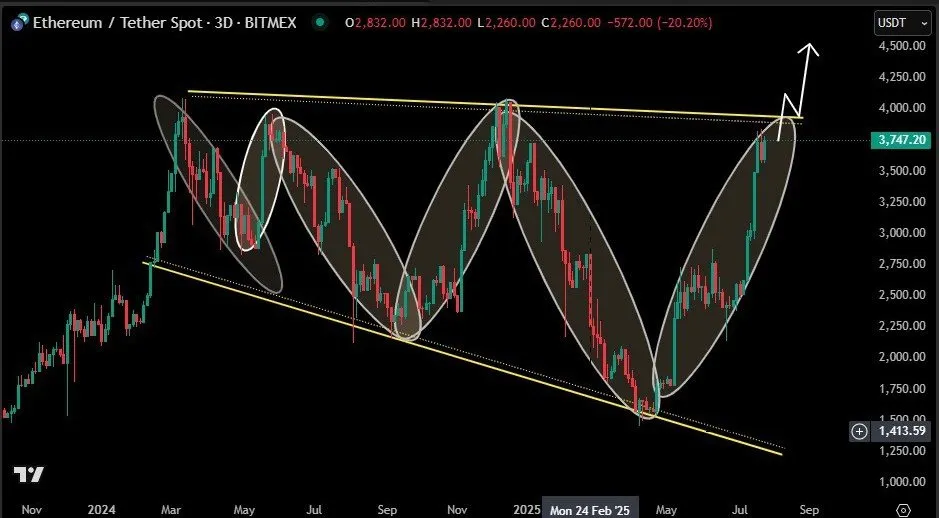

Technical analysis indicates that Ethereum is approaching a diamond pattern resolution around $2,832.

Seasonal data show that August historically delivers 64.2% returns during post-halving years, positioning ETH for potential acceleration toward $4,000-$6,000 targets.

Diamond Pattern Resolution Targets $4,000 Breakout

Ethereum’s 3-day chart reveals a massive diamond formation approaching resolution around $2,832, with the pattern reaching its apex where decisive breakouts typically occur.

The diamond represents one of the most powerful reversal patterns, characterized by expanding volatility followed by contracting volatility.

ETH has reached successive highs around $4,000 and lows around $1,400, creating the classic diamond shape.

The ascending trendline provides crucial support through multiple tests, with the recent breakout above this support suggesting renewed bullish momentum.

Diamond patterns developing over extended periods typically lead to proportionally larger moves when finally resolved toward the upper boundary.

Analyst projections of over $ 4,000 resulted from measured moves following successful upward resolution, targeting previous cycle resistance levels where significant institutional positioning awaits confirmation.

Ethereum Price Prediction: Seasonal Strength Points to $6,000 August Target

The monthly returns heatmap provides crucial seasonal context, supporting bullish prospects for August.

Historical data shows August typically delivers exceptional returns for Ethereum, averaging 64.2% during post-halving years.

The pattern consistently reveals strong performance, with gains of 35.62% in 2021, 25.32% in 2020, and 92.86% in 2017.

Current July performance shows 50.79% for 2025, suggesting momentum is building for the traditional August rally.

If historical patterns hold true from current levels around $2,800, the 64.2% average August return would project the Ethereum price toward the $6,000 target range during its strongest seasonal month.

Additionally, CME futures open interest, which has reached record levels of $7.85 billion, provides further institutional validation.

It shows sophisticated traders are positioning aggressively for continued upside during historically strong performance periods, as ETF inflows create supply constraints.

Best Wallet: Final Months to Join $14.2M Presale Before December Deadline

Ethereum’s potential supply shock from sustained ETF inflows and a breakout toward $4,000-$6,000 targets creates a compelling opportunity for alternative tokens within the Ethereum ecosystem.

Best Wallet’s $BEST token presale has raised over $14.2 million, with the December 31, 2025, deadline rapidly approaching.

This closing deadline offers investors the final months to secure positions before the window closes permanently.

The $BEST token unlocks exclusive presale launchpad access, discounted trading fees, and staking rewards, which are essential for capitalizing on Ethereum’s potential acceleration phase.

Best Wallet’s comprehensive platform provides secure multi-chain functionality with institutional-grade Fireblocks MPC integration alongside built-in DEX capabilities for optimal ETH positioning.

The upcoming Best Card integration enables spending gains with up to 8% cashback during potential rally phases toward seasonal targets.

With Ethereum potentially facing upside moves of 43-114% during August and sustained ETF demand creating supply constraints, the approaching December deadline creates a final opportunity window for investors seeking to capitalize on the next ETH rally.

$BEST will capitalize greatly on this momentum, and interested investors are advised to check the presale website and secure their position now.