Futures-based SOL and XRP ETFs have crossed the $1 billion mark in total inflows just months after launching. This surge in investor interest is fueling fresh debate over the potential arrival of spot ETFs.

Strong Debut for SOL and XRP Futures ETFs

New data show that futures-based SOL and XRP exchange-traded funds (ETFs) have collectively drawn over $1 billion since their debut in March and April, respectively. The category’s rapid growth includes contributions from the REX-Osprey Solana staking ETF, which alone has amassed around $150 million in assets under management.

These products give investors exposure to the price movements of their underlying digital assets through futures contracts rather than direct holdings. Since its launch in April 2025, the Teucrium 2X Long Daily XRP ETF (XXRP) has seen weekly inflows, as CoinGape previously reported. This demonstrates the consistent demand from investors for exposure to leveraged XRP. The ETF’s AUM has now surpassed $160 million.

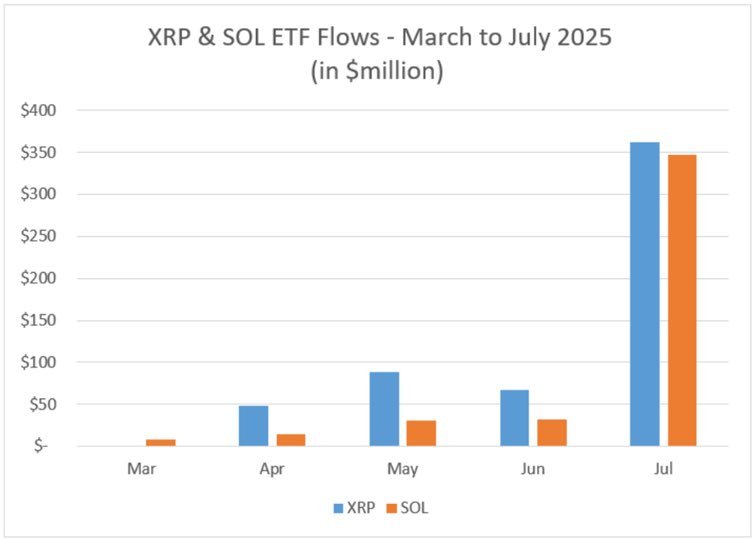

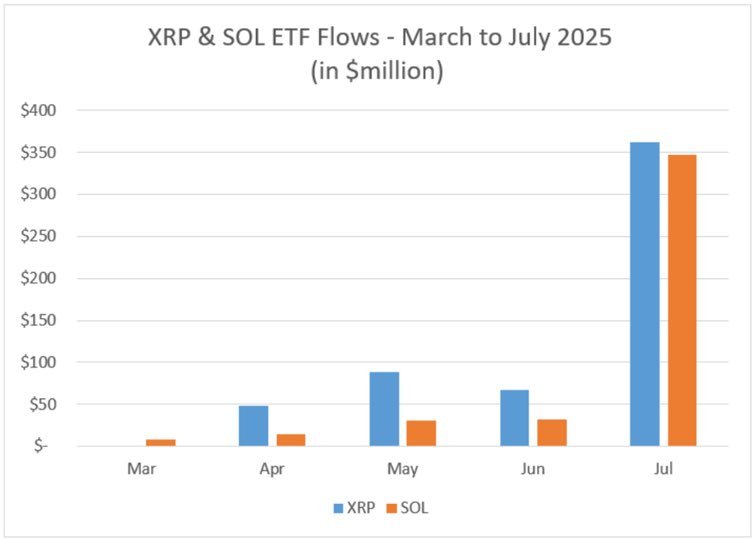

SOL and XRP ETFs saw a sharp increase in July, each bringing in about $350 million, following relatively low inflows in the first few months. This suggests that investors are becoming more confident in regulated products with a crypto connection.

Volatility Shares was the first to bring a Solana-linked ETF to market in March 2025, launching both a standard futures-based fund and a 2x leveraged SOL ETF.

Spot ETF Hopes Gain Momentum

Some analysts are taking the strong performance of these futures-based funds as evidence of underlying demand for spot ETFs. Geraci previously argued that the success of the current offerings could pave the way for BlackRock SOL and XRP ETFs in the future.

While some market commentators insist that discussions are ongoing with a filing deadline set for October, others point to official comments from BlackRock denying immediate plans for such applications. However, analyst MartyParty has refuted claims circulating online that BlackRock had denied having plans for SOL and XRP ETFs. He said conversations with sources confirmed the story was false and likely fabricated or taken out of context by a reporter from The Block.

According to MartyParty, SOL and XRP spot ETF products are still very much in discussion. He added that October remains the deadline for any potential application, but the timing cannot be confirmed. He accused The Block of spreading “biased fake news” and urged XRP and Solana investors to unfollow the publication.

Notably, the quick capital accumulation into XRP and SOL ETFs highlights the demand for diversified cryptocurrency investment vehicles in markets that are subject to regulation. The $1 billion milestone is currently a definite sign that investor interest in SOL and XRP is still very much alive and well. In the upcoming months, the discussion surrounding spot ETFs will only intensify.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: