- Ethereum treasury companies offer “regulatory arbitrage opportunities” that make them better investments than ETH ETFs, says Standard Chartered’s Geoffrey Kendrick.

- These companies have bought 1.6% of the total ETH in circulation — same as ETH ETFs — since sprouting up in June.

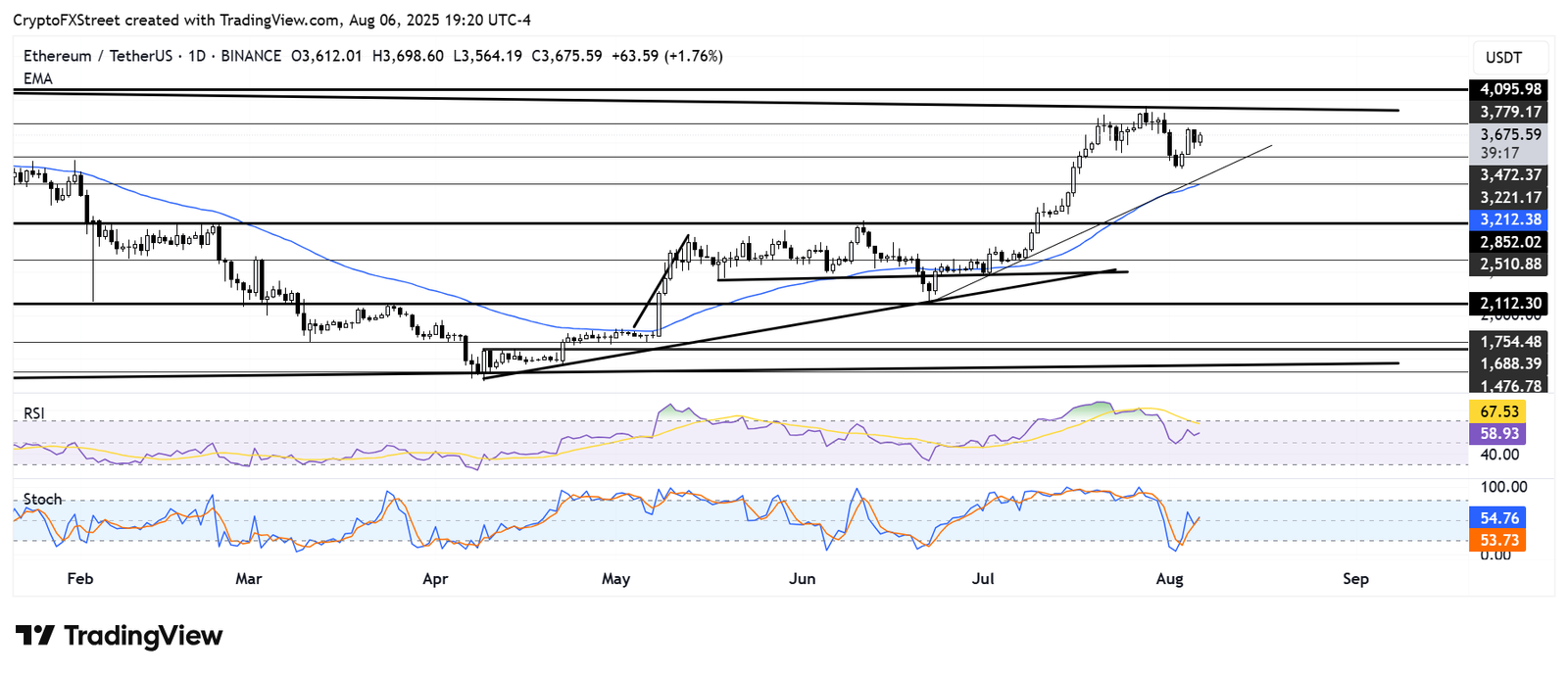

- ETH could validate the continuation of another bullish pennant if it flips the critical resistance at $4,100.

Ethereum (ETH) saw a 3% gain on Wednesday following Standard Chartered’s report that public entities leveraging the altcoin as their primary reserve asset are a finer investment option than US spot ETH exchange-traded funds (ETFs).

ETH treasury companies are better buys than ETH ETFs: Standard Chartered

Ethereum treasury companies are proving to be a better investment opportunity compared to ETH ETFs as their net asset value (NAV) multiples have begun normalizing above 1, according to Standard Chartered’s global head of digital asset research, Geoffrey Kendrick.

“Given NAV multiples are currently just above 1 I see the ETH treasury companies as a better asset to buy than the US spot ETH ETFs,” he noted.

The net asset value of these companies represents their market capitalization divided by their total ETH holdings.

“This normalization of the net asset value multiple makes the treasury companies now very investable for investors seeking access to ETH price appreciation, increasing ETH per share […] and access to staking rewards,” wrote Kendrick. “I see no reason for the NAV multiple to go below 1.0 because I see these firms as providing regulatory arbitrage opportunities for investors.”

Most ETH treasury companies generate yields through staking and deploying their funds across decentralized finance (DeFi) protocols, unlike ETH ETFs in the United States, which do not offer these features.

Since gaining mainstream attention in June, Kendrick highlighted that Ethereum treasury companies have purchased 1.6% of the entire ETH in circulation, equalling the buying power of their ETF counterparts during the period. Earlier in the week, BitMine Immersion (BMNR) and SharpLink Gaming (SBET) reported holdings of over 833,100 and 521,900 ETH, respectively.

Meanwhile, after two consecutive trading days of outflows, US spot Ethereum ETFs returned to inflows on Tuesday, pulling in $73.22 million, per SoSoValue data.

Ethereum Price Forecast: ETH could be forming another bullish pennant

Ethereum experienced $61.67 million in futures liquidations over the past 24 hours, according to Coinglass data. The total amount of long and short liquidations accounted for $21.20 and $40.47 million, respectively.

The top altcoin has largely been consolidating within the $3,400 and $3,800 range since July 21 after a two-week-long rally that spanned July 8-20. The consolidation could mark the formation of a bullish pennant if ETH continues trading above the $3,220 support, which is strengthened by the 50-day Exponential Moving Average (EMA).

ETH/USDT daily chart

The top altcoin could be primed to retest the resistance of a descending trendline near $3,900 if it holds the support of a lower rising trendline extending from June 22. A flip of the descending trendline resistance and a subsequent move above the critical selling pressure near $4,100 will validate the continuation of a bullish pennant pattern.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are struggling to find direction near their neutral levels, indicating indecision among market participants.

A daily candlestick below $2,850 will invalidate the bullish thesis.