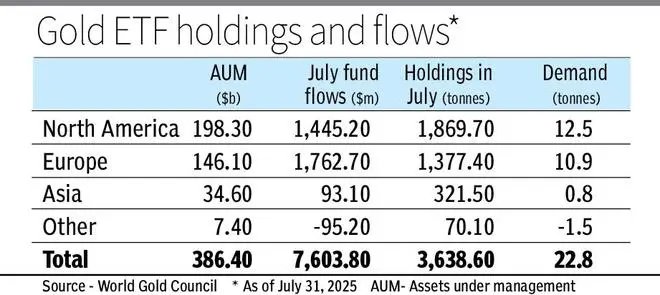

India and Japan lifted investments into gold ETFs (exchange-traded funds) in July, along with North America and Europe. Overall, global ETFs witnessed inflows to the tune of $3.2 billion in July, data from the World Gold Council (WGC) showed.

July witnessed inflows into gold ETFs in Asia at $93 million, despite an outflow in China. Its investors’ risk appetite improved as they shifted to equities, which saw their strongest performance since September 2004. In India, investments into gold ETFs was $156 million and in Japan, $215 million.

Global gold ETFs’ total assets under management increased to $386 billion in July, up 1 per cent from June to another high. Collective gold holdings increased by 23 tonnes to 3,639 tonnes, the highest month-end in 35 months, data showed.

On track for 2nd best show

Inflows into gold ETFs in North America were $1.4 billion in July, taking total inflows in 2025 to $22 billion. The investments are on track for their second-strongest annual performance.

“While flows remained positive, they did slow month-on-month. We attribute this to a short-term rebound in the dollar and a rise in rates, as expectations for future Fed cuts continue to be pushed further out,” said the WGC.

Some investors most probably booked profits and diverted them into equities, especially as recent trade announcements from Japan and the EU lifted risk appetite. “However, we’re also seeing speculative stocks gain traction, which could point to frothy conditions remerging. Still, the trajectory of US-China trade negotiations will likely remain one of the dominant drivers of future market sentiment,” said the WGC, a body of gold-producing nations.

It said continued inflows into gold-backed ETFs will likely be supported as signs that tariff effects trickle through more meaningfully to growth and/or inflation.

Outflow in Germany

European funds saw their third consecutive monthly investments rise in July. They attracted $1.8 billion. German funds saw investors logging out. “Gold’s outsized strength in British pounds attracted local investors,” the WGC said.

Inflows were witnessed in Switzerland and France too in July. The US tariffs uncertainty until July 27 supported investors’ interest growth concerns in the EU. “This was reflected in a pick-up in physical bar and coin demand, which saw the regional demand more than double year-on-year to 28 tonnes in Q2,” said the global gold organisation. In other regions, modest outflows from the gold ETFs were witnessed

Trading volumes in the gold market were $297 a day on average, higher by 2.3 per cent from June. Over-the-table-counter (OTC) volumes were 2 per cent higher than in June at $154 billion a day, but they were below the first half average of $165 billion. However, they were higher than the 2024 average of $128 billion.

On the Commodity Exchange (Comex), US, trade volumes averaged $137 billion a day, though global ETF activities dropped 15 per cent from June to $4.9 billion a day. Net longs in Comex gold futures were up 12 per cent from June to 676 tonnes, while money managers increased their net longs by 4 per cent.

Published on August 8, 2025