MarioGuti/iStock via Getty Images

As the stock market volatility increased and downside pressure grew significantly due to the broader tech selloff, investors with a stake in the iShares U.S. Financial Services ETF (NYSEARCA:IYG) don’t need to fear because the sector is poised to benefit from fundamental factors and investors rotation out of risky sectors. The fundamentals factors – better than expected economic conditions, the potential rate cuts and solid earnings growth forecasts – all are calling for the extension of the bull run. In addition, cheap valuations and high dividend yield would also make financial stocks an attractive option for sector rotation. Therefore, I maintain my buy rating on iShares U.S. Financial Services ETF.

Stock Market Correction and Financials

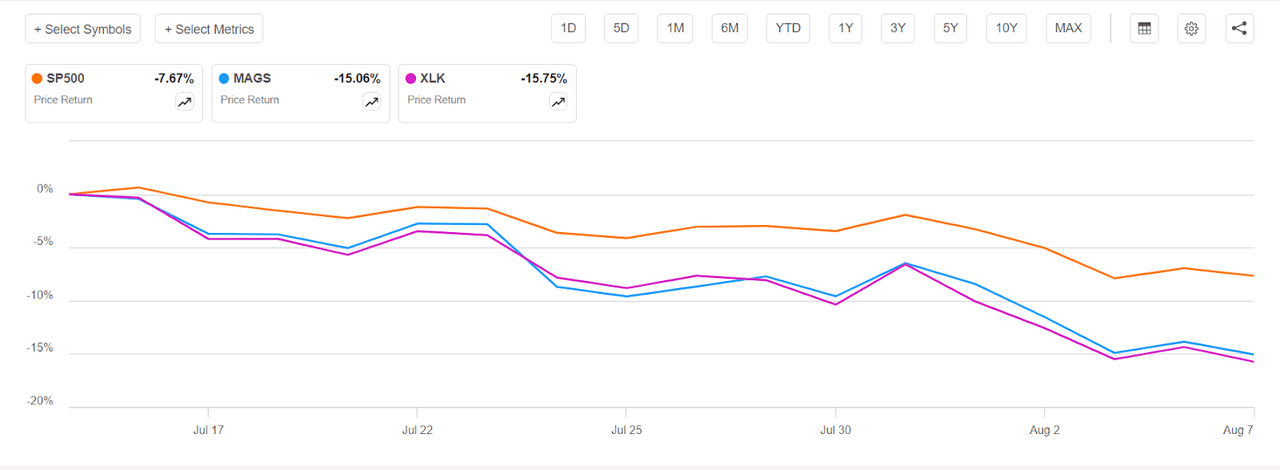

S&P 500, mega stocks and technology sector price performance since record high in mid-July (Seeking Alpha)

After a stunning bull run, more than 7% of the S&P 500 value has been wiped out since reaching a record high in mid-July. The selloff is mainly driven by tech stocks and the mega-8 group due to multiple reasons, including fading AI-related expectations, lofty valuations and slowing growth. The mega-8 group and the technology sector fell into the correction territory, losing nearly 15% of the price from recent highs.

As investor sentiment about AI has declined to skepticism from positive, there is a risk of further selloff because optimism over AI played a key role in skyrocketing tech stocks prices. The markets were expecting tech companies to produce billions of dollars in revenue by selling AI-related software, products and services. The tech companies have also boosted investors’ hopes by investing billions of dollars in the technology. For instance, after investing billions of dollars in emerging technology over the years, Alphabet’s (GOOG) (GOOGL) CFO Ruth Porat said in an earnings call that majority of its $13 billion investments in the June quarter were related to AI. Similarly, Microsoft (MSFT) has been spending billions of dollars quarter over quarter to gain a leading role.

However, it appears that tech companies will take a longer time to show a significant impact of AI on their revenue and profits. So far, despite spending billions of dollars, only a few companies like NVIDIA (NVDA) and Microsoft have successfully converted their AI investments into revenue and profits. Meanwhile, most of the tech companies are only integrating AI into existing and new products to improve their performance and efficiency.

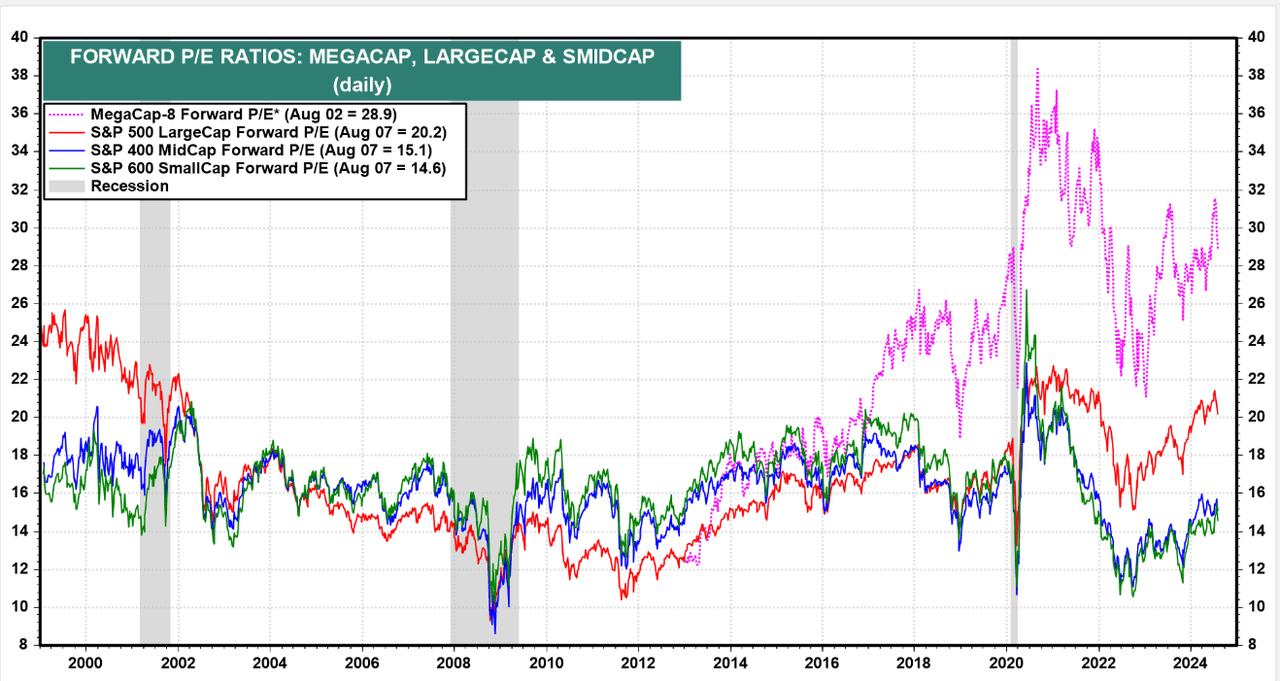

Besides AI, the valuation risk is also high despite the recent tech selloff. The mega-8, which was the key driver of the S&P 500’s uptrend, are currently trading around 29x forward earnings compared to their five-year average of 24x. The technology sector’s forward PE of 25x is also above its 10-year average. Moreover, as it appears challenging for major tech companies like Meta Platforms (META) NVIDIA, Amazon (AMZN), Tesla (TSLA) and Microsoft to sustain their growth rates in the coming quarters, investors might not be willing to pay a significant premium. Therefore, the price may come down to fix valuations with their long-term averages.

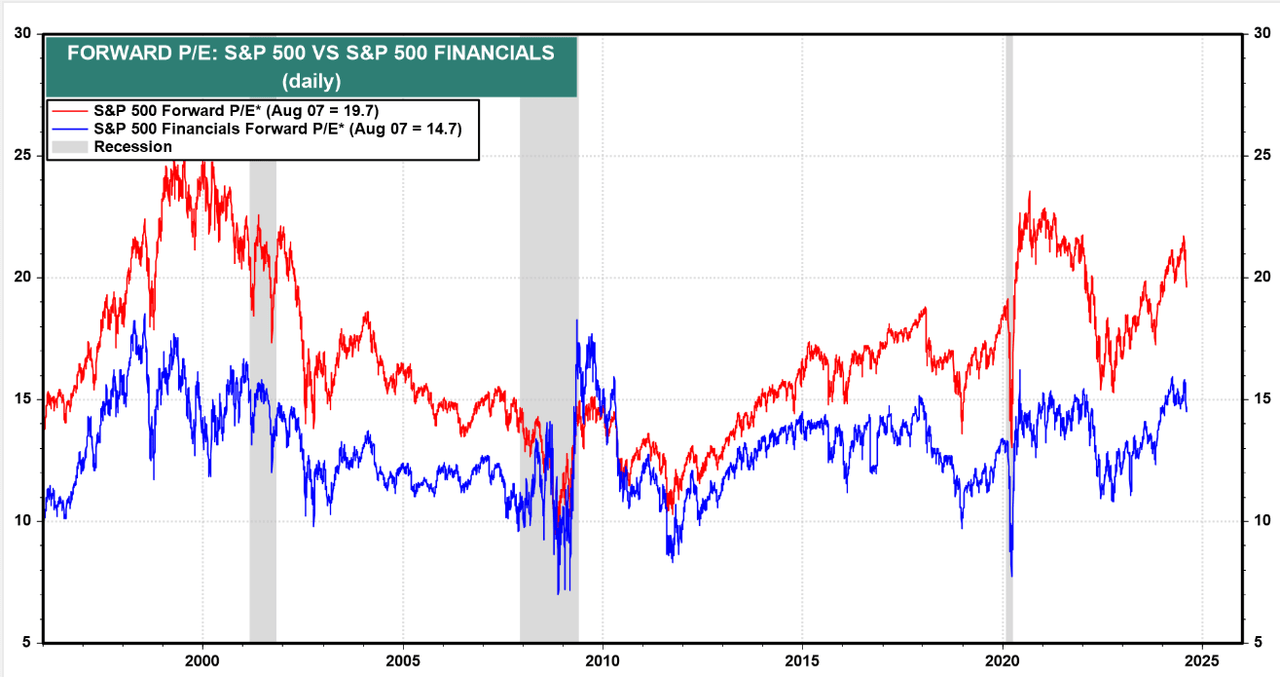

Financials sector forward PE Vs S&P 500 (Yardeni)

Meanwhile, the financials sector continues to trade at attractive valuations, making it a solid contender for rotation out of the expensive tech sector. The financials sector is currently trading around 15x forward earnings, down from the S&P 500’s 20x. In addition, the upside is likely to be backed by a growth factor. According to FactSet data, the financials sector is expected to experience 14% and 10% earnings growth in 2024 and 2025, respectively. In the June quarter, the Financials sector’s approximately 16% earnings growth was the third-highest among eleven S&P 500 sectors. Furthermore, the potential rate cuts are likely to bring more stability in the financial sector. Following an unexpected increase in unemployment and a decline in job growth rate, the market pundits are currently forecasting larger rate cuts in the coming months. Although rate cuts will negatively impact banks and consumer finance companies profitability, it will lower credit losses, increase loans and improve deposits.

IYG: Buy the Dip

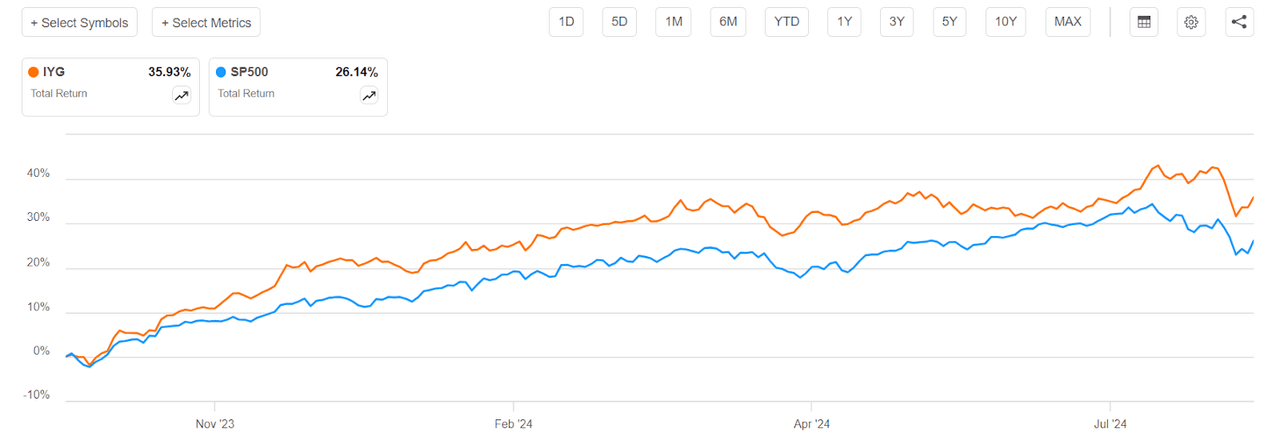

IYG vs S&P 500 total returns (Seeking Alpha)

iShares U.S. Financial Services ETF performed exceptionally since I last rated it a buy in October 2023, outperforming with a total return of nearly 33% compared to the S&P 500’s 23%. Despite the recent volatility, financial stocks and ETFs are likely to extend the uptrend because of the sector’s attractive valuations and strong earnings growth power. The risk factor with IYG is also limited when compared to a single stock, given its diversified portfolio structure. Its exposure to the top-performing companies from various industries within the financials sector improves its ability to maximize gains and lower the downside risk. IYG’s portfolio is spread across banks, capital market, asset management and other financial services companies.

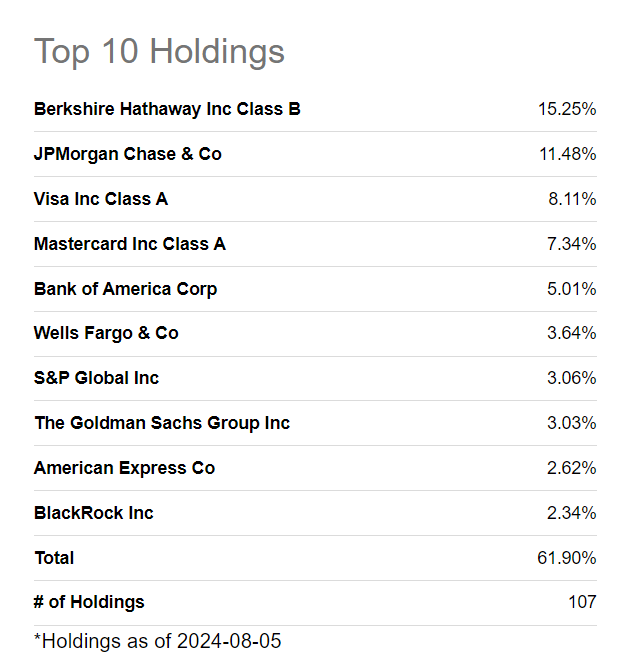

IYG top 10 holdings (Seeking Alpha)

IYG’s top 10 holdings accounts for approximately 62% of the overall portfolio. Its top stock holdings are ranked among the top-performing in their respective industries. For instance, Warren Buffett’s Berkshire Hathaway (BRK.B) is considered one of the safest investments given its multi-sector approach along with a long history of generating steady price gains. Its stock price soared 20% year to date as it continues to impress investors with a double-digit operating earnings growth and record $276 billion in cash. With a quant score of 4.98, Berkshire earned a strong buy ratings based on Seeking Alpha quant system.

JPMorgan Chase (JPM), IYG’s second largest holding, also outperformed the broader market index so far in 2024. In addition, the US banking giant’s impressive financial performance enabled it to raise its dividend for the second time in 2024. The bank generated 21% year over year revenue growth while its earnings per share of $6.12 grew 38% from the previous quarter and 28% from the year ago period. Visa (V) and Mastercard (MA), the largest payment transfer companies, are also among its top holdings with a combined weight of more than 15%. Both companies are expected to generate double-digit earnings growth in 2024 and 2025. The rest of its top holdings include banking giants like Bank of America (BAC), Wells Fargo (WFC) and Goldman Sachs (GS). Bank of America and Wells Fargo earned strong buy ratings based on Seeking Alpha quant system, while Goldman Sachs is also a fundamentally sound bank. Goldman Sachs earnings grew 172% year over year on a 14% revenue growth in the second quarter. Overall, IYG’s portfolio concentration in top-performing stocks from various industries in the financials sector would enable it to maximize gains and limit downside risk.

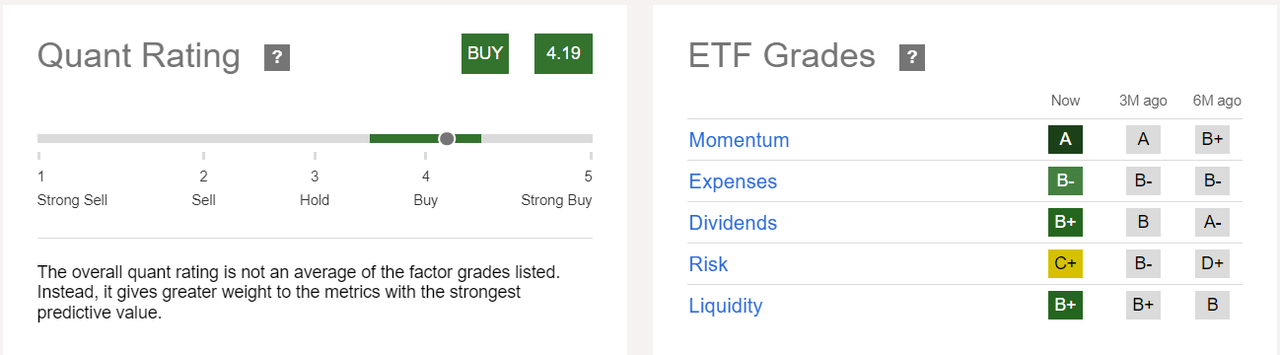

Quant Rating

IYG quant rating (Seeking Alpha)

IYG earned a buy rating with a quant score of 4.19 based on the Seeking Alpha quantitative analysis, which is in line with my fundamental analysis. Besides a C-plus grade on the risk factor, the ETF received solid grades on the rest of the factors. A score on a momentum factor indicates the robust share price momentum while a B plus score on dividend reflects healthy cash returns for shareholders. Its expense ratio of 0.40 is lower than the median of all ETFs. Moreover, with $1.32 in billion assets under management and above-average trading volume, its liquidity is strong among peers such as First Trust Financials AlphaDEX® Fund ETF (FXO) and Invesco Dorsey Wright Financial Momentum ETF (PFI). Although its risk factor increased recently, I believe the financials sector is fundamentally sound enough to navigate the impact of broader market volatility.

In Conclusion

The financials sector has demonstrated strong resilience against monetary tightening in the past year as banks, consumer finance companies and capital markets delivered record profits and returned significant cash to shareholders. The stability in the financial sector is likely to improve in the coming quarters because of the increasing prospects for rate cuts. Cheap valuations and strong earnings growth power could also be key drivers of price upside. Overall, ETFs like IYG appear to be one of the best investment vehicle to avoid the broader market volatility and benefit from a shift in market conditions.