Cumulative flows into the spot Bitcoin BTCUSD exchange-traded funds (ETF) have exceeded $20 billion following the United States-based products clocking four consecutive days of inflows.

Spot Bitcoin ETFs have received $20.26 billion in cumulative flows since the products launched in the US on Jan. 11, according to Farside Investors data.

Over the past four days alone, around $1.64 billion has flowed into 11 ETF products from ARK 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, Valkyrie, BlackRock, Grayscale, Bitwise, Hashdex, and Franklin Templeton.

Notably, on Oct. 16, the world’s largest asset manager, BlackRock, saw $393.4 million in daily inflows, the largest amount since July 22, when it clocked $526.7 million.

Market participants are ‘bullish’ on the inflows figure

Pseudonymous crypto trader Crypto Lord told his 344,500 X followers that they “ are not bullish enough” while pointing out that Bitcoin ETFs crossing $20 billion marks the “fastest growth in ETF history.”

ETF store president Nate Geraci commented on the news, declaring that the products are “just vacuuming up $$$.”

Bitcoin maximalist Chetan Kaul pondered in an Oct. 17 X post whether “$30 billion by the end of the year” may be possible.

A few analysts are still skeptical

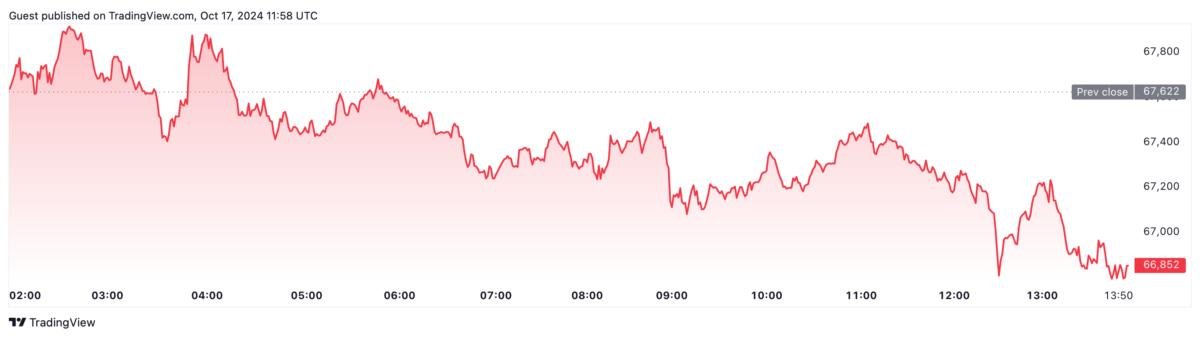

Spot Bitcoin ETFs breaking $20 billion in cumulative flows follows Bitcoin’s price surpassing the critical $65,000 price level, a milestone market participants have been anticipating since it dipped below the level on Sept. 30.

In an Oct. 17 analyst note, CryptoQuant contributor Amr Taha warned that large inflows don’t always lead to lasting price surges.

“Positive netflows above 400M USD in Bitcoin ETFs do not always lead to sustained price increases and, in many cases, have historically coincided with price corrections,” Taha stated.

On Oct. 17, Cointelegraph reported that Bitcoin’s significant weekly gains have caused some market participants to worry that the market may witness one last retracement before the asset continues its rally to new all-time highs.

Bitcoin data firm, TheKingfisher pointed out that:

“Current trading activity around $68.4k is linked to earlier volatility from July 29, when prices dropped to 49k just five days later.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.