Spot Ethereum exchange-traded funds, or ETFs, had seven consecutive days of outflows shedding over $5.7 million in assets on Friday, Aug. 23, bringing the cumulative figure to $464 million, data by SoSoValue shows.

Cumulative net assets locked in these Ethereum (ETH) ETFs stand at about $7.65 billion.

The Grayscale Ethereum Trust has $5 billion followed by the Grayscale Mini Ethereum Trust with $1.01 billion. It is followed by ETFs from Blackrock, Fidelity, Bitwise, and VanEck.

Institutional investors reluctance

In a note to Bloomberg, crypto analyst Noelle Acheson noted that many institutional investors are a bit reluctant to invest in Ethereum ETFs and prefer to focus on Bitcoin (BTC) for their diversification efforts.

However, she expects that Ether ETFs will likely see more inflows in the future, akin to the metal industry, where gold ETFs hold over $100 billion in assets while those tracking silver have less than $20 billion.

The opportunity cost

The other reason why Ethereum ETFs are struggling is the opportunity of holding them vis-a-vis buying Ether.

Buyers of the cheapest Ether ETF — Grayscale Mini Ethereum — will pay a small expense ratio of 0.15%. However, they will also avoid making money through staking.

Data by StakingRewards shows that Ethereum yields about 3% or $300 if you invest $10,000 in it.

The data shows that Ethereum’s net staking inflow has risen in 20 of the last 30 days, reaching over $93.7 billion. Therefore, since Ether ETFs track Ethereum prices, many investors are opting for Ether.

Ethereum is underperforming Bitcoin

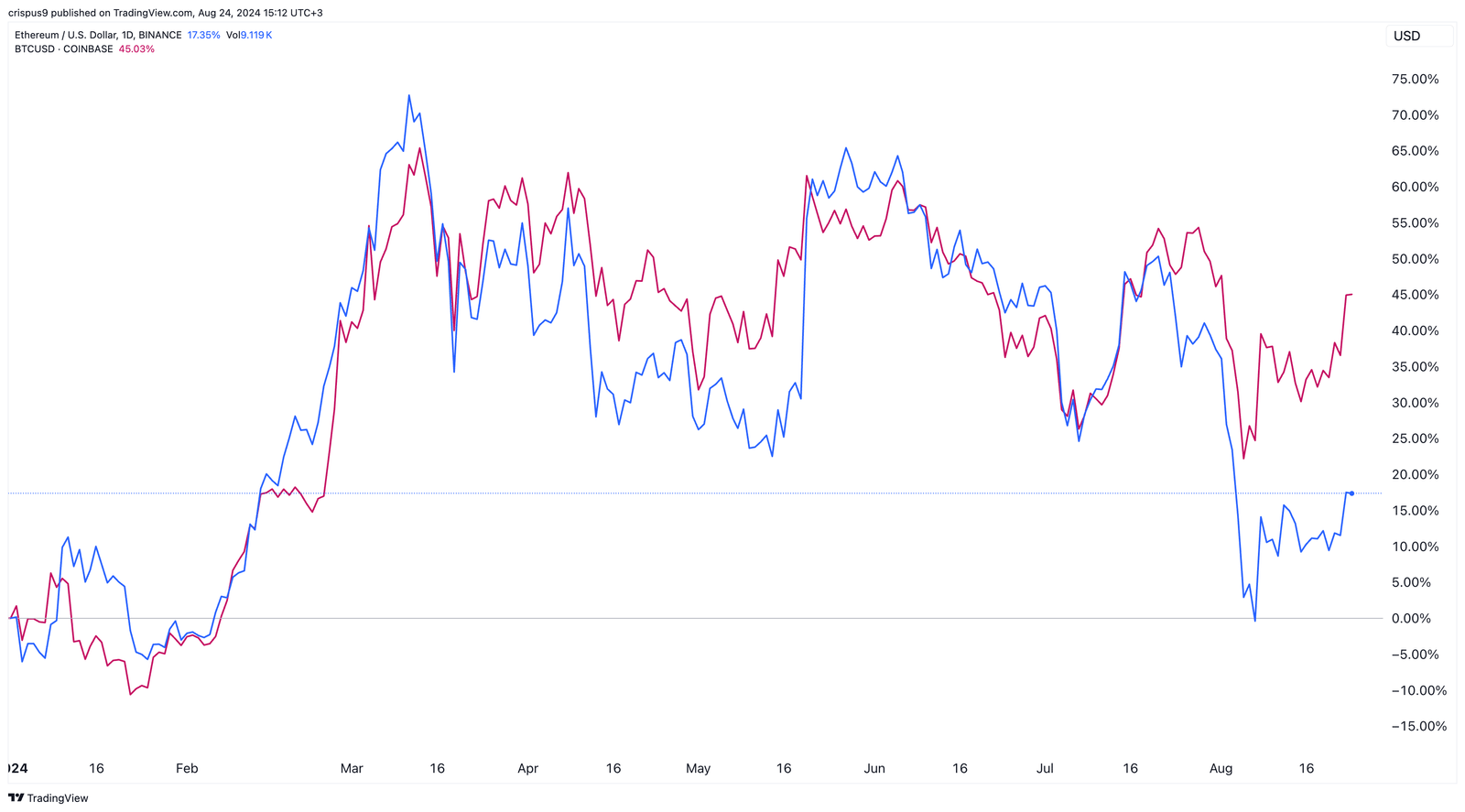

Another likely reason is that Bitcoin is doing better than Ether this year. It has risen by over 45% while ETH is up by less than 20%.

This performance is likely because Ethereum is facing substantial competition from Solana (SOL) and Tron (TRX).

Tron has become a major player in stablecoin transactions, handling daily volumes of over $40 billion. Similarly, Solana has seen substantial traction because of its meme coins. As a result, in July, Solana was the biggest chain in DEX volumes, handling over $58 billion.

Ethereum’s ETF performance will likely be a red flag for financial services companies considering launching other altcoin ETFs like Solana and Avalanche.