|

GUANGZHOU, China, April 24, 2025 /PRNewswire/ — In 2024, the A-share market achieved a historic milestone with total dividend payouts reaching RMB 2.4 trillion (US$ 338 billion). As of April 13, 1,156 listed companies had announced dividend plans amounting up to RMB 1.13 trillion (US$ 160 billion). Meanwhile, the dividend yield of the CSI 300 Index and CSI Dividend Index has reached 3.5% and 6.3%, highlighting strong cash distributions. On April 28, E Fund Management (“E Fund”), the largest mutual fund manager in China, will launch E Fund CSI Dividend Value ETF (Code: 563700), the first ETF tracking the CSI Dividend Value Index, expanding its range of low-cost dividend ETFs.

In the midst of trade tensions, dividend indices such as the CSI Dividend Index and the CSI Dividend Low Volatility Index are gaining traction. These indices focus on domestically oriented sectors with low trade sensitivity-overseas revenue contributions in the first half of 2024 are just 6.3% and 4.3%, compared to 11% for the CSI 300 Index.

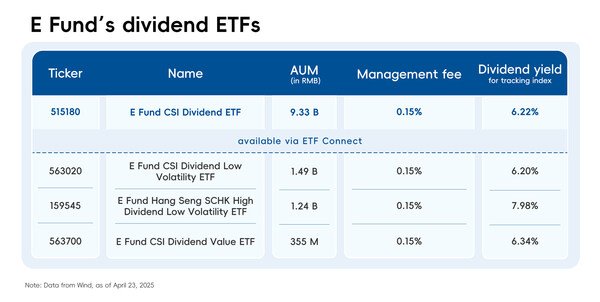

E Fund’s dividend ETF lineup now includes E Fund CSI Dividend ETF (Code: 515180), E Fund CSI Dividend Low Volatility ETF (Code: 563020), E Fund Hang Seng SCHK High Dividend Low Volatility ETF (Code: 159545) and E Fund CSI Dividend Value ETF. Among them, E Fund CSI Dividend ETF, available via ETF Connect, achieved a scale of RMB 9.3 billion (US$ 1.28 billion), largest of its kind tracking the CSI Dividend Index, as of April 23. These offerings all adopt the lowest management fee rate of 0.15% annually, helping investors to cost-effectively invest in high-dividend assets.

Moreover, the entry of annuity funds, public funds, and other medium- to long-term capital funds into the stock market has elevated the strategic importance of dividend-focused investments, especially wealth management funds are increasingly favoring low-volatility dividend strategies. For instance, E Fund CSI Dividend Low Volatility ETF has attracted significant holdings from wealth management funds, with these funds occupying three of the top ten shareholder positions, collectively accounting for 9.23% of outstanding shares, as of December 31, 2024.

About E Fund

Established in 2001, E Fund Management Co., Ltd. (“E Fund”) is a leading comprehensive mutual fund manager in China with over RMB 3.5 trillion (USD 497 billion) under management.* It offers investment solutions to onshore and offshore clients, helping clients achieve long-term sustainable investment performances. E Fund’s clients include both individuals and institutions, ranging from central banks, sovereign wealth funds, social security funds, pension funds, insurance and reinsurance companies, to corporates and banks. Long-term oriented, it has been focusing on the investment management business since inception and believes in the power of in-depth research and time in investing. It is a pioneer and leading practitioner in responsible investments in China and is widely recognized as one of the most trusted and outstanding Chinese asset managers.

Source: E Fund. AuM includes subsidiaries. Data as of March 31, 2025. FX rate is sourced from PBoC.