Not all growth-oriented exchange-traded funds are built the same.

Are you discouraged by the adage “it takes money to make money”? It wouldn’t be odd if you were. There’s some degree of truth to the premise, after all — even if you’re a great stock picker, your returns are still limited by the total amount of money you’re able to put to work. If you’ve got a few hundred bucks to start with, it can be difficult to buy a meaningful number of shares of any one company and also build a diversified portfolio.

Fortunately, there’s a solution to the problem: Just buy a single exchange-traded fund (ETF) that already holds all the growth stocks you’d want to own anyway. You can own as much or as little of a particular ETF as your budget will allow. Better still, you can easily add to this holding as more funds becomes available.

In that context, the best growth ETF for you to consider right now is the iShares Russell 1000 Growth ETF (IWF 0.84%).

Why the iShares Russell 1000 ETF is your best bet

There are certainly bigger and better-known growth-oriented exchange-traded funds out there. Take the Vanguard Growth ETF as an example, which boasts $136 billion in total assets. And while it’s not a growth ETF per se, the Invesco QQQ Trust can be treated as one given it holds most of the market’s top growth names.

For the average long-term investor who’s looking to avoid excess volatility, though, the iShares Russell 1000 Growth ETF fits the bill for a couple of key reasons.

The Russell 1000 Growth fund is built to mirror the collective performance of all the growth stocks among the U.S. stock market’s biggest 1,000 companies. As of this writing, nearly 400 stocks qualify to be one of the ETF’s market cap-weighted holdings.

And that nuance creates this fund’s first distinguishing factor. While the iShares fund is about as top-heavy as the QQQ Trust and the Vanguard Growth ETF (thanks to market-crushing performances from names like Microsoft, Apple, and Nvidia), the remainder of its $97 billion portfolio is far better balanced and more representative of the overall market.

For perspective, the iShares ETF’s 10th-biggest position — Tesla — accounts for around 2.5% of the fund’s total value, while Vanguard’s 10th-largest holding only makes up 1.6% of its portfolio. That disparity widens the further away you get from either ETF’s biggest holdings and move toward their smaller ones. The iShares Russell 1000 Growth ETF also owns NYSE-listed drugmaker Eli Lilly as a top-10 position, which isn’t held by the Invesco QQQ Trust at all.

Perhaps the even-better reason to buy a stake in the iShares growth fund (particularly if you’re starting out with a relatively small amount of money), however, is that it offers exposure to an overlooked sliver of the market you probably didn’t even know you wanted: mid-cap stocks.

Although the bulk of the ETF’s value comes from the large caps in its portfolio, the Russell 1000 Growth fund also holds a bunch of stocks that aren’t found in the S&P 500 large-cap index.

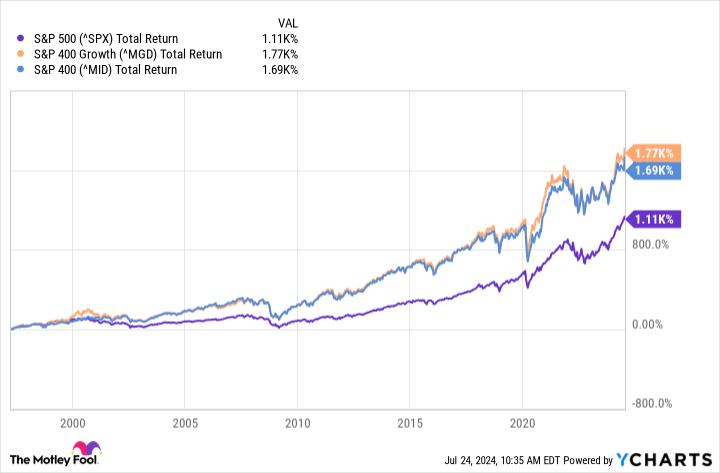

This is no small matter, either. The S&P 400 Mid-Cap Index has historically outperformed large caps, while the S&P 400 Mid-Cap Growth Index historically fared even better.

Data by YCharts.

Why? It’s largely because most mid-cap stocks are in the sweet spot of their existence, after they’ve grown beyond their wobbly start-up years but before sheer size becomes a growth impediment.

You should also know the Russell 1000 Growth ETF’s expense ratio is a modest 0.19%. You’re not going to be significantly crimping your net returns just for buying and holding this fund for the long haul.

Simpler, safer, and lower stress

Again, this particular ETF isn’t the only growth-minded choice out there. Either of the other funds would be solid growth holdings as well, not to mention the many other options available. It’s not wrong to own more than one ETF, either.

For long-term growth investors who aren’t starting out with a ton of money or who want a simple holding that can be added to over time, the iShares Russell 1000 Growth ETF is a great low-worry choice.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Tesla, and Vanguard Index Funds – Vanguard Growth ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.