Morsa Images

I’ve been fortunate to interview a number of thought leaders in the cannabis space on my podcast Lead-Lag Live. The one thing I always came away from these conversations? Cannabis demand is incredible, but the challenges of investing in the space negate the industry’s growth, given a lack of a clear framework on the federal end of things. At some point, this will change. And when it does, you may want to consider the AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS). This ETF includes companies focused on cultivation and distribution, known as multi-state operators (MSOs) and ancillary cannabis operators. MSOS invests only in US-based cannabis-related companies, excluding Canadian exposures common in rival cannabis ETFs.

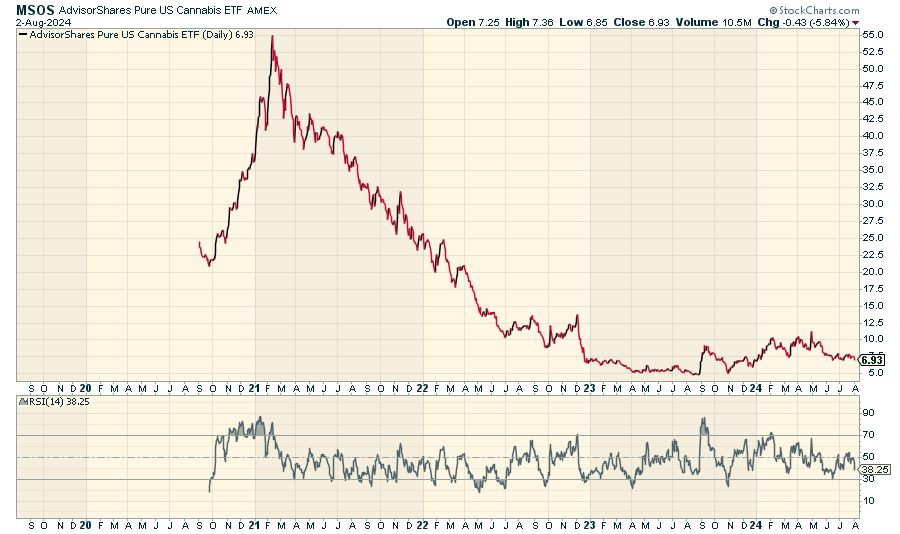

The fund has had a very hard time since the 2021 peak, and, candidly, has been flat on its back recently. Perhaps, though, that’s exactly why you may want to position here.

stockcharts.com

A Look At The Holdings

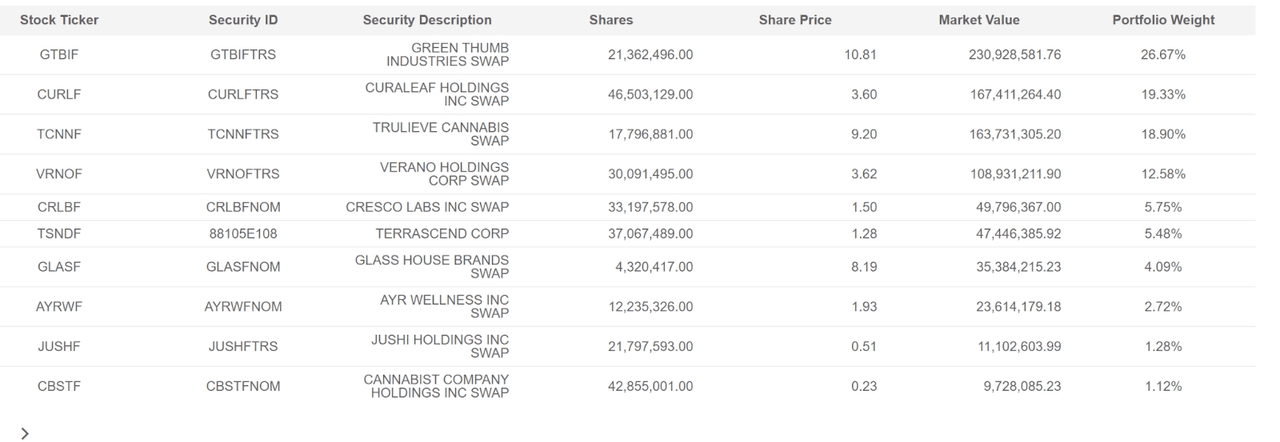

Fundamentally, MSOS is a basket of top-tier US cannabis companies across production, distribution and retail segments. Or perhaps more accurately, a collection of swaps around those companies.

advisorshares.com

A swap is a derivative contract between two parties (usually one of which is a financial institution) who exchange cash for the return of the asset the swap is for. Because of a lack of federal legalization, MSOS gets access to the return patterns of cannabis companies through these swap agreements. Confusing? Sure. But essentially the only way the fund can get access to more companies in the absence of a federal framework that’s friendly towards investing.

Now, with that said, there’s a high degree of concentration here, with the biggest allocation making up nearly 27% of the fund. High concentration. What do these companies the swaps cover do? Green Thumb Industries is a leading national cannabis consumer packaged goods company and retail operator that manufactures and distributes a portfolio of branded cannabis products including Beboe, Dogwalkers, Dr. Solomon’s, and the GTI House of Brands. Curaleaf Holdings Inc is a multi-state cannabis operator with a vertically integrated network across the United States. Trulieve Cannabis Corp is a vertically-integrated “seed-to-sale” multi-state operator with dominance in Florida and a quick expansion across the US. Verano Holdings Corp. is a vertically integrated multi-state operator operating cultivation, processing, and retail stores across multiple states. And Cresco Labs Inc is a vertically integrated multi-state cannabis operator, cultivating the highest-quality branded cannabis products for a range of customer offerings in servicing both consumer and business-to-business customers.

Peer Comparison

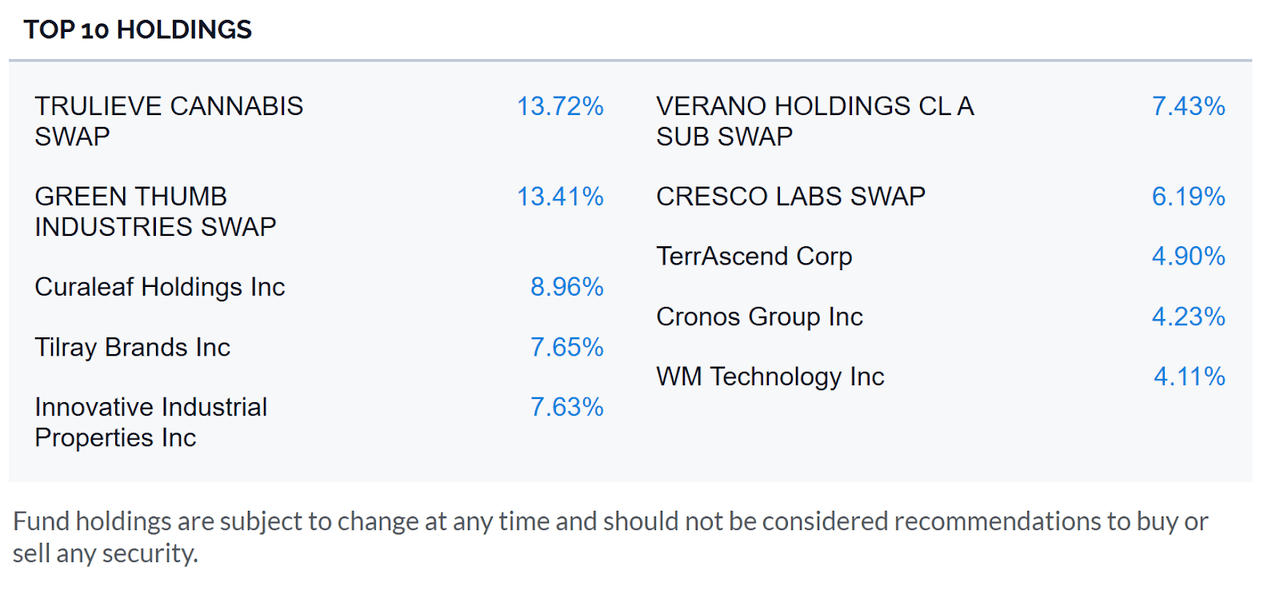

MSOS is not the only cannabis ETF you can buy. One fund worth comparing this against is the Amplify Seymour Cannabis ETF (CNBS). This ETF is actively managed, which focuses on the legal cannabis industry in the US and Canada. The fund similarly uses swaps for some of its positions, and also has a high concentration in the top 10.

advisorshars.com

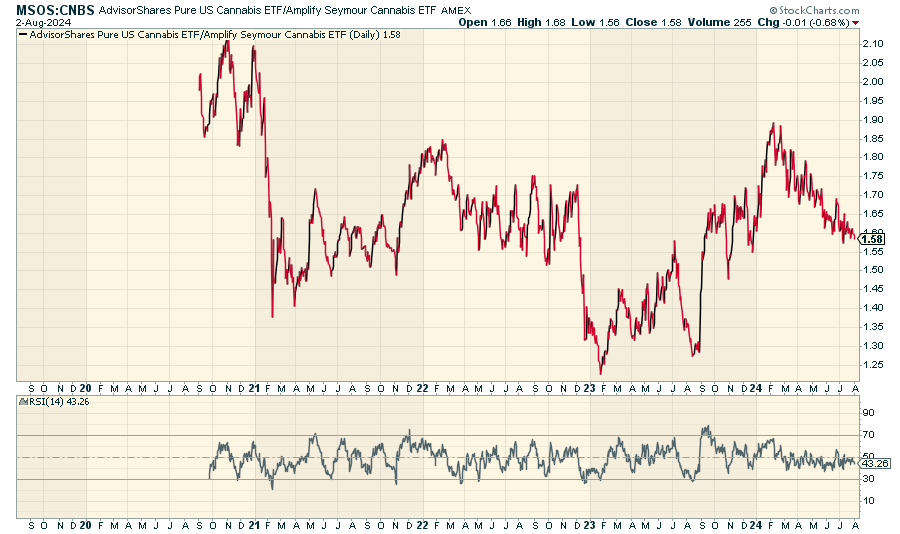

When we look at the price ratio of MSOS to CNBS, we find that the relative performance has been erratic. While MSOS is underperforming now, I don’t think there’s a clear message when looking at the chart from a long-term perspective.

stockcharts.com

Pros and Cons

On the plus side? ETFs like this are the only practical way for institutions to get exposure to the US cannabis industry, which remains an illiquid, unregulated sector. By owning the fund, institutional investors have an easy way to get fully invested in the cannabis sector without having to do thorough due-diligence on dozens of cannabis stocks. Moreover, the fund’s active management permits it to be nimble in reacting to the evolving regulatory and industry environment, capitalizing on opportunities as they appear.

The risks are big, though. Cannabis-related securities represent an emerging and volatile sector. The industry may be subject to legal regulations regarding medical marijuana and recreational cannabis that may vary from state to state and from country to country. Any adverse ruling or change in law affecting cannabis-related securities would likely materially and adversely affect the Fund and its shareholders. In addition, as cannabis-related activities remain illegal under US federal law. The securities of issuers engaged in such activities could be adversely affected by changes in, or the failure to comply with, federal laws or regulations.

Furthermore, the cannabis industry is still in its very early days, and lots of companies in the industry are not as profitable as they should be, not as easily scalable as they should be, or not as disruptive as they should be. Indeed, given its early stage, the cannabis industry and, consequently, the MSOS ETF, is potentially more likely to be volatile than other industries.

Conclusion

With the launch of the AdvisorShares Pure US Cannabis ETF, US investors have an innovative means of accessing the fast-growing, cannabis economy. MSOS provides investors with unique, diversified, liquid, and actively managed exposure to the dynamic US cannabis space. And although the potential returns can be huge, uncertainty remains problematic. Should we see the federal side catch up (finally) to various states that have legalized cannabis, that would be the time to position here. Either way – lots of potential, and frustration, ahead.