Ethereum price is approaching a crucial phase as technical signals align with rising institutional demand. Charts reflect setups that mirror earlier breakout phases, bringing fresh confidence back into the market. Spot ETFs have already absorbed over 286,000 ETH in recent weeks, reinforcing this optimism. Together, these factors position ETH price at the edge of what could be its next defining cycle.

Ethereum Price Action Mirrors Historic Setup

Analyst Merlijn The Trader highlights a repeating structure that echoes Ethereum’s price breakout in 2021. His chart reveals the same rhythm; a dead-cat bounce, months of consolidation, and a final retest.

That setup ignited ETH price from $200 to $4,000 during the last bull run. The current pattern looks nearly identical, with the retest forming close to $2,000.

The parallel strengthens the conviction that Ethereum may be preparing for another exponential climb. ETH long-term price prediction now consistently points toward the $10,000 level.

Merlijn The Trader)

On the weekly chart, Ethereum price is also forming an inverse head-and-shoulders pattern, often seen as a bullish reversal. The left shoulder rests near $2,200, the head dipped close to $1,500, and the right shoulder has lifted above $3,500. Yet resistance at $4,943 remains the decisive barrier.

Weak overbought conditions, with the Stoch RSI signal slipping below the signal, signal short-term cooling. This opens the door to a retest of $4,100 before stronger demand resumes. Such a rebound would finally break Ethereum out of its consolidation since 2021, setting the stage for growth.

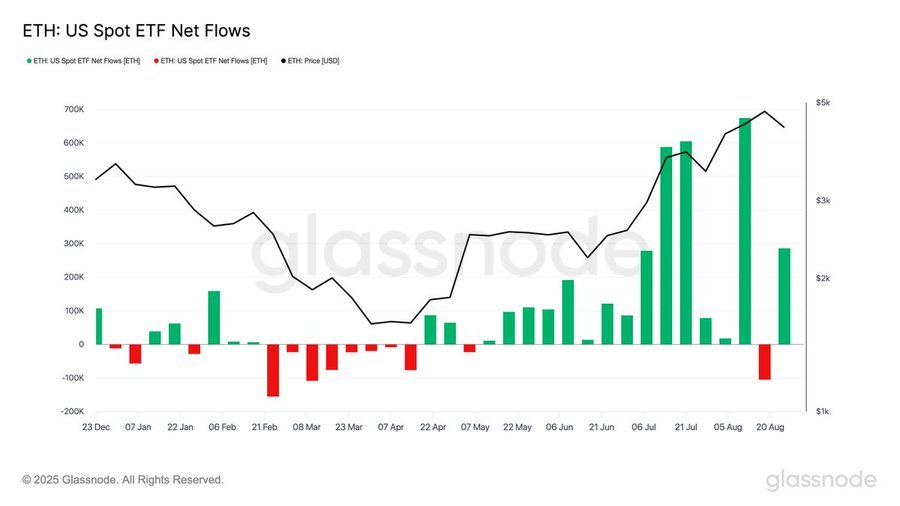

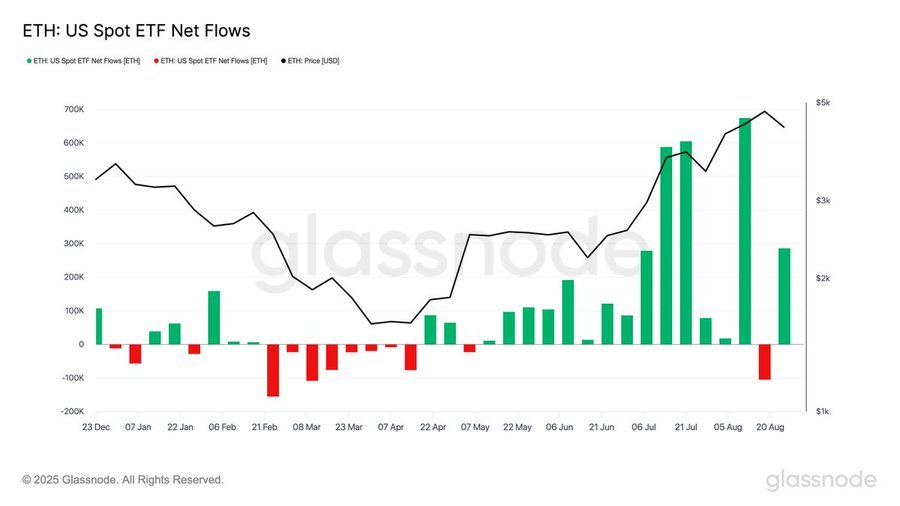

ETFs Absorb 286K ETH, Fueling Confidence

US spot Ethereum ETFs posted inflows of more than 286,000 ETH in one week. This is one of the largest totals since their launch. The ETH finished close to $4,400 and institutional demand did not wane. Glassnode analytics highlights steady inflows, enhancing the existence of a strong demand layer.

Unlike the 2021 cycle, where retail was leading the charge, institutions are now fully engaged. Bearish liquidity flows tend to diminish exchange supply and make sharp sell-offs even more difficult to sustain.

The sentiment creates resiliency and adds further momentum to Ethereum’s bullish trajectory. With the continued ETH ETFs flowing into the market, and as long as that continues, Ethereum price has additional buy support for its breakout towards $10,000.

To sum up, Ethereum price is backed by both repeating technical structures and expanding institutional demand. The breakout setup reflects patterns that once powered historic gains across the market. ETF inflows add a lasting demand layer that alters Ethereum’s supply landscape. Together, these forces make the $10,000 target an increasingly likely reality for ETH price.

Frequently Asked Questions (FAQs)

The critical resistance is $4,943, a level that must break to confirm the breakout.

US spot ETFs absorbed 286K ETH in one week, adding structural demand and boosting long-term confidence.

Because large-scale buyers add lasting demand, reduce exchange supply, and create stronger market resilience.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: