In a recent X thread, Matt Hougan, CIO of Bitwise, takes on the common narrative that Bitcoin ETFs are just some sort of retail-driven phenomenon. According to Hougan, Bitcoin ETFs are being adopted by institutional investors at historic rates, outpacing all other ETFs in history.

Numbers speak for themselves, with a net inflow of $17.5 billion since their inception in January, placing the Bitcoin ETFs well on track to top the prior record set by the Nasdaq-100 QQQs. The latter originally gathered about $5 billion during its first year. This sort of comparison shows just how aggressive the growth of BTC ETFs has been.

Despite this remarkable performance, critics have raised concerns about the degree of institutional involvement in Bitcoin ETFs. They often cite data from quarterly disclosures known as 13Fs, which reveal that, as of Q2 2024, institutional investors hold just 21% of the assets under management (AUM) in BTC ETFs, with the remaining 79% held by retail investors. This disparity is frequently used to argue that institutional interest is limited.

Bitcoin ETFs vs. Historical Benchmarks

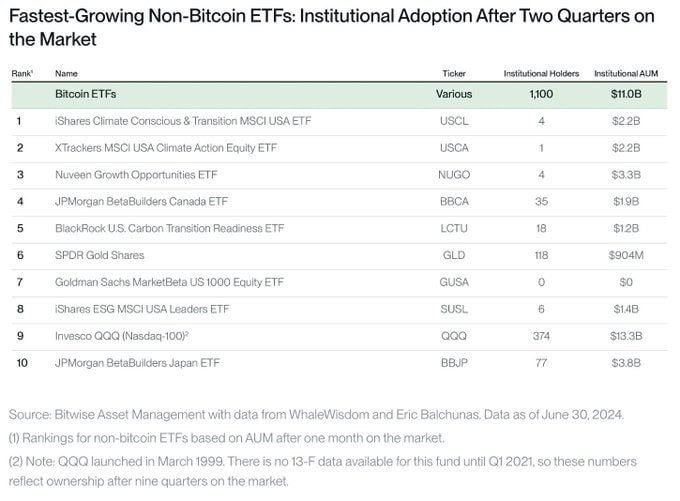

However, Hougan’s analysis, supported by data from Eric Balchunas, reveals a different story. When examining the institutional ownership of the ten fastest-growing ETFs of all time, BTC ETFs lead in both the number of institutional holders and the total institutional AUM after two quarters.

Though the Nasdaq-100 QQQs are often cited as a benchmark, their historical data is not that complete; QQQ was released in March 1999, and detailed 13F data only became available from Q1 2001-nine quarters after its launch. Even so, BTC ETFs boast three times the number of institutional holders as compared to the QQQs at a similar stage.

The huge amounts of retail investment in Bitcoin ETFs may be the reason why institutional involvement would seem to be less important and therefore, overshadow this fact. On the other hand, it is true retail dominance that does not take away the fact that Bitcoin ETFs are experiencing rapid institutional adoption. Nevertheless, Bitcoin ETF has a unique place in the market, as indicated by robust retail enthusiasm combined with growing institutional interest.

Related Reading | Ethereum’s 2025 Catalyst: How Pectra Could Transform DeFi Interaction