Key Takeaways

- US spot Bitcoin ETFs accumulated $1 billion in three days.

- This record growth indicates strong market demand for Bitcoin investments.

Share this article

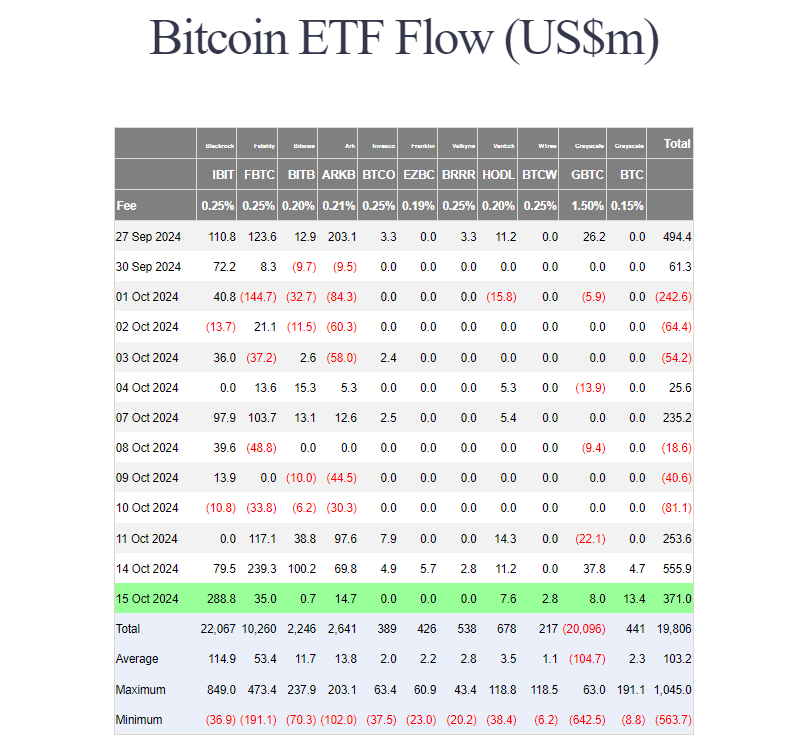

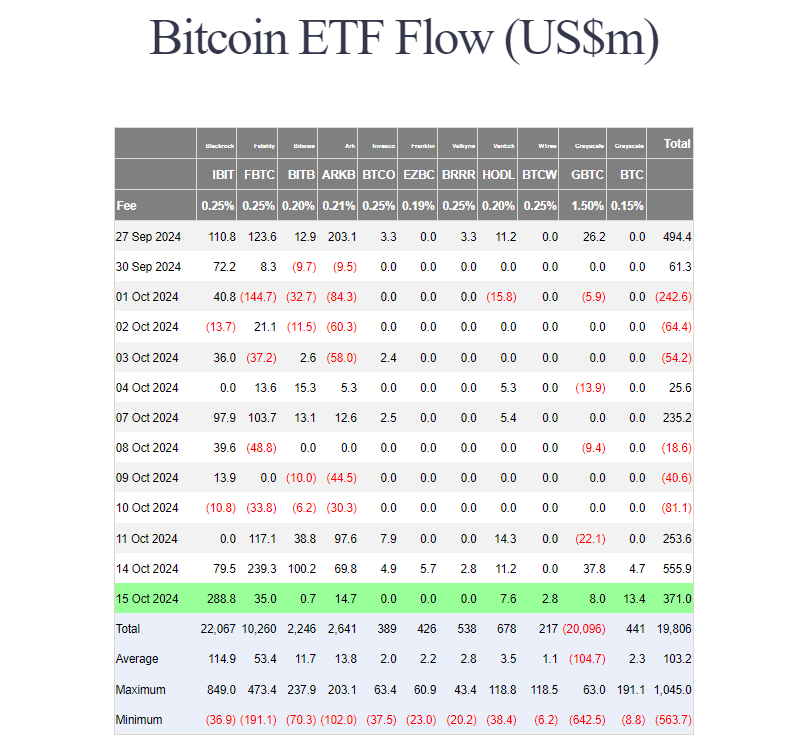

US spot Bitcoin ETFs have seen a major surge in net purchases, totaling over $1 billion in the last three trading days, according to Farside Investors. Fidelity and BlackRock have been the standout performers, attracting approximately $760 million combined during the stretch.

Flows returned in the green last Friday as the Bitcoin ETFs collectively drew in $253 million, ending their brief outflow streak that lasted three consecutive days. On Monday, these funds logged almost $556 million in net inflows, the highest level since early June.

Yesterday alone, ETF net buying topped $371 million with no redemptions reported. BlackRock’s IBIT captured the largest share inflows, accumulating over $288 million, while Fidelity’s FBTC took in around $35 million.

Other competing funds managed by Bitwise, Ark Invest/21Shares, VanEck, WisdomTree, and Grayscale, also experienced gains. Grayscale’s GBTC and BTC have extended their winning streak to two days.

Inflows surged amid a rally in Bitcoin, with the price crossing $65,000 on Monday and moving closer to $68,000 yesterday, CoinGecko data shows. Bitcoin is now only 9% away from its all-time high.

Standard Chartered analysts predict that Bitcoin could approach its previous high of approximately $73,800 ahead of the US presidential election.

The analysts also note that the improving odds for Donald Trump’s re-election could create a favorable environment for Bitcoin, as historically, his presidency has been viewed positively by many in the crypto community.

Share this article