The Treasury Department and the Internal Revenue Service have introduced new guidance, clearing the way for them to stake digital assets and share rewards with investors.

IRS Creates Safe Harbor For Crypto Staking

The IRS, on Monday issued guidance under Revenue Procedure 2025-31, allowing exchange-traded products and trusts to stake digital assets under specific conditions.

The safe harbor provides tax and regulatory clarity for traditional financial vehicles seeking to participate in proof-of-stake networks, such as Ethereum (CRYPTO: ETC).

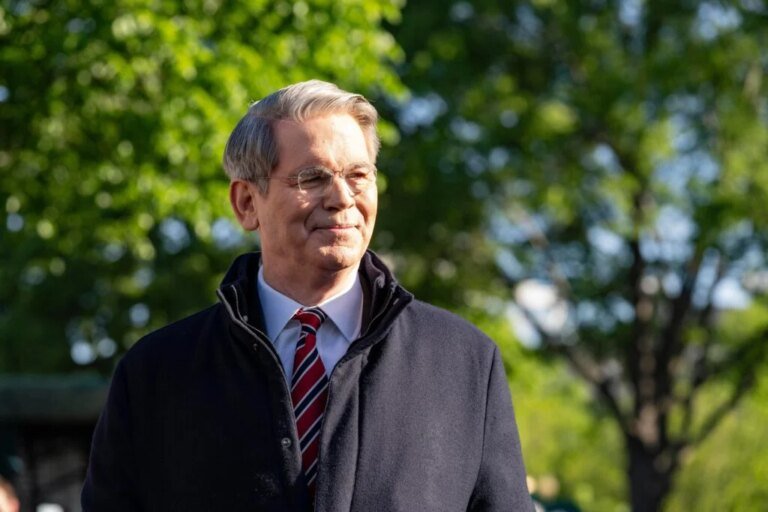

Treasury Secretary Scott Bessent announced the development on X, calling it a major step toward strengthening America’s role in the digital asset economy.

“Today@USTreasury and the @IRSnews issued new guidance giving crypto exchange-traded products (ETPs) a clear path to stake digital assets and share staking rewards with their retail investors,” he wrote.

Adding, “This move increases investor benefits, boosts innovation, and keeps America the global leader in digital asset and blockchain technology.”

See Also: Bitcoin Flat As Fed Policy Meet Looms; Ethereum, Dogecoin, XRP Decline: Analyst Flags Support Where They Plan To ‘Load Heavily’ On ETH

What Are The Conditions For Participation

The IRS guidance outlines strict requirements for funds and trusts that wish to stake crypto while maintaining their federal tax qualification.

Eligible entities must hold only one type of digital asset and cash, use a qualified custodian and operate exclusively on permissionless proof-of-stake networks.

The 18-page document explains longstanding questions about whether staking could disqualify a trust or ETF for tax purposes, an issue that has deterred many institutional investors from entering the space.

Consensys Counsel Applauds IRS’s Move

Bill Hughes, senior counsel at blockchain firm Consensys, said the change “provides long-awaited regulatory and tax clarity” for institutional vehicles.

He added that the move transforms staking “from a compliance risk into a tax-recognized, institutionally viable activity.”

Hughes said the guidance will likely accelerate mainstream adoption of proof-of-stake blockchains by allowing ETFs and trusts to share staking rewards directly with retail investors.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: DT phots1 / Shutterstock.com