US spot Ether exchange-traded funds (ETFs) printed the second-largest daily inflows on record as the cryptocurrency approached all-time high prices.

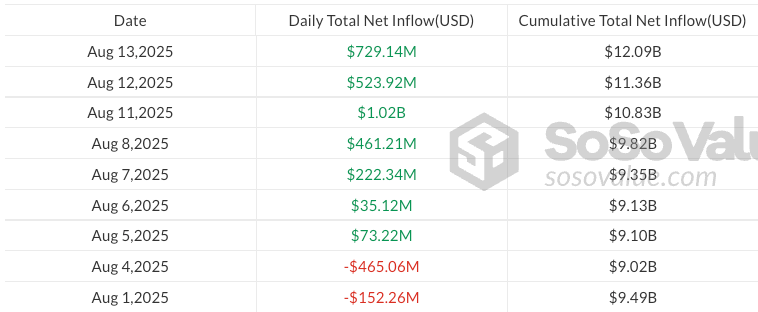

Ether (ETH) funds saw $729 million of inflows on Wednesday as ETH surged past $4,700 for the first time since November 2021, according to data from SoSoValue.

It was the second-largest daily inflow into spot Ether ETFs, following the record $1.02 billion poured into ETH funds on Monday.

The latest inflows are only 0.5% above the previous record of $727 million set on July 16, when the crypto asset was trading at around $3,150, according to CoinGecko data.

$2.3 billion of inflows in three days

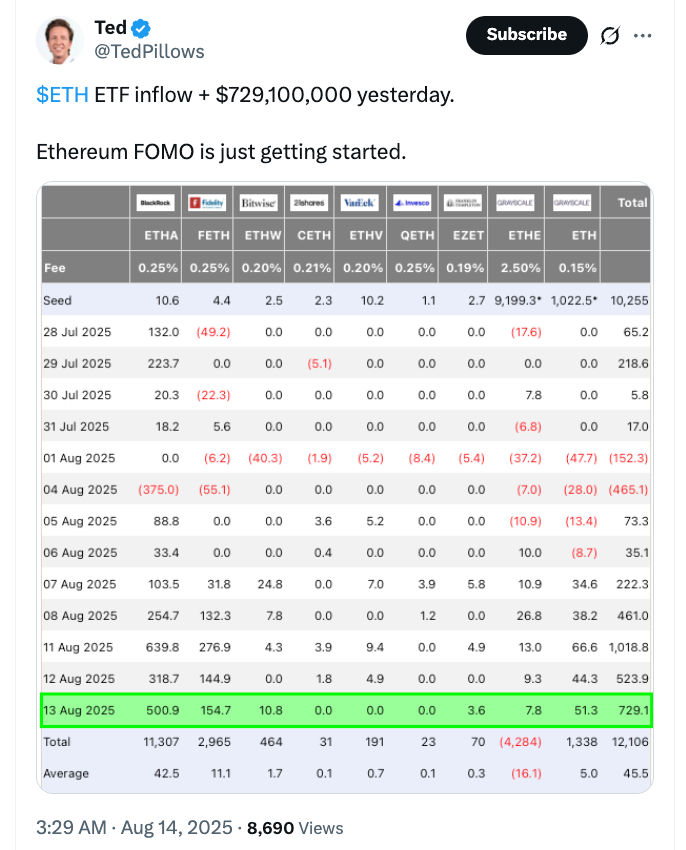

Wednesday’s inflows came mainly from BlackRock’s spot Ether ETF, iShares Ethereum ETF (ETHA), which attracted more than $500 million, according to SoSoValue. Fidelity Ethereum Fund (FETH) ranked second, totaling $155 million.

With the latest gains, spot Ether ETFs have attracted about $2.3 billion in inflows over the past three days, up 8.5% from the previous weekly record of $2.12 billion set between July 14 and July 18.

The new inflows are also a sharp increase over the $270 million seen in spot Ether ETFs in the past trading week.

Spot Ether ETFs have recorded seven consecutive days of inflows, bringing the total inflows during this streak to $3.07 billion.

Related: ETH transaction count rising amid $5K push, but competition erodes market share

According to SoSoValue, total net inflows in Ether funds reached a record $12.1 billion on Wednesday, while total trading volumes also broke a record high of $4.5 billion.

“Ethereum FOMO is just getting started”

With Ether ETFs consistently hitting new highs amid the ongoing ETH rally, many expect it to continue setting fresh records.

Addressing the $729 million inflow in spot Ether ETFs, crypto market observer Ted Pillows suggested that the “Ethereum FOMO is just getting started” in an X post on Thursday.

The ongoing ETH rally has been a major contributor to the rising inflows, as the crypto asset has surged nearly 29% over the past seven days.

“The higher the price, the bigger the inflows,” crypto analyst ZeroHedge wrote in an X post on Thursday.

As of publication, Ether traded at $4,744, or about 3% away from the all-time high of $4,878 recorded on Nov. 21, 2021, according to historic prices data from CoinGecko.

Magazine: Altcoin season 2025 is almost here… but the rules have changed