Robert Kiyosaki has expressed approval for President Donald Trump‘s recent executive order, which he believes will democratize access to alternative investments for 401k investors.

Last week Kiyosaki took to X to share his thoughts on President Trump’s recent executive order. According to him, the order aims to democratize access to alternative investments for 401k investors.

Kiyosaki, who is known for his unconventional investment strategies, stated that he does not invest in mutual funds or ETFs, referring to them as “for losers.”

Also Read: Robert Kiyosaki Says Most Poor People Are Poor Because They Break These Two Laws of Money

Instead, he believes that the new executive order will open doors for “smarter” and “more sophisticated investors” to add alternative investments such as real estate, private equity and debt, crypto, and precious metals under a 401k tax umbrella.

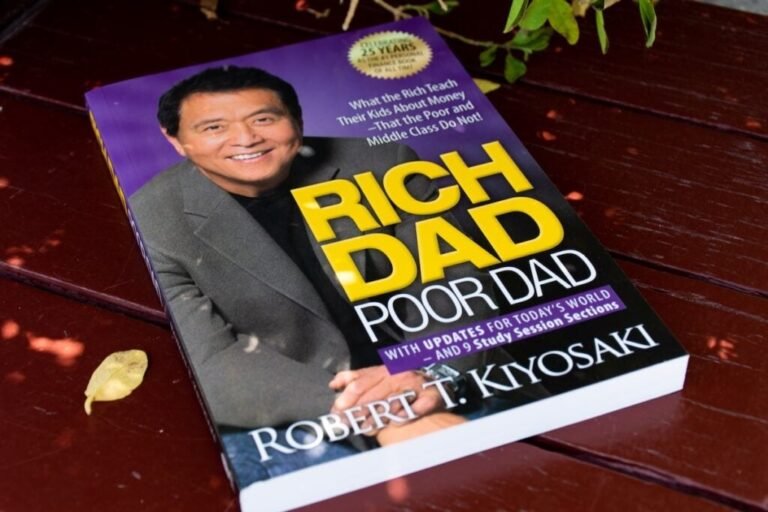

Kiyosaki’s endorsement of the executive order is significant due to his influence in the financial education sector. The author has long advocated for financial literacy and the importance of understanding different investment strategies.

He believes that the new order will encourage investors to be smarter and wiser, urging them to “study” and do their “homework.”

However, Kiyosaki also cautioned that those unwilling to put in the effort to understand these alternative investments should stick with “vanilla” mutual funds and ETFs.

In his post, he thanked his friend Andy Schectman for the “heads up” and expressed happiness that the new order treats investors like “adults” and increases the value of his gold, silver, and Bitcoin investments.

Read Next

‘Rich Dad Poor Dad’ Author Warns Of Economic Pain, Says Baby Boomers Will Be ‘Biggest Losers’

Image: Shutterstock/hamdi bendali

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.