The Chicago Board Options Exchange (CBOE) has confirmed the launch of spot Ethereum exchange-traded funds (ETFs) next week.

The cryptocurrency market is set to witness a major milestone as spot Ethereum ETFs are slated to begin trading on the CBOE next week.

CBOE revealed the information in the latest “new listings” notice on its website, confirming the launch of five Ethereum (ETH) ETFs. These include:

- 21Shares Core Ethereum ETF (CETF)

- Fidelity Ethereum Fund (FETH)

- Franklin Ethereum ETF (EZET)

- Invesco Galaxy Ethereum ETF (QETH)

- VanEck Ethereum ETF (ETHV)

According to the notification, trading for these highly anticipated ETFs will commence on July 23, pending regulatory approval.

The proposed ETFs will track ETH, the native token of the Ethereum blockchain, which is the second-largest cryptocurrency with a market capitalization of $420.8 billion, trailing only Bitcoin’s $1.1 trillion market value.

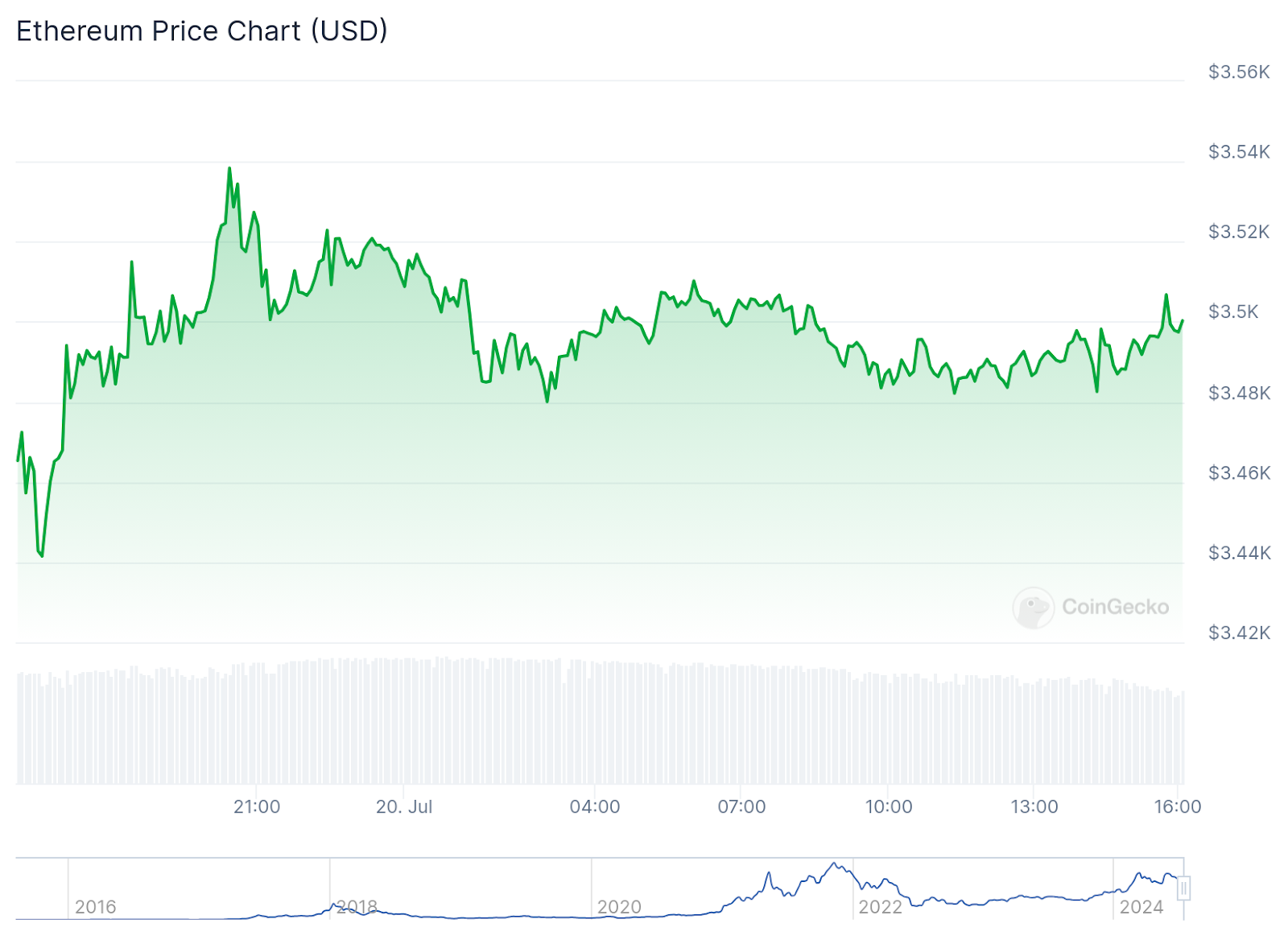

The price of ETH hasn’t reacted much to the news just yet, having only gone up by a modest 0.8% in the last 24 hours. Trading volumes were also down 15.5%, with about $13.3 billion worth of ETH changing hands since yesterday.

This development follows months of speculation and revised predictions from industry analysts.

Social media buzz

More recently, the anticipation for the launch of spot Ethereum ETFs has been evident on social media. For instance, on July 14, Nate Geraci, a prominent voice in the ETF space, expressed confidence in the imminent approval, citing no apparent reasons for further delays and noting that issuers were prepared for the launch.

Following this, on July 15, Bloomberg’s Senior ETF analyst Eric Balchunas reinforced Geraci’s prediction, informing his followers that the SEC had contacted issuers to finalize documentation and request effectiveness for a launch on Tuesday, July 23, assuming “no unforeseeable last-minute issues” arose.

Earlier forecasts by Balchunas had suggested that the ETFs might begin trading as early as July 2. However, he later adjusted his prediction to July 18, which closely aligns with the new official launch date.

Two months ago, the Securities and Exchange Commission (SEC) seemed to have applied the brakes on the approval of Ethereum ETFs, using the same arguments it had made when delaying giving the nod for spot Bitcoin ETFs. The regulator claimed that there were concerns over potential fraud and investor protection regarding the spot Ethereum ETFs.

However, the confirmation from the CBOE signals a promising step forward for the crypto market. Their performance and demand will be closely monitored, as their success could pave the way for additional crypto ETF filings in the future.

This approval coincides with the markedly improved performance of spot Bitcoin ETFs, which have seen a significant net inflow of $17 billion, highlighting the increasing mainstream acceptance of crypto investments.