Both institutional and retail investors of the Spot Bitcoin Exchange-Traded Funds (ETFs) are beginning to bet big on BTC as the products have witnessed a notable surge in inflows, implying that investors are highly interested and confident in the potential of the digital asset in the long term.

A Substantial Inflows Into Spot Bitcoin ETFs

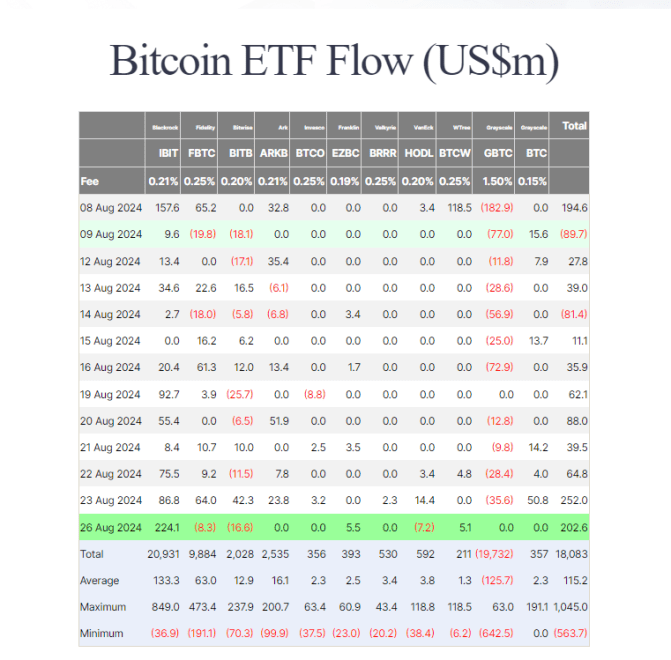

According to data from London-based investment management company Farside Investors shared by Micheal Van De Poppe, a crypto expert and Chief Information Officer (CIO) of MN Consultancy, the spot Bitcoin ETFs have increased drastically in the past day.

On Monday, Van De Poppe pointed out that the exchange funds experienced a whopping $202 million in net positive inflows. This is a significant increase in net inflows compared to last Monday’s inflows worth $62.1 million, indicating rising adoption of the products among investors daily.

The net inflows recorded just yesterday is nearly 50% of the overall net inflows witnessed through the entire trading days of last week, valued at about $500 million.

Should the spot Bitcoin ETFs continue to attract significant inflows like this, Van De Poppe claims it is a critical sign of strength, possibly leading to an increase in the value of the largest cryptocurrency asset. Given the impact of the products on prices and the renewed investors’ interest, the market expert is confident that Bitcoin could hit a new all-time high before September closes.

It is worth noting that BlackRock‘s unparalleled iShares Bitcoin Trust (IBIT) solely makes up for the surge in inflows. The platform’s IBIT fund attracted over $224 million worth of daily inflows, marking its highest inflow in the last 35 days, specifically on July 22, when it saw about $526 million in capital.

In the past day, other investment management companies’ funds like Franklin BTC ETF (EZBC) and WisdomTree BTC Fund (BTCW) attracted positive inflows of $5.5 million and $5.1 million, respectively. Meanwhile, Bitwise BTC ETF (BITB), Fidelity Wise Origin Bitcoin Fund (FBTC), and VanEck BTC ETF (HODL) recorded substantial daily outflows of $16.6 million, $8.3 million, and $7.2 million.

Lastly, Grayscale‘s BTC ETF (GBTC), Invesco Galaxy Bitcoin ETF (BTCO), and Coinshares Valkyrie Bitcoin Fund ETF (BRRR) registered zero daily inflows.

BTC’s Recent Price Performance

This influx of capital in the spot Bitcoin ETFs comes at the heels of a recent price decline, with BTC falling from about $65,000 to $62,720. The development indicates that institutional and individual investors are leveraging on the price decline to boost their exposure to the digital asset.

With the products attracting significant inflows, there is speculation that BTC might begin to rise again in the coming days. BTC’s trading volume has grown by over 44% in the last day, with its price at $62,818.

Featured image from Unsplash, chart from Tradingview.com