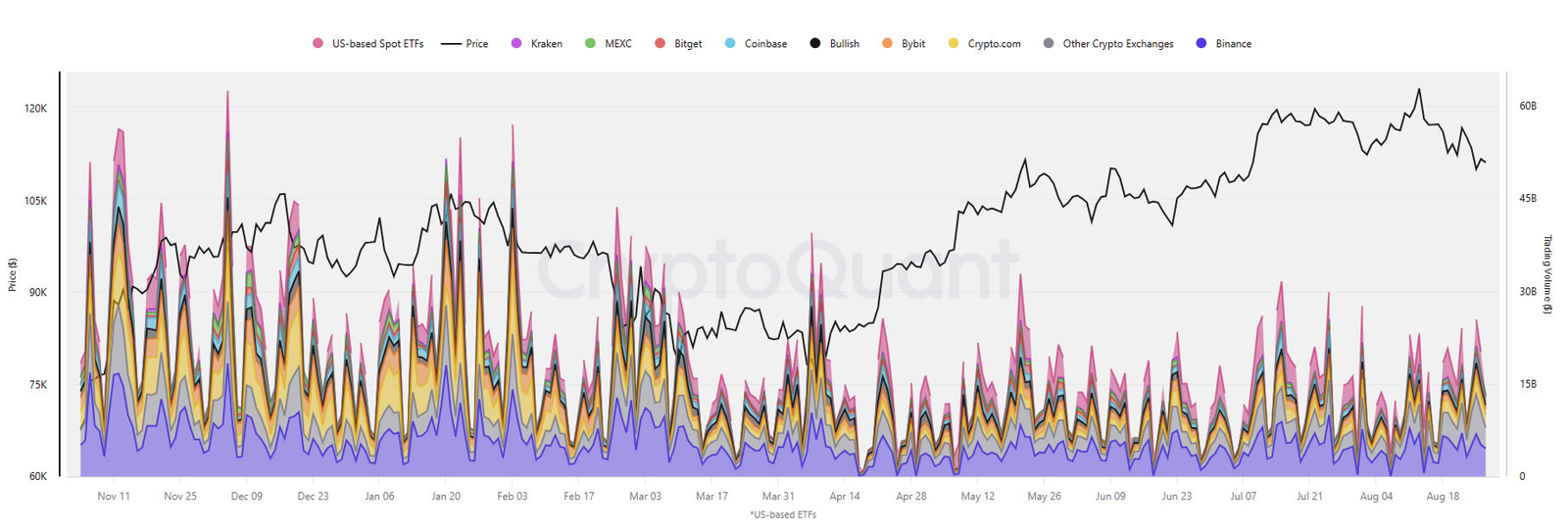

United States-based spot Bitcoin exchange-traded funds are now responsible for a significant share of daily spot trading as institutional investors have continued to warm to crypto.

“Bitcoin spot trading volumes through US-based ETFs have become a significant source of investor exposure to Bitcoin,” said Julio Moreno, head of research at blockchain analytics firm CryptoQuant, on Thursday.

US-based spot Bitcoin (BTC $110,211) ETFs now regularly generate $5 billion to $10 billion in daily volume on active days, sometimes surpassing most crypto exchanges, “reflecting growing institutional demand,” he added.

Binance still leads in spot trading volume

However, the world’s largest crypto exchange, Binance, consistently leads in spot trading volume, he said.

Bitcoin volumes have surged to $18 billion, and Ether (ETH $4,387) volumes have been as high as $11 billion on peak days.

Total daily trading volume for the 11 US spot Bitcoin funds is currently $2.77 billion, according to CoinGlass. This is around 67% of the daily spot Bitcoin volume on Binance, which is about $4.1 billion, according to CoinGecko.

Binance’s total daily volume for all of its pairs is around $22 billion.

CEX BTC volumes compared with spot BTC ETF volumes. Source: CryptoQuant

“US spot Bitcoin ETFs have emerged as a dominant force in crypto markets and demonstrate their pivotal role in price discovery and institutional adoption,” director at LVRG Research, Nick Ruck, told Cointelegraph.

Moreno pointed out that ETH spot trading is mostly concentrated on Binance, followed by Crypto.com, and ETFs rank sixth at just 4%.

This underscores “limited ETF participation in ETH spot trading,” indicating “slower institutional adoption of Ethereum compared to Bitcoin.”

However, recent daily ETF figures tell a different story.

Bitcoin ETF flows slow as Ether takes over

Inflows into the eleven spot Bitcoin ETFs have slowed this week, totaling $571.6 million over the past four trading days, according to CoinGlass.

The BlackRock iShares Bitcoin Trust (IBIT) has the largest share of these inflows with almost 40% or $223.3 million since Monday.

It came as Bitcoin has slumped around 2.5% since Monday, falling to $111,600 at the time of writing as sentiment cooled.

Comparatively, spot Ether ETFs have performed much better with an aggregate inflow of $1.24 billion, more than double that of BTC funds over the past four trading days.

Ether funds have not seen a net outflow day since Aug. 20 and have clocked over $4 billion in inflows this month, making up 30% of the total inflow since the products were launched 13 months ago.

“Current flow dynamics show ETFs are not just supplementing but actively reshaping spot market liquidity, with their trading activity increasingly correlated with underlying BTC price movements,” Ruck said.

These products now represent a significant percentage of Bitcoin’s total supply, cementing ETFs as a fundamental gateway for traditional capital.