The Vanguard Growth ETF is a long-term winner, but it is no stranger to steep sell-offs.

In the span of just two years, the combined market cap of Nvidia (NVDA 0.80%), Apple (AAPL 0.36%), and Microsoft (MSFT 0.80%) has gone from $4.36 trillion to just over $10 trillion. Microsoft and Nvidia are already at the forefront of artificial intelligence (AI), while Apple plans to further integrate AI into its products and services.

The rapid rise in the value of these three companies in a relatively short amount of time has changed the landscape of the broader market. They now make up nearly 20% of the S&P 500 (^GSPC -0.03%) and a staggering 44% of the tech sector.

However, some investors may want even more exposure to growth than what an S&P 500 index fund could offer. You may also want to invest in companies like Nvidia, Apple, and Microsoft while not being limited to a tech sector exchange-traded fund (ETF).

With 183 holdings across a variety of sectors, a mere 0.04% expense ratio, and a combined 33.5% weighting in Nvidia, Apple, and Microsoft, the Vanguard Growth ETF (VUG 0.46%) stands out as an ultra-low-cost way to invest in the top growth companies. Here’s why the ETF could be worth buying at an all-time high.

Image source: Getty Images.

What to expect from the Vanguard Growth ETF

The Vanguard Growth ETF celebrated its 20-year anniversary earlier this year. Formed out of the fallout of the dot-com bust, the ETF has been through multiple market downturns and built a track record as one of the most well-known go-to growth ETFs. Its net assets stand at over $260 billion, which is colossal for a non-index fund.

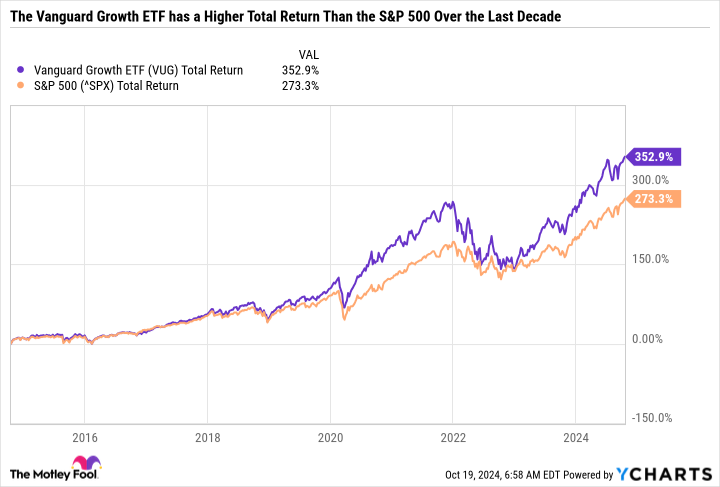

Over the last decade, the Vanguard Growth ETF has outperformed the S&P 500 even when factoring in dividends. And because its expense ratio is so low, or just $4 for every $10,000 invested, investors aren’t holding back their performance with fees.

VUG Total Return Level data by YCharts

The simplest reasons to buy the Vanguard Growth ETF are that you want high exposure to mega-cap growth stocks, you are willing to pay a premium price for those top stocks, you don’t want to own some of the larger stodgier companies in the S&P 500, you don’t mind getting very little dividend income, and you are willing to endure the volatility of growth stocks.

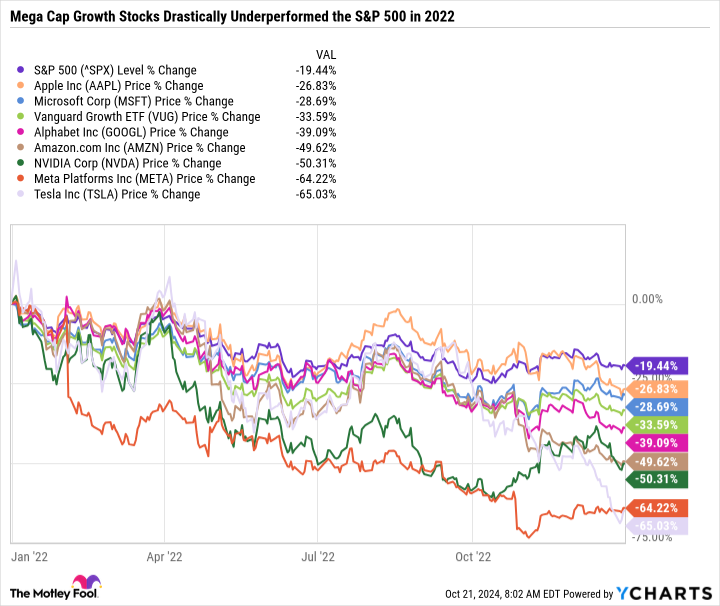

Referring back to the chart above, you can see that the Vanguard Growth ETF has suffered some sizable sell-offs. Late 2018, early 2020, and 2022 saw drastic declines in top growth names. It’s easy to forget now, but 2022 was an especially brutal year for growth investors. The very companies that have fueled explosive gains in 2023 and 2024 all underperformed the S&P 500 in 2022 — leading the Vanguard Growth ETF to lose a third of its value.

The above chart isn’t meant to scare you — but rather — showcase what you could be signing up for when investing in top growth stocks. 53% of the Vanguard Growth ETF is allocated in the seven names in the chart, also known as the “Magnificent Seven.” The fund’s performance is heavily dependent on a handful of companies.

Volatility is often the price of admission when it comes to unlocking potentially market-beating gains. By leaving out companies like Berkshire Hathaway, UnitedHealth, Procter & Gamble, JPMorgan Chase, Coca-Cola, and PepsiCo and allocating higher weights to growth names, the Vanguard Growth ETF is taking away some of the reliable stodgy value names that tend to do well when the market goes down. In other words, it is trading away a layer of protection for more exposure to upside potential.

A recipe for long-term success

No one knows if the Vanguard Growth ETF will beat the S&P 500 in the next month or year. However, we do know that the top holdings of the Vanguard Growth ETF are truly remarkable companies with many advantages when allocating capital. Companies grow in value when their earnings go up, or their earnings growth rate is expected to increase. A lot of the downturns in growth stocks are due to expectations getting ahead of reality rather than fundamental concerns with the core business. Over time, these companies have a way of growing into their valuations. Take Microsoft, for example.

Microsoft has a 35.4 price-to-earnings ratio, which is above its 10-year median P/E of 31.6. So, at first glance, you could say that Microsoft looks overvalued. However, if Microsoft’s stock price goes nowhere for a year and it grows earnings by 15%, its P/E ratio would be below that 10-year median level. You can apply the same exercise to virtually any growth stock and conclude that earnings growth can always justify a high valuation over time.

The perfect buy-and-hold ETF for risk-tolerant investors

Investing is all about trade-offs. When investor sentiment is positive, folks may be willing to pay a higher price today for future growth. When sentiment is negative, investors may want to see proven results before bidding up a stock.

The magic of earnings growth is what makes the Vanguard Growth ETF such an excellent long-term holding, even around its all-time high. For the ETF to underperform the S&P 500 over the next five to 10 years, we’d have to see some major slip-ups across the top names, a widespread, prolonged tech downturn, or some other unforeseen risk pop up such as global competition from a non-American company completely disrupting core aspects of the U.S. economy.

In sum, the Vanguard Growth ETF is set up to do well over the long term. But it’s one of those funds where it is paramount to know what you are getting into ahead of time and brace yourself for heightened volatility.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, JPMorgan Chase, Microsoft, Nvidia, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool recommends UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.