Should you alter your buying strategy for this popular Vanguard S&P 500 tracking vehicle?

Since October 2022, the U.S. stock market has experienced a remarkable upswing. The Vanguard S&P 500 ETF (VOO -0.17%) has surged by an impressive 56.6% over this period. This bull run has been fueled by attractive valuations following Federal Reserve rate hikes, positive corporate-earnings reports, and widespread enthusiasm surrounding artificial intelligence (AI) advancements.

However, this prolonged rally has not been without its skeptics. Market analysts have raised concerns, pointing to the S&P 500‘s cyclically adjusted price-to-earnings (CAPE) ratio, which currently hovers around 36 — more than double its historical average of 17. This elevated valuation has sparked debate about potential market overheating and the looming risk of a significant correction.

Image source: Getty Images.

Economic indicators and market complexities

Adding another layer of complexity is the recent cooling of AI hype. Despite massive investments from Silicon Valley giants, the latest Census Bureau report indicates a 0.6% decrease in AI adoption among U.S. companies. This decline comes at a curious time, as tech leaders like Microsoft contemplate trillion-dollar investments in pursuit of artificial general intelligence.

As investors navigate these complex and often contradictory signals, they face a challenging balancing act between optimism and caution in an increasingly uncertain landscape.

Recent economic indicators have further complicated the picture. Consumer spending has been slowing modestly in the first half of 2024, suggesting a potential economic-momentum shift heading into the second half of the year.

According to the Bureau of Labor Statistics, the labor market is also showing signs of cooling off. This trend is evidenced by the unemployment rate, which ticked up further to 4.1% in the most recent quarter, reaching its highest level since November 2021. This development may indicate a softening in job market conditions, potentially impacting consumer confidence and spending patterns.

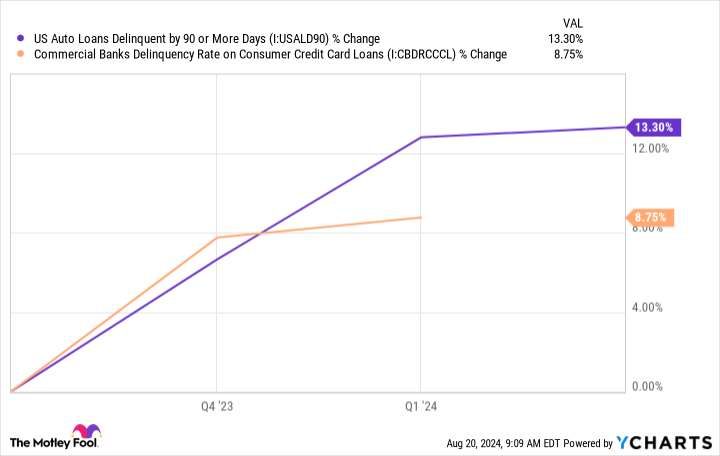

Another concerning trend is the rise in delinquencies across various types of consumer debt. Credit cards, auto loans, and mortgages have all seen an uptick in late payments, with non-homeowners particularly affected.

US Auto Loans Delinquent by 90 or More Days data by YCharts.

This increase in delinquencies could be a sign of growing financial stress among consumers, possibly stemming from the combination of rising interest rates and inflationary pressures.

The enduring appeal of index investing

The Vanguard S&P 500 ETF, a popular index-tracking vehicle, forms the cornerstone of many investment portfolios. Warren Buffett has advised that most everyday investors should hold 90% of their stock portfolio in this low-cost S&P 500 tracking vehicle.

The logic behind this recommendation is compelling: Historically, very few investors have managed to consistently outperform the S&P 500 for a variety of reasons.

The Vanguard S&P 500 ETF thus offers non-professional investors a straightforward way to participate in the market without taking on the substantial risk of buying individual stocks.

This brings us to the heart of this article — namely, how should investors approach their S&P 500 ETF strategy in the current market climate? Let’s break down three possible ways to play this dynamic market.

A Goldilocks scenario for investors

Scenario 1: Too cold: Increase your investments

This scenario banks on the potential for a “Gutenberg moment” in AI within the next two to three years. Proponents of this view believe we’re on the cusp of transformative AI breakthroughs that could revolutionize industries and drive unprecedented economic growth.

To date, AI hasn’t had much impact on the broader economy, but tech leaders like Nvidia‘s CEO Jensen Huang have laid out a compelling case for the tech to unlock an entirely new economy based on AI-powered automated factories, autonomous vehicles, and AI agents.

The strategy here would be to increase your weekly or monthly purchases of this exchange-traded fund. The rationale is that if AI advancements materialize as hoped, they could propel the market to new heights, potentially justifying current valuations and driving further gains.

However, this approach assumes that AI will deliver on its promises within a relatively short time frame. If AI progress is slower than anticipated or fails to translate into broad economic gains, investors could end up overexposed to a wildly overvalued market.

Scenario 2: Just right: Maintain your current strategy

This scenario adheres to the time-tested principle of dollar-cost averaging. The strategy here is to keep your weekly or monthly ETF purchases consistent.

The rationale behind this approach is that dollar-cost averaging helps mitigate the risks of market timing by spreading investments over time. This approach acknowledges the difficulty of predicting short-term market movements and focuses on long-term growth.

It provides a middle ground, allowing investors to maintain exposure to potential upside while not overcommitting in case of a downturn. This balanced approach can be particularly appealing in times of market uncertainty, as it allows investors to participate in potential gains while maintaining a degree of caution.

Scenario 3: Too hot: Decrease buying and build cash reserves

This scenario takes a more cautious approach, drawing inspiration from Warren Buffett’s famous advice to “be fearful when others are greedy, and greedy when others are fearful.”

The strategy here would be to decrease your weekly or monthly ETF purchases to build a larger cash position. The rationale is that by increasing cash reserves, you can position yourself to capitalize on potential market corrections or crashes. This approach aims to take advantage of future buying opportunities at more attractive valuations.

While this strategy can protect against downside risk, it also runs the risk of missing out on continued market gains if a significant correction doesn’t materialize. Investors choosing this path should be prepared for the possibility of underperforming the market in the short term if the bull run continues.

Choosing the right approach

The choice between these scenarios ultimately depends on your risk tolerance, investment goals, investing horizon, and personal outlook on market conditions and AI developments. Some investors might opt for a blended approach, slightly adjusting their Vanguard S&P 500 ETF purchases while building a moderate cash reserve ahead of a potential market crash.

Regardless of the chosen strategy, it’s crucial to remember that the S&P 500 has historically rewarded patient, long-term investors. While short-term market movements can be unsettling, maintaining a disciplined approach has proven to be the most reliable path to long-term success.