MarketVector Indexes has launched two new benchmarks focused on stablecoin and real-world asset tokenization (RWA) infrastructure, alongside the debut of two exchange-traded funds from US issuer Amplify ETFs designed to track the indexes.

According to Tuesday’s announcement, the MarketVector Stablecoin Technology Index and the MarketVector Tokenization Technology Index are designed to give investors regulated exposure to companies and digital asset products involved in stablecoin issuance, payments and settlement, as well as platforms supporting tokenized RWAs.

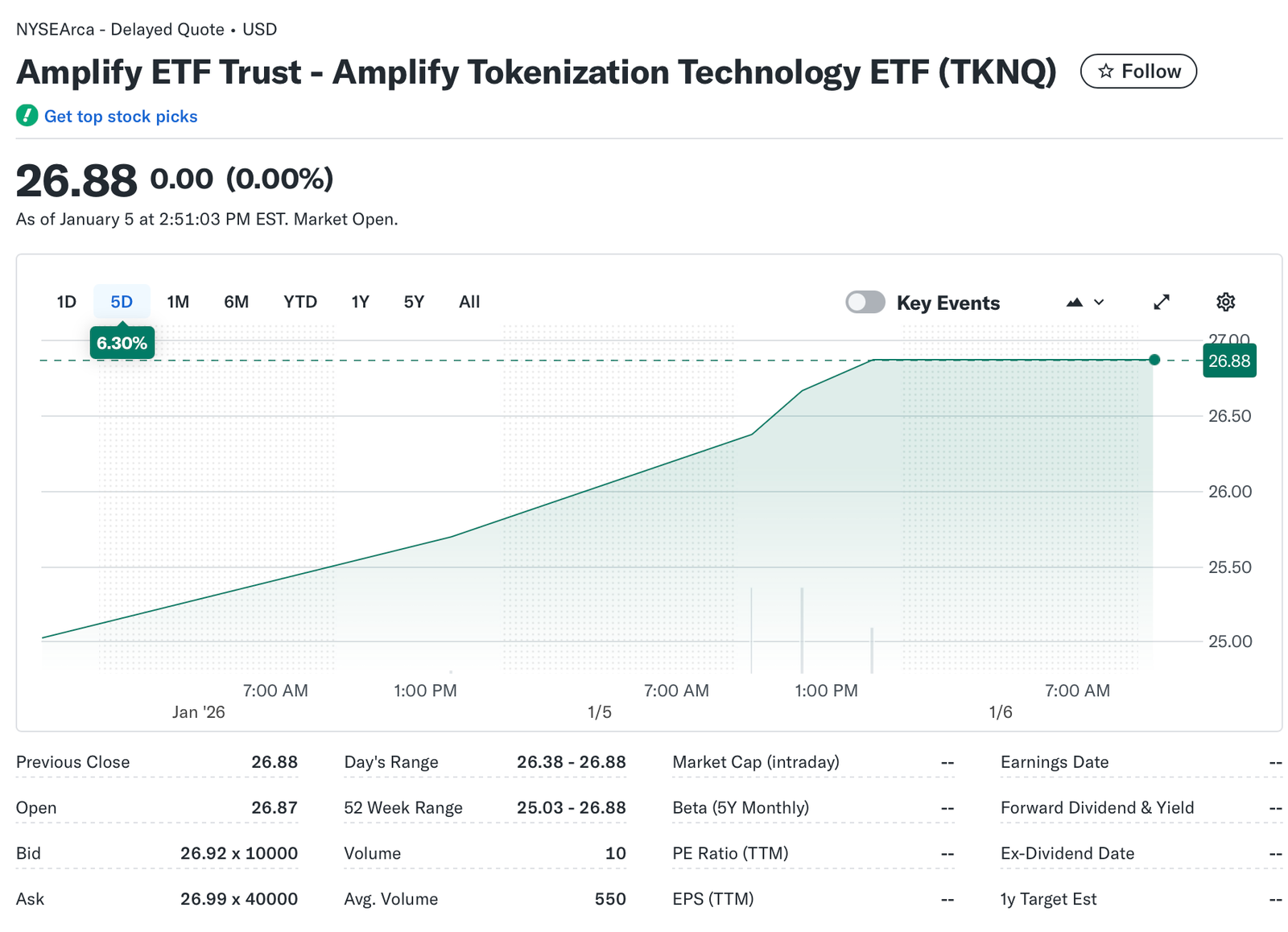

The company also announced the launch of two funds from Amplify ETFs tied to the new benchmarks. The Amplify Tokenization Technology ETF (TKNQ) tracks the tokenization-focused index, while the Amplify Stablecoin Technology ETF (STBQ) follows the stablecoin benchmark.

Both funds are structured to follow MarketVector’s benchmarks rather than hold stablecoins or tokenized assets directly. The ETFs will trade on the NYSE Arca exchange in the United States.

Based in Germany, MarketVector is an index provider and regulated benchmark administrator overseen by BaFin, with benchmarks licensed by exchange-traded product issuers worldwide.

The company did not disclose which companies or products are currently included in the index.

Related: China’s financial associations reclassify RWAs as ‘risky,‘ report says

Stablecoin and RWA growth in 2025

Stablecoins and the tokenization of real-world assets were among the key narratives shaping crypto markets in 2025.

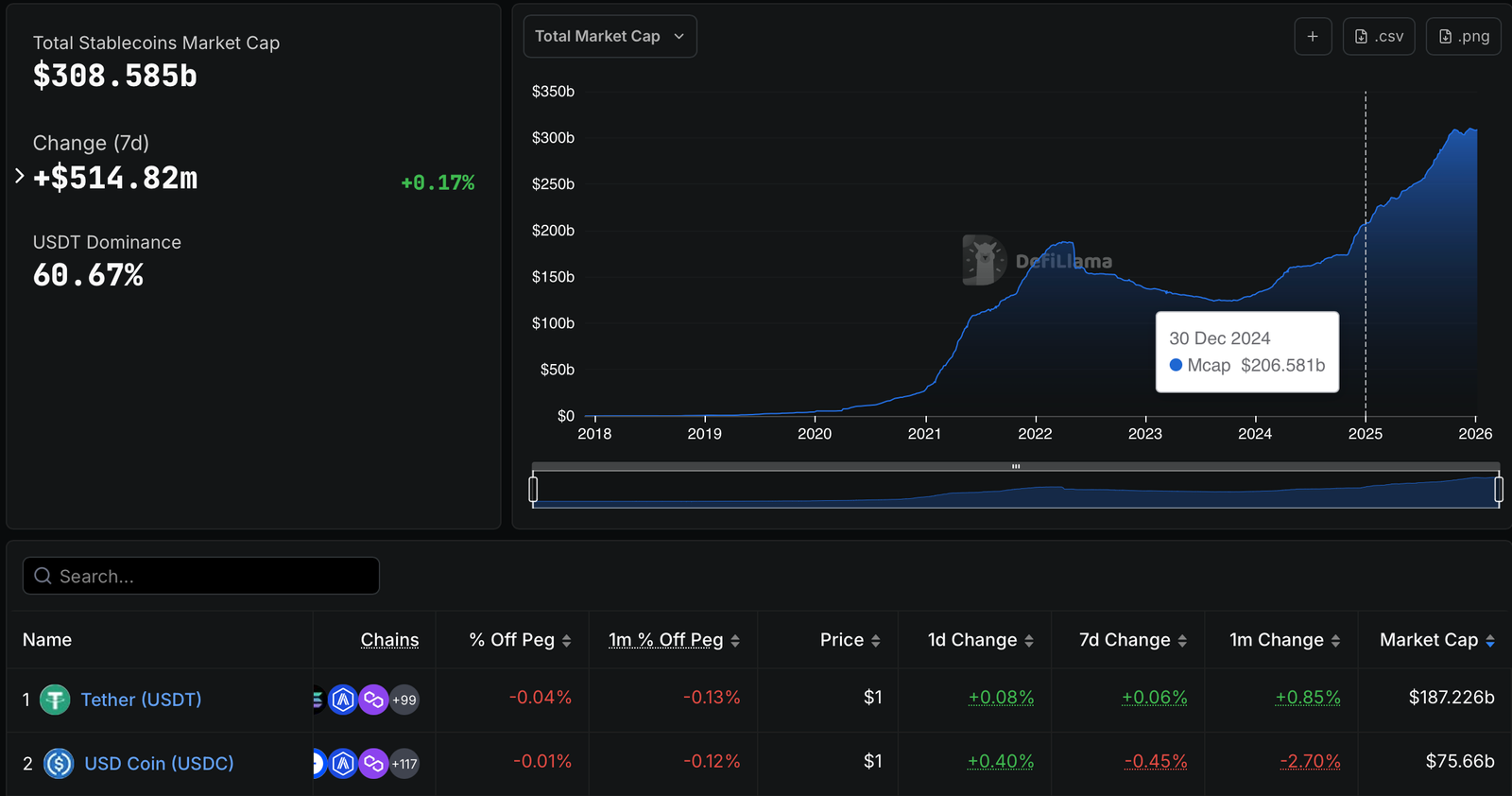

DeFiLlama data shows the stablecoin market cap is currently $308.6 billion, up more than 50% from the end of 2024.

Despite the launch of several new stablecoins last year, the market remains highly concentrated. Tether’s USDt (USDT) accounts for about 60% of total stablecoin market capitalization, while Circle’s USDC (USDC) represents about 24% of the market.

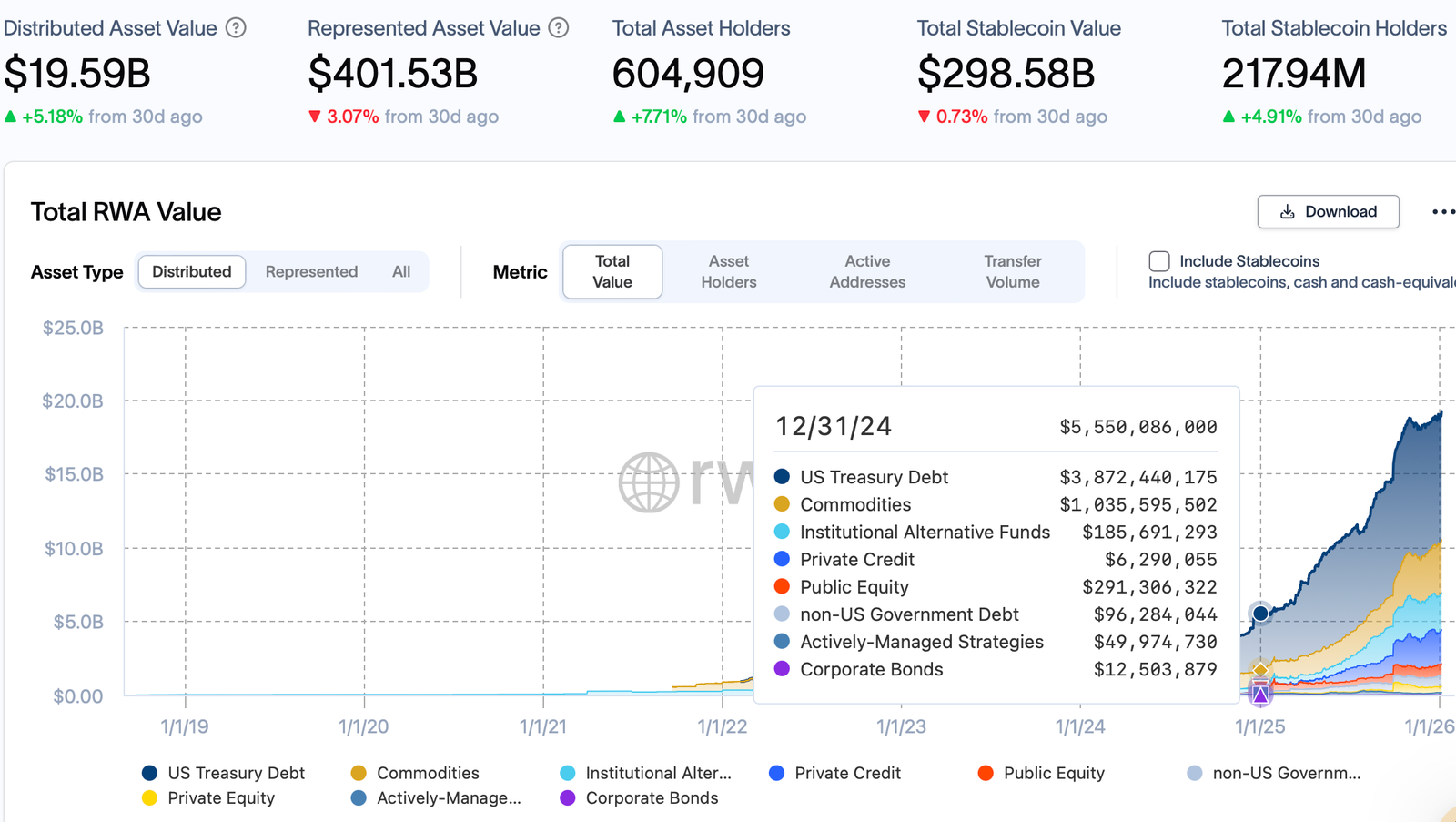

Real-world asset tokenization, the process of representing traditional financial assets as blockchain-based tokens, experienced even faster growth in 2025.

According to data from RWA.xyz, the total value of tokenized RWAs rose to about $19.6 billion at the time of writing, up from roughly $5.55 billion at the end of 2024, an increase of about 250%.

Tokenized US Treasury debt accounts for roughly $9 billion of the total RWA market, driven largely by products such as BlackRock’s BUIDL, Circle’s USYC and Franklin Templeton’s BENJI, which tokenize short-term government securities.

Several crypto industry executives who spoke with Cointelegraph late last year said they expect adoption of stablecoins and tokenized real-world assets to continue growing in 2026.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026