The prospects for a Solana SOL/USD based exchange-traded fund (ETF) gaining approval in 2024 appear increasingly slim, according to Eric Balchunas, Senior ETF Analyst for Bloomberg.

What Happened: Balchunas suggests that without significant changes in regulatory leadership, the chances of such an approval are minimal.

“There’s a snowball’s chance in hell of approval unless there’s a change in leadership,” Balchunas stated, highlighting the challenging regulatory environment facing crypto-based ETFs.

This pessimistic outlook has been further reinforced by actions from the U.S. Securities and Exchange Commission (SEC).

The SEC has rejected Cboe BZX’s 19b-4 filings for two prospective spot Solana ETFs, leading to their withdrawal from the Cboe website, according to The Block.

This decision followed discussions between the SEC and issuers, during which the regulatory body expressed concerns that Solana should be classified as a security.

Meanwhile, according to data from Polymarket, a decentralized information markets platform, the probability of a Solana ETF being approved in 2024 stands at a mere 6% as of Aug. 20.

This represents a drop from the 12% chance when VanEck applied for a Solana ETF at the end of June.

Also Read: Bitcoin Seesaws Between $59,000 And $60,000, But Consolidation Could Be Over Soon: CryptoQuant

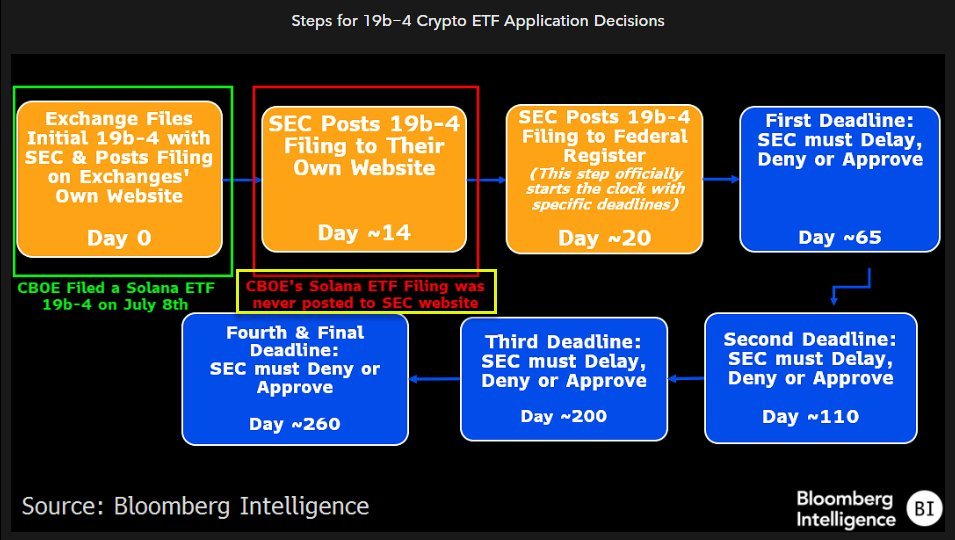

Why It Matters: The approval process for crypto ETFs follows a complex timeline, according to Bloomberg Intelligence.

The process begins with exchanges filing initial 19b-4 forms with the SEC, followed by a series of posting and review stages. For the Solana ETF specifically, the Chicago Board Options Exchange (CBOE) filed its 19b-4 form on July 8.

However, the crucial next step – the SEC posting this filing to its website – has not occurred, potentially signaling regulatory hesitation.

The timeline for ETF approval decisions involves multiple deadlines, with the SEC having the option to delay, deny or approve at various stages.

The first deadline typically falls around day 65 after the initial filing, with subsequent deadlines at approximately 110, 200, and 260 days.

The lack of progress in the Solana ETF’s case suggests that it may face significant hurdles in meeting these deadlines.

As the cryptocurrency community grapples with these regulatory challenges, the upcoming Benzinga Future of Digital Assets event on Nov. 19 will provide a critical forum for discussion.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.