The U.S. Securities and Exchange Commission (SEC) is withdrawing all delay notices for Solana, XRP, HBAR, and other crypto exchange-traded funds (ETFs). This comes following the latest general listing standards for crypto ETFs approved by the regulator this month.

US SEC Drops Delay Notices for Solana, XRP, and Other Crypto ETFs

The final deadlines for the US SEC to approve multiple ETFs tracking spot prices of crypto assets, including Solana (SOL), XRP, Hedera (HBAR), Litecoin (LTC), and Cardano (ADA), are due in October. Also, the crypto market awaits a decision to permit staking on spot Ethereum ETFs.

The commission is now withdrawing all notices of a longer review period ahead of its final deadline, indicating progress in ETFs approval. Delay notices are dropped for Solana ETFs by Bitwise, VanEck, Fidelity, Canary, 21Shares, and Invesco Galaxy.

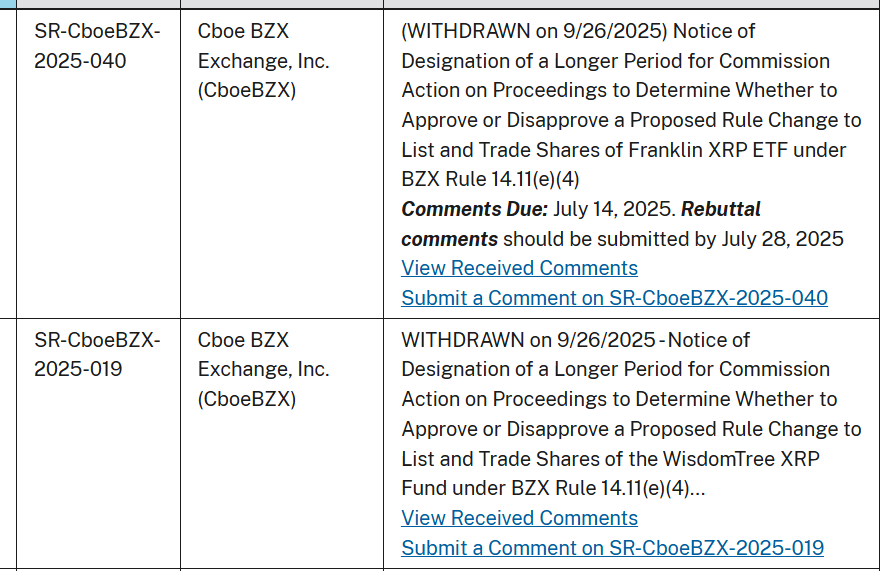

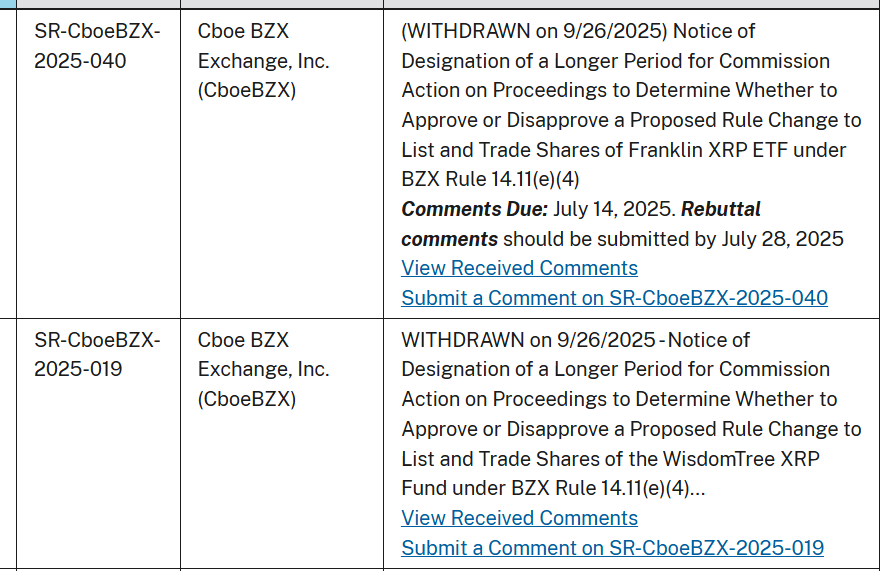

In addition, notices were withdrawn for XRP ETFs by Bitwise, Franklin, WisdomTree, Canary, CoinShares, and 21Shares. Also, Canary HBAR ETF, CoinShares Litecoin ETF, Canary Litecoin ETF, and 21Shares Polkadot delay notices were taken down.

This comes following the approval of the Generic Listing Standards for crypto ETFs two weeks ago, which takes effect on October 1. Notably, the Canary spot Litecoin ETF will list on Nasdaq, with trading set to begin in the next few days.

Fast Tracking Staking on Ethereum ETFs

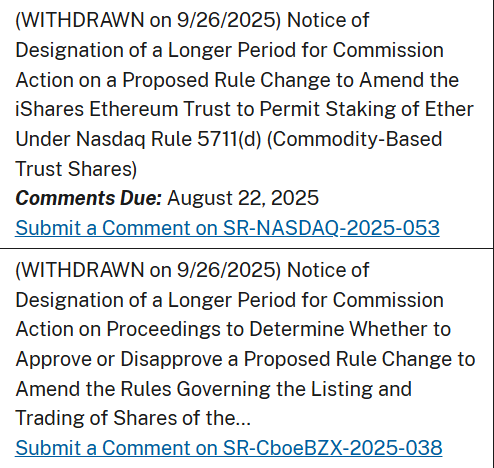

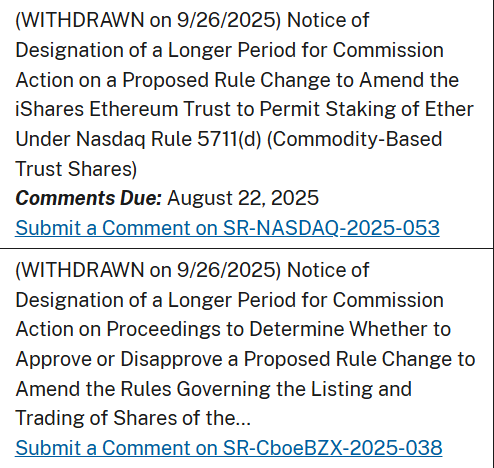

The SEC has also withdrawn notices of designating longer periods for approving staking on Ethereum ETFs. Delay notices were dropped for BlackRock’s iShares, Fidelity, Franklin, VanEck, 21Shares, Bitwise, and Invesco Galaxy Ethereum ETFs.

Nasdaq, CBOE BZX Exchange, and NYSE Arca have filed to amend their earlier Bitcoin and Ethereum ETFs in compliance with the general listing standards. Notably, the REX-Osprey ETH + Staking ETF under the Investment Company Act of 1940 started trading, providing direct spot ETH exposure while distributing rewards generated from real on-chain staking.

“The proposed change would allow the shares to continue listing and trading on the Exchange and permit the Trust to operate in reliance on the generic listing standards in Rule 8.201-E (Generic) instead of the terms of the original approval order,” according to NYSE Arca.

Prices React to This Massive Crypto News

XRP price jumped 4% in the past 24 hours, with the price currently trading at $2.90. The 24-hour low and high are $2.77 and $2.90, respectively.

Furthermore, SOL price has rebounded to $210, up more than 3% in the last 24 hours. Trading volume has increased by 46% in the last 24 hours, indicating a rise in interest among traders.

Meanwhile, HBAR price climbed more than 2% in the past 24 hours, with the price currently trading at $0.2152. The 24-hour low and high are $0.2077 and $0.2168, respectively.