The US Securities and Exchange Commission (SEC) delayed decisions on the Bitwise Dogecoin ETF and the Grayscale Hedera ETF, keeping both applications under review until November 12.

On Tuesday, the SEC pushed back its deadline on NYSE Arca’s proposal to list the Bitwise Dogecoin ETF. The application was first filed in March and published in the Federal Register on March 17, beginning the statutory review period.

That same day, the agency also extended its review of Grayscale’s application to list the Hedera ETF, setting the same November deadline.

Grayscale updated filings for its long-standing Litecoin and Bitcoin Cash trusts, seeking to convert them from trusts into ETFs. Moving the trusts to a national exchange would allow daily share creations and redemptions, keeping prices closer to net asset value and reducing the steep premiums and discounts seen in over-the-counter (OTC) trading.

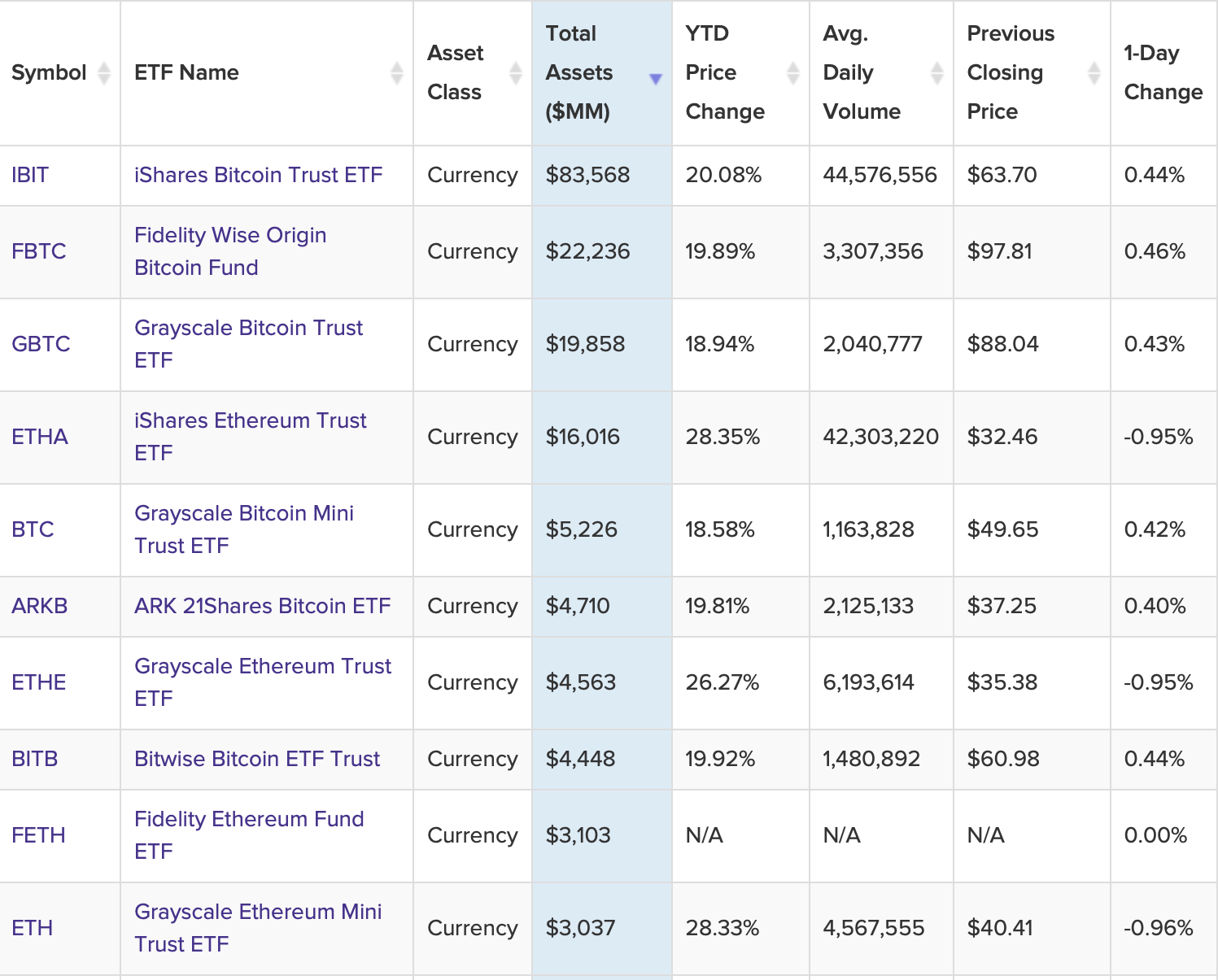

The company set the precedent in 2024 when it converted the Grayscale Bitcoin Trust (GBTC) into the first US spot Bitcoin ETF after a court battle with the SEC. It is now looking to apply the same model to Bitcoin Cash (BCH) and Litecoin (LTC).

Related: How high can DOGE price go when a Dogecoin ETF is approved?

SEC delays highlight uncertain path for altcoin ETFs

The surge of altcoin ETF applications in 2025 has left the SEC with a growing backlog.

As of July 31, at least 31 altcoin spot-ETF applications had been filed in the first half of 2025, including proposals for XRP, Dogecoin, Solana, Litecoin, Avalanche and BNB.

As of August 29, at least 92 crypto-related ETF products were awaiting SEC decisions. Notably, institutional interest is especially high for Solana (SOL), with eight applications, and XRP, with seven applications in line.

In most cases, the SEC has opted to use the full length of its review periods, repeatedly extending deadlines rather than issuing early approvals or rejections.

In August, the SEC postponed multiple crypto ETF filings, including NYSE Arca’s Truth Social Bitcoin and Ethereum ETF to Oct. 8, the 21Shares and Bitwise Solana ETFs to Oct. 16 and the 21Shares Core XRP Trust to Oct. 19.

On Aug. 25, the agency extended its review of Cboe BZX’s proposal to list the WisdomTree XRP Fund, setting Oct. 24 as the new deadline, and the same day delayed its decision on the Canary PENGU ETF to Oct. 12.

Magazine: SEC’s U-turn on crypto leaves key questions unanswered