The ETF has returned over 11,000% over the past decade. Will it continue? That’s the million-dollar question.

You don’t need to find the next Amazon or hit on a lottery ticket-type stock to make big money in investing. Sure, you might get lucky, but there are safer roads one can travel to financial Valhalla. Believe it or not, exchange-traded funds (ETFs) can be a great way to diversify your investments and make you rich.

Bitcoin has minted millionaires for years, but there are nuances to cryptocurrency that can be a pain to deal with. Enter the Grayscale Bitcoin Trust ETF (GBTC 2.71%). The trust was created in 2013 and initially offered solely to institutional and accredited investors before it began trading over the counter in 2015. In January 2024, it was listed on the NYSE Arca exchange and formally became a spot Bitcoin ETF.

You could say it combines the best of both worlds: It is a simple investment option with the potential upside of Bitcoin.

Can the ETF make you a millionaire? Here is what you need to know.

Owning Grayscale Bitcoin Trust versus Bitcoin

An exchange-traded fund, or ETF, is a basket of assets (most commonly stocks) that trade under a single ticker symbol. Instead of buying stocks, the Grayscale Bitcoin Trust ETF purchases Bitcoin and holds it securely in cold storage. The ETF’s shares represent the value of the underlying Bitcoin. In other words, it’s a way to invest in Bitcoin without owning it yourself.

Why would someone do this instead of buying Bitcoin outright?

The most common reasons are safety and convenience. Owning Bitcoin or other cryptocurrencies requires setting up an account with a crypto exchange or a wallet. Wallets have unique passwords, and you can lock yourself out if you forget them. You may have seen some exchanges run into problems, such as the infamous downfall of FTX.

On the other hand, the Grayscale Bitcoin Trust is an ETF. You can buy or sell it right from your stock brokerage account. It also takes responsibility for holding and securing the Bitcoin off your hands.

The bull case for Bitcoin and the Grayscale Bitcoin Trust ETF

Bitcoin’s remarkable returns over the past decade tend to draw people to it, even if they’re not sure why it’s going up in the first place.

The primary investment thesis for Bitcoin is that it’s an anti-inflationary digital asset. You might think of it like a digital version of gold. You can’t use gold for payment in many stores, but it carries value because people desire it and consider it a store of value.

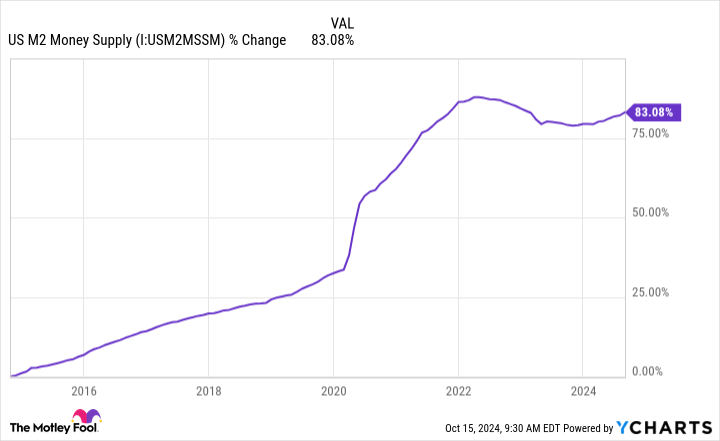

Importantly, there is a fixed Bitcoin supply. Bitcoin mining constantly increases the supply, but there is an eventual cap of 21 million, and the supply grows more slowly each time Bitcoin halves. Bitcoin’s price is in U.S. dollars, and the number of dollars in the economy is rapidly increasing. It’s a big reason why the country has seen so much inflation in recent years.

US M2 Money Supply data by YCharts.

The United States government has continually run at a deficit, meaning it’s spending more than it generates in tax revenue. The country borrows money to fill that gap, which pushes the money supply higher and is a sneaky component of inflation. These economic dynamics and growing demand for Bitcoin as society adopts it more could continue driving Bitcoin’s price higher.

Is the ETF a millionaire-maker?

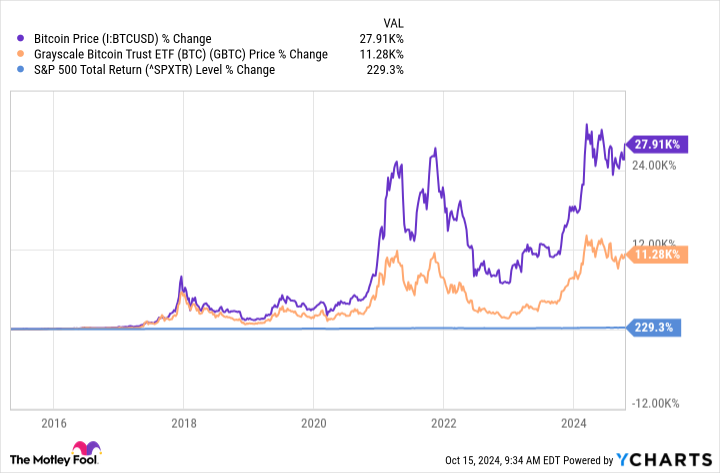

Of course, nothing is free. The Grayscale Bitcoin Trust ETF doesn’t manage its Bitcoin assets for nothing. It charges a 1.5% expense ratio for its services. Additionally, the ETF buys Bitcoin continually, so it’s essentially averaging up over time as Bitcoin’s price rises. As a result, the ETF doesn’t perform as well as Bitcoin itself.

Bitcoin Price data by YCharts.

However, notice how it’s still trounced the S&P 500 since its shares started trading over the counter. Yes, an 11,000% return can turn modest sums into lots of money.

Will it continue? Nobody can say for sure. The monetary policies that have helped Bitcoin thrive are still in place. The U.S. money supply has grown for decades since debasing from the gold standard in 1971. I don’t see why Bitcoin can’t continue appreciating, though it’s a guess as to the price or when it will get there. Bitcoin is also notoriously volatile.

That said, Bitcoin’s upside makes the Grayscale Bitcoin Trust ETF a potential millionaire-maker that offers more convenience and ease than owning the crypto itself. Consider holding ETF shares as part of a long-term-oriented, diversified portfolio.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Bitcoin. The Motley Fool has a disclosure policy.