Institutional investors can benefit from increased retail ETF trading when market makers “increase the interaction” between the two order flows, according to Peter Whitaker, head of EMEA market structure and regulation at Jane Street.

In a report, titled Retail Trading in European Listed ETFs, Jane Street said market makers can help bridge the liquidity gap between retail and institutional investors by providing and unwinding risks based on their trading characteristics.

Retail traders tend to trade most on Mondays and Fridays and have a lower trading share in mid-week, according to data from UK RSP, a dedicated retail trading platform.

Chart 1: Average daily non-retail venues’ turnover versus retail venues’ share in European-listed ETFs

Source: big xyt

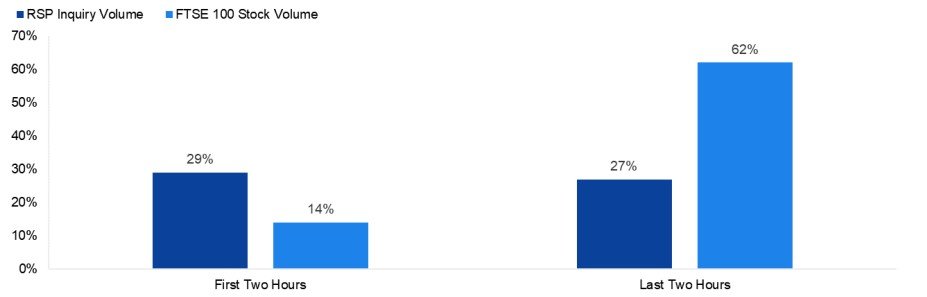

Furthermore, almost a third of retail trades look to execute in the first two hours of trading, versus just 14% of the turnover of the stocks in the FTSE 100.

Chart 2: Percentage turnover at start and end of day – RSP inquiry vs FSTE 100 stocks

Source: big xyt

“While generally institutional investors’ orders may not be able to interact directly with these retail focused models, institutions can get the benefit of the subsequent hedging and unwind of risk by market makers,” Whitaker said.

“Providing risk to retail orders at the time it is demanded and then unwinding risk during the institutional trading day, can help that liquidity become more accessible.

“This interaction may contribute to the relationship between the retail share of ETF trading and the share of on-order book trading in ETFs.”

It added the “recycling of liquidity” can also extend across products.

For example, risk provided by market makers to retail in one ETF may make prices tighter across other correlated ETFs, “enabling the wider risk appetite from retail trading to be transferred in part to institutions’ trading across asset classes”.

Which ETFs are retail investors trading?

While retail investors tend to use a more concentrated range of ETFs than institutional investors, there is still a large amount of correlation across which the benefits can be felt.

The top 50 ETFs account for 43.5% of retail investor turnover, versus just 28% for the remaining flow for institutional investors, however market makers can transfer this risk across asset classes, according to Jane Street.

Chart 3: Turnover by ETFs underlying asset class

Source: big xyt

Retail investors are less concerned with ETF size and market-wide turnover than institutional investors.

“Retail customers likely prefer ETFs listed in their local currency and may have preferences for different dividend structures, for example accumulating over distributing, further focussing retail activity into these particular trading lines,” Whitaker said.

Retail ETF trading growth

Retail ETF trading is growing, driven in part by the uptake of German retail investors using ETF savings plans.

ETF usage among retail investors is now higher than cash equities, accounting for 7% of all ETF trading on retail venues versus 3-4% for cash equities, according to Jane Street analysis.

“Exchanges and market infrastructure providers more broadly are looking to build new, innovative solutions to support ETF and retail trading given the strong tailwinds supporting these segments of the market,” Whitaker added.

Despite this, he added differences in execution timing and the ETFs being traded will remain, meaning “the role of market makers will remain of the utmost importance to provide liquidity and enhance institutions’ execution performance”.

Innovation among retail platforms has also been tipped as the catalyst for driving ETF liquidity onto exchanges in Europe.

On exchange liquidity has been touted as a major issue for a fragmented European ETF ecosystem currently dominated by request-for-quote (RFQ), which accounted for 55% of ETF execution at the end of 2022.