The US Securities and Exchange Commission has issued notices of effectiveness for several Ethereum-related exchange-traded funds (ETFs) as they begin trading today, July 23.

Available information on the regulator’s website confirms the effectiveness of the S-1 filing of different issuers, including VanEck, Grayscale, Bitwise, Invesco, and Fidelity, among others.

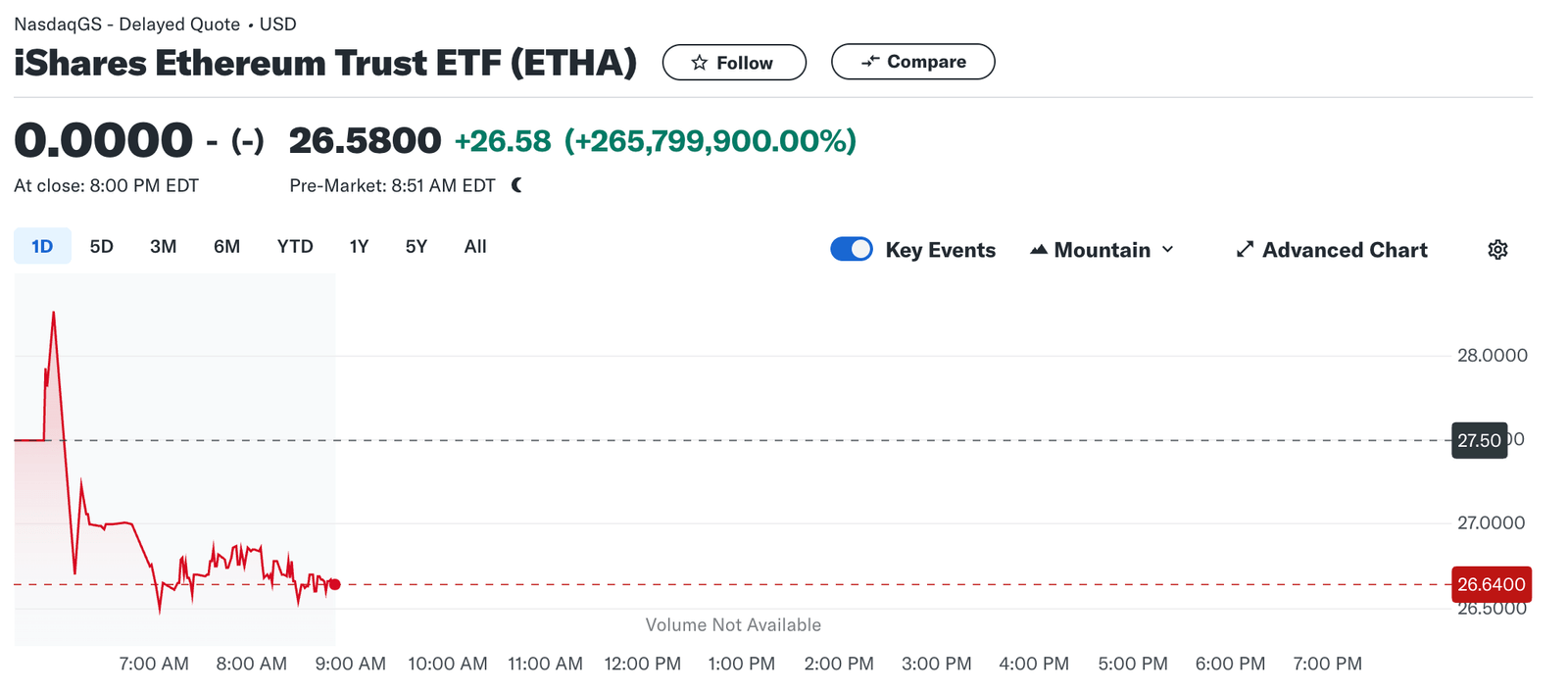

Pre-market trading is already open, with BlackRock’s iShares Ethereum Trust (ETHA) opening at $27.50 before falling slightly to $26.64 as of press time.

On July 22, reports emerged that the SEC had given its final approval for the spot Ethereum ETFs to begin trading on July 23. Asset management firm Grayscale confirmed that its Ethereum ETF products—the Grayscale Ethereum Mini Trust and Ethereum Trust Fund—would start trading on the New York Stock Exchange today.

This development ends weeks of waiting for ETF products of the second-largest digital asset by market capitalization, which the regulator had extensively investigated and initially suggested was a security.

Market experts hailed the move, pointing out that the ETFs will provide convenient access, liquidity, and transparency for investors looking to gain exposure to digital assets. Jay Jacobs, BlackRock’s US Head of Thematic and Active ETFs, said:

“Ethereum’s appeal lies in its decentralized nature and its potential to drive digital transformation in finance and other industries.”

How will ETH price react?

While ETH’s price has been largely muted despite the impending launch of the ETFs, blockchain research firm Kaiko reported that it was unclear how the initial inflows from the products could impact the asset.

Will Cai, head of indices at Kaiko, said:

“The launch of the futures based ETH ETFs in the US late last year was met with underwhelming demand, all eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation. Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

Meanwhile, Bitwise’s CIO Matt Hougan predicted that the upcoming spot Ethereum ETFs will propel the digital asset’s price to new all-time highs of more than $5,000. He said:

“By year-end, I’m confident the new highs will be in. And if flows are stronger than many market commentators expect, the price could be much higher still.”