This ETF is head and shoulders above the Dow Jones.

You’ve probably heard of the Dow Jones Industrial Index (^DJI 1.14%). After all, it’s one of the oldest stock market indexes, and its ups and downs are often quoted in news articles and television broadcasts.

Yet, I’m here to tell you that, as an investment vehicle, the Dow simply doesn’t cut it.

So, let’s explore an alternative that has performed better and offers superior diversification.

Image source: Getty Images.

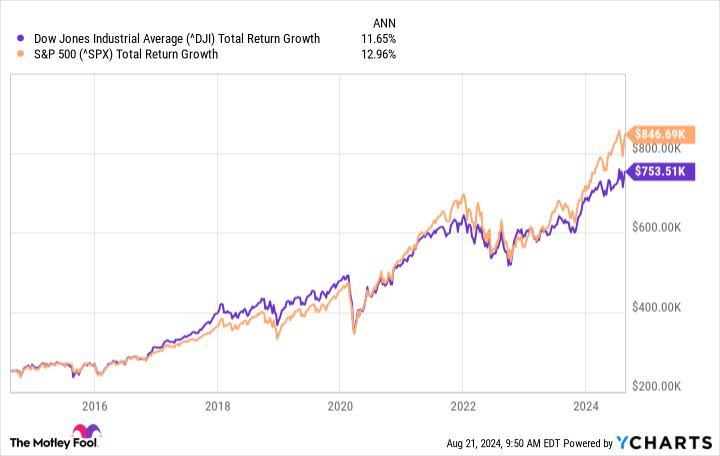

Comparing the Dow to the S&P 500

First things first: Let’s compare the Dow to one of the other best-known stock market indexes around, the S&P 500. Each index tracks the performance of a basket of stocks. For the Dow, there are 30 stocks, and, unsurprisingly, the S&P 500 tracks 500 stocks.

That itself is a significant difference. The Dow is less diversified than the S&P 500, meaning it is more volatile and more likely to experience large swings when one stock rises or falls dramatically.

What’s more, the Dow index is weighted by the price of the stocks that comprise it. That means that high-priced stocks like UnitedHealth and Goldman Sachs — each of which trades at above $500 per share — are the Dow’s two largest holdings. However, those two companies are far from the largest companies in America. UnitedHealth is the 13th largest and Goldman Sachs is the 56th largest. So, while the Dow does contain Apple and Microsoft (the two largest companies in the U.S. by market cap), they are not the Dow’s largest holdings, because their stock prices are lower than those of UnitedHealth and Goldman Sachs.

The S&P 500, on the other hand, is weighted by market cap. That means Apple, Microsoft, and Nvidia are its three largest holdings. And that’s been a good thing, as those tech giants have been some of the best-performing stocks over the last ten years.

Indeed, that’s the biggest reason why the S&P 500 has outpaced the Dow over the last decade.

As shown above, the S&P 500 has generated a compound annual growth rate (CAGR) of 13% over the last decade, while the Dow managed only 11.7%. And that kind of difference can matter. For example, a $250,000 portfolio invested in the Dow ten years ago would be worth about $90,000 less than the same portfolio invested in the S&P 500.

How best to invest in the S&P 500

There are many ways to invest in the S&P 500 index. However, in my opinion, the best way for the average investor is via an exchange-traded fund (ETF). They’re cheap, accessible, and easy to understand.

Of the many ETFs that mirror the S&P 500’s return, the Vanguard S&P 500 ETF (VOO 1.08%) is a top choice. Most importantly, the fund has a long track record of closely replicating the S&P 500’s performance.

Second, the fund’s expense ratio is tiny — only 0.03%. While all ETFs charge fees to fund their operations, this fund keeps its fees to a minimum, meaning investors keep more of their hard-earned money.

In summary, due to its superior diversification, market-cap weighting, and performance, investors should favor the S&P 500 over the Dow Jones. Moreover, the Vanguard S&P 500 ETF offers a straightforward and inexpensive way to invest in the index. That’s something that can make any investor happier and richer.

Jake Lerch has positions in Goldman Sachs Group and Nvidia. The Motley Fool has positions in and recommends Apple, Goldman Sachs Group, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.