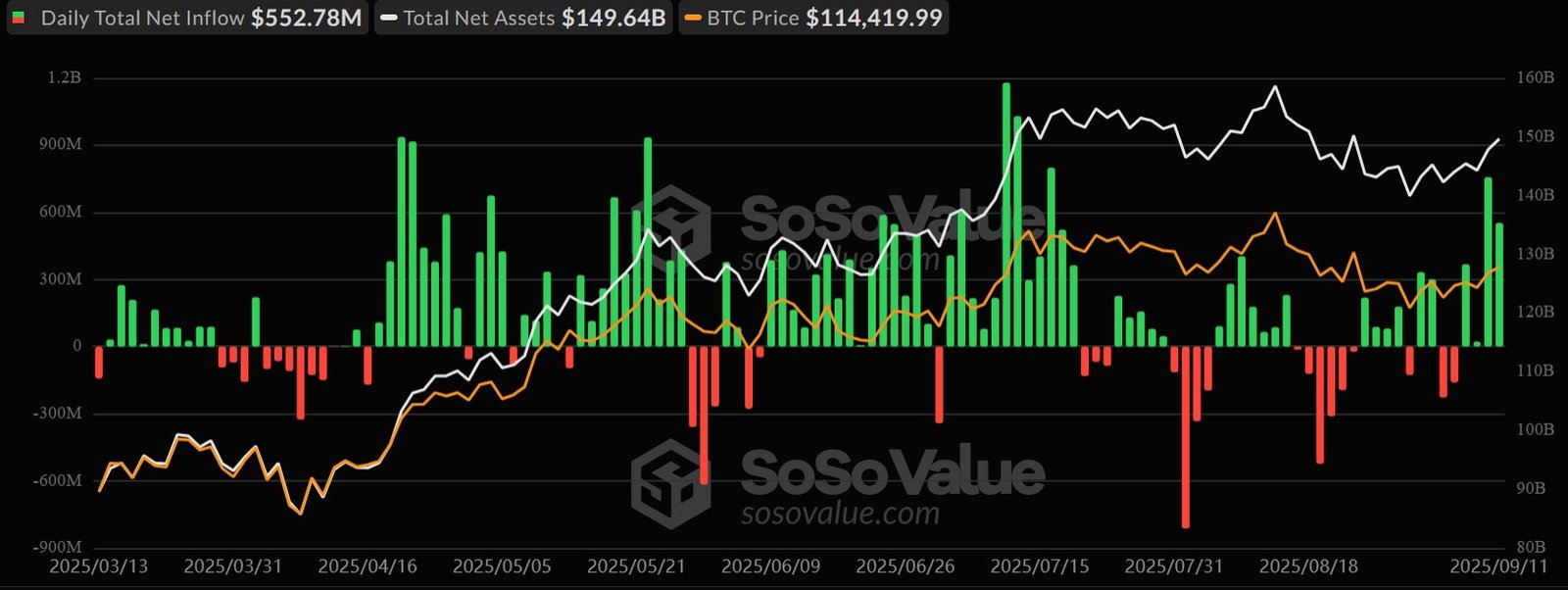

Spot Bitcoin exchange-traded funds (ETFs) saw strong demand this week, recording more than $1.7 billion in inflows before the trading week closes on Friday.

SoSoValue data showed that the ETFs had a strong week, with Wednesday having nearly $800 million in inflows. As of Thursday, the ETF tracker showed that spot Bitcoin ETFs already had $1.7 billion in net inflows this week.

The strong performance marks the ETFs’ biggest weekly total in nearly two months, highlighting renewed confidence in the asset class.

The strong ETF inflows came as Bitcoin (BTC) climbed back to $115,000, up 4.5% from its $110,000 price last Friday.

Spot Ether ETFs recover from nearly $800 million in outflows

Spot Ether ETFs also had a strong week, recording over $230 million in net inflows as of Thursday. This is a sharp asset class recovery after nearly $800 million in outflows last week.

While ETH ETFs recover, corporate treasury holder BitMine continued to stack up Ether (ETH) purchases this week. On Monday, BitMine purchased 202,500 ETH, which sent its holdings to the 2 million ETH milestone. The company made a follow-up purchase on Wednesday, buying $200 million in ETH from Bitgo.

Data from the Strategic ETH Reserve website shows that BitMine currently holds over 2 million ETH, worth $9.3 billion at the time of writing.

The ETH data tracker also shows that in total, ETH reserve companies hold nearly 5 million ETH, worth about $22.1 billion.

Meanwhile, ETF issuers hold 6.6 million ETH, worth nearly $30 billion, to back the assets. This means that almost 12 million ETH, nearly 10% of the circulating supply are held by institutions.

Related: CoinShares to go public in the US through $1.2B SPAC merger

CZ compares the crypto market cap to Nvidia

The broader crypto market also crossed $4.1 trillion again this week, a level previously reached in July and August.

Binance co-founder Changpeng Zhao highlighted the milestone on X, comparing the combined value of the entire crypto space to Nvidia, which stands at roughly $4.3 trillion, according to 8marketcap.

“The combined market cap of all future money is less than one chip company’s market cap. You do the math,” Zhao wrote.

Magazine: Meet the Ethereum and Polkadot co-founder who wasn’t in Time Magazine