[SINGAPORE] Exchange-traded funds (ETFs) listed on the Singapore Exchange (SGX) have recorded net inflows of S$700 million in the first half of this year, according to the local bourse’s ETF Market Highlights report for H1 2025.

This is supported by S$1.2 billion in net creations across 22 ETFs, alongside S$500 million in net redemptions from 13 ETFs.

As at June 2025, Singapore’s ETF market comprised 47 listings with total assets under management (AUM) reaching S$14.3 billion, up 32 per cent year on year.

Equity and gold ETFs led the growth, with turnover increasing by 69 per cent and 62 per cent, respectively. Retail segment turnover also saw strong momentum, climbing 67 per cent year on year.

Inflows for Singapore-focused ETFs stood at S$568 million, driven by declining Singapore dollar rates and robust market momentum. In particular, the combined AUM of the SPDR Straits Times Index ETF and Nikko AM Singapore STI ETF hit a record high of S$2.8 billion in June 2025.

Here are the top 10 SGX-listed ETFs in terms of total returns for H1 2025. As a gauge, the S&P 500 is up more than 8 per cent year to date.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

1. SPDR Gold Shares

The SPDR Gold Shares ETF tracks the performance of gold bullion, with its underlying index being LBMA Gold Price PM.

Therefore, it provides investors with direct exposure to gold prices without the need to hold physical metal. Its return rate was the highest among all SGX-listed ETFs for the half year at 17 per cent.

With growing geopolitical uncertainties and robust safe-haven demand, the ETF saw record inflows and AUM, as holdings surged 75 per cent year on year to reach S$2.4 billion in June 2025.

2. Phillip SING Income ETF

The top Singapore equity ETF for H1 of this year offers exposure to 30 high-yielding SGX-listed stocks screened for quality and financial health. Its interest is in income-focused strategies and it has a dividend yield of 3.6 per cent.

It tracks the Morningstar Singapore Yield Focus Index and saw a return of 11.9 per cent for the half year and nearly 26 per cent for the full year.

3. Lion-Nomura Japan Active ETF (Powered by AI)

An actively managed ETF using artificial intelligence (AI)-driven models to select constituents from Japan’s Tokyo Stock Price Index, its returns for the first half of this year was at 11.7 per cent. Its total returns for one year stood at 13.8 per cent.

The Lion-Nomura Japan Active ETF is the second best performing equity ETF on SGX for the half year.

4. Lion-OCBC Securities Hang Seng Tech ETF

The ETF tracks the Hang Seng Tech Index, and provides exposure to 30 of the largest Chinese tech firms listed in Hong Kong, such as Tencent, Alibaba and Meituan. Its H1 2025 return stood at 10.4 per cent.

The Lion-OCBC Securities Hang Seng Tech ETF continued to perform well amid China’s stimulus efforts and optimism on AI-related technologies despite broader macro challenges.

Its top three sectors are consumer discretionary, communications and information technology, with its AUM standing at S$378 million as at May 2025.

5. Lion-OCBC Securities Apac Financials Dividend Plus ETF

This ETF tracks top dividend-paying financial stocks across Apac via the iEdge Apac Financials Dividend Plus Index, with a 9.9 per cent return recorded for the period.

It is able to offer stable income and quality exposure to the region’s banking and insurance sectors, and benefits from regional rate cut expectations.

The Lion-OCBC Securities Apac Financials Dividend Plus ETF is the fourth top-performing equity SGX-listed ETF for the half year.

6. Xtrackers FTSE Vietnam Swap UCITS ETF

This ETF offers exposure to Vietnam’s equity market, which made gains on manufacturing recovery and foreign direct investment inflows. It tracks the FTSE Vietnam Index, and benefits from Vietnam’s export-driven growth and regional supply chain shifts.

For H1 2025, its returns stood at 9.9 per cent. It is the fifth top-performing equity SGX-listed ETF for the half year.

7. CGS-Fullgoal Vietnam 30 Sector Capped ETF

The CGS-Fullgoal Vietnam 30 Sector Capped ETF tracks 30 of Vietnam’s top-performing sectors with caps to prevent over-concentration. It gives investors balanced exposure across financials, industrials, and consumer sectors – key growth drivers in the country’s economy.

The ETF’s underlying index is the SGX iEdge Vietnam 30 Index, and recorded a H1 2025 return of 9.7 per cent.

8. Xtrackers MSCI Singapore UCITS ETF

The ETF benefited from the recovery in property and banking stocks, and Singapore dollar-focused investor sentiment amid falling local rates.

It provides exposure to large, mid, and small-cap Singapore companies by tracking the MSCI Singapore Investable Market Total Return Net Index, with a H1 2025 return rate of 9.7 per cent.

9. UOB Apac Green Reit ETF

Focused on high-yield real estate investment trusts (Reits) across Apac with strong ESG credentials, the UOB Apac Green Reit ETF achieved the best half-year performance among the five Reit ETFs listed on the SGX.

It tracks the iEdge-UOB Apac Yield Focus Green Reit Index, with half-year returns at 9.3 per cent.

The ETF recorded the highest returns among SGX’s sustainability-linked ETFs as well for H1 of this year.

10. Xtrackers MSCI China UCITS ETF

This ETF offers broad exposure to Chinese equities including tech, financials, and consumer names, as its underlying index is the MSCI China TR Net Daily USD Index. For the half year, its returns stood at 8.9 per cent.

It tracks the performance of large and mid-cap Chinese companies across A Shares, H Shares, B Shares, Red Chips, P Chips and foreign listings.

Reit ETFs see new AUM all-time high; S-Reits record strong distribution yield

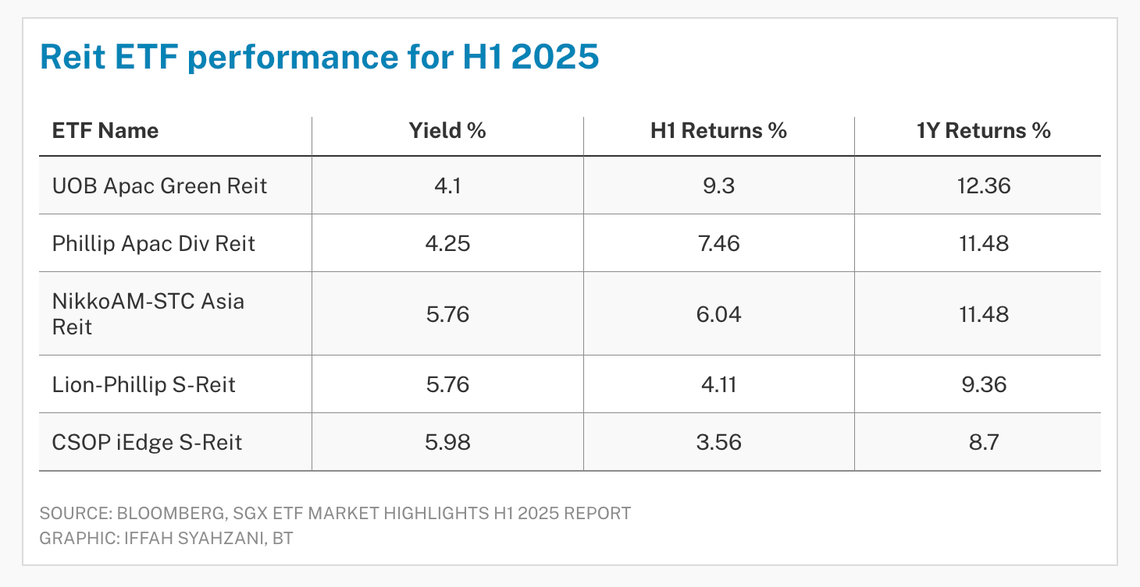

Amid the current murky geopolitical and global trade climate, SGX-listed Reit ETFs displayed strength in the first half, with S-Reit ETFs offering highest returns in June. S-Reit ETFs also have the highest gross dividend indicated yields of up to 6 per cent now.

The AUM value of Reit ETFs achieved a new record of nearly S$1.2 billion, surpassing the last high in September 2024 of around S$1 billion.

UOB Apac Green Reit ETF recorded the top half-year returns level of 9.3 per cent followed by Phillip Apac Div Reit ETF whose H1 return rate stood at 7.5 per cent. It achieved 4.4 per cent returns in Q2, beating its peers in total returns over a three-month period.

CSOP iEdge S-REIT Leaders Index ETF was the best performer for the month of June, returning 4.7 per cent.

The five Reit ETFs paid out an average dividend of close to 5.2 per cent, with CSOP iEdge S-REIT Leaders Index ETF’s 12-month gross yield at about 6 per cent.

According to SGX data in June, retail investors were the net buyers of S-Reits, as the sector received a total net retail inflow of around S$400 million as at Jun 26, 2025.

The report noted that investor interest in S-Reits has been “reignited” in the first half of this year, as reflected in strong total inflows of S$155 million in H1 2025.