- SEC has also approved the settlement of crypto ETFs in-kind, which enhances efficiency.

- Nasdaq, CBOE, and NYSE are approved for direct asset options.

- Large companies want ETF faster and cheaper.

The SEC of the United States( U.S) has authorized crypto ETFs to conduct in-kind redemptions. Shares can now be created, issued, and redeemed using Bitcoin and Eth. Previously, only cash settlement was allowed.

Recent SEC rules remove an ETF market hurdle. Bitcoin and Ethereum have replaced cash as the medium of exchange for institutions and market makers. This update includes all of the approved spot Bitcoin and Ether ETFs,s such as BlackRock and Fidelity ETFs.

The in-kind trading mechanisms that are common to conventional commodity ETFs, such as gold, can now be replicated.

Major Exchanges and Names Back the Shift

Source – X

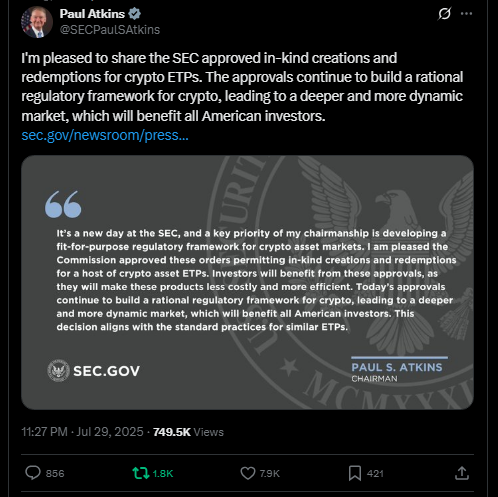

Nasdaq, CBOE, and NYSE applied for these changes. The SEC moved quickly, granting them approval. Head of the S.E.C., Paul Atkins, said it was a fresh start for the SEC. He said his leadership will focus on creating a crypto asset market regulatory framework. Such products will be cheaper and more effective.”

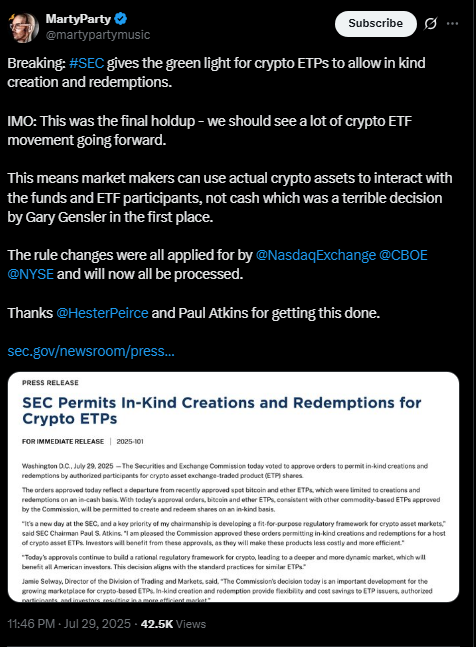

Source – X

Commissioner Hester Peirce also pushed for the change. She and Paul Atkins were instrumental in the reform. As it was pointed out by Martyparty on X (formerly Twitter), this was the last holdup, and we are likely to see a lot of crypto ETF action going forward. Market makers are now able to engage with the funds and ETF participants using actual crypto assets (as opposed to cash, which was a horrible move on the part of Gensler in the first place).

All the rule changes had been requested by Nasdaq, CBOE, and NYSE and are now going to be processed. It was made possible by Hester Peirce and Paul Atkins.

The argument of the SEC refers to increased efficiency and possible cost savings. Jamie Selway, director of the division at the SEC, stated that the move is expected to bring flexibility and cost savings to the ETP issuers, authorized participants, and investors. This results in a more efficient market.”

Industry Preps for Volatile Moves

According to the SEC, the alterations will allow large actors to create and redeem ETF shares with the help of crypto, not fiat. This is able to reduce taxes and accelerate trades by the large players. In the past, market makers had friction and additional expenses due to cash settlements.

Institutional adoption is expected to rise. The SEC is closing the crypto-traditional market gap. In-kind settlement has long been possible on commodity ETFs, e.g., gold. Crypto was the exception — until now. This move may see the introduction of new ETF products and attract more capital into the industry.

ETF liquidity providers and traders gain new flexibility. Redemptions of funds can be done more easily; prices of the shares can remain much near net asset value. In-kind redemption offers flexibility and cost advantages for ETP issuers, licensed participants, and investors, says Jamie Selway.

Market-Wide Reaction and What’s Next

Crypto platforms and investors welcomed the news with enthusiasm. Many view this as a turning point. The policy change may force other regulators around the world to adjust their crypto ETF regulations. The regulatory risk will decrease because the markets will become more transparent and accessible.

The same shift paves the way to more coins being listed on ETFs since the in-kind option will be incorporated into future ETF applications in the main exchanges in the U.S. Regulators believe that the number of people engaging in the activity and trading may increase, and new funds can flow into the industry.

U.S. crypto ETFs can proceed. The situation with in-kind redemptions gaining traction will alter the environment of digital assets once more.