(Bloomberg) — Wall Street is still awaiting regulatory approval for the first full-blown private-asset ETFs, but for now opportunistic issuers are continuing to churn out products that claim to replicate the booming asset class — and stretching the definition of “liquid private equity.”

The movement to debut private-asset ETFs gained momentum last year after Apollo Global Management and State Street Global Advisors filed for a fund that would directly hold private credit investments. Regulators are still considering whether — and how — such a product would be allowed to function given that the underlying instruments are inherently hard to trade.

In the meantime, though, a handful of ETF issuers have attempted to take advantage of the appetite for such products with new exchange-traded funds that mimic private equity exposure by, for instance, investing in small-cap stocks of companies that are similar to those in buyout vehicles or emulating PE firms’ investment approach.

To be clear, none of the new funds claim direct PE investments, but rather a rough approximation of them. To some market-watchers, that undercuts the spirit of what private equity investments are supposed to provide.

“We can’t help but think of these recent launches as Bud Light for PE: watered down and not the real thing, like a true private equity fund,” said Todd Sohn, senior ETF strategist at Strategas.

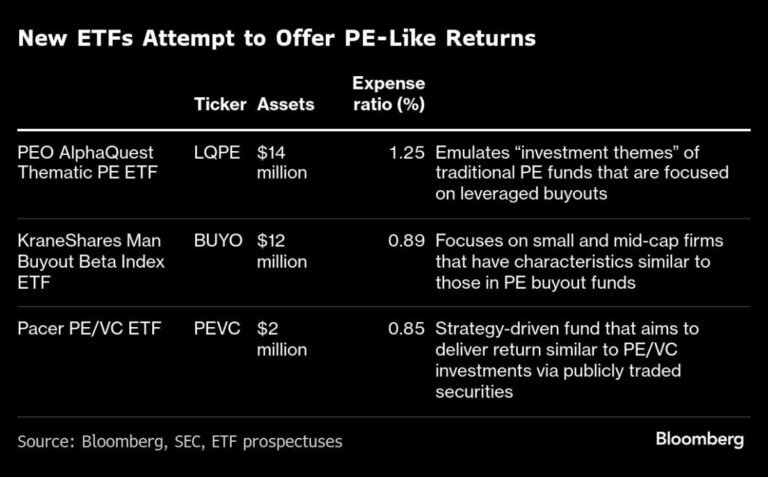

Still, the new funds — from the PEO AlphaQuest Thematic PE ETF (ticker LQPE, i.e. “liquid PE”) to the Man Buyout Beta Index ETF (BUYO) and Pacer’s PE/VC ETF (PEVC) — may appeal to some retail investors who otherwise would have narrow avenues of access or exposure to private markets.

Wall Street is on a race to demystify the world of private markets amid growing demand among mainstream investors to diversify into the asset class on the promise of elevated returns with muted volatility. Yet reliable and timely data on everything from company revenues and debt is hard to find — if at all — because private companies don’t have the same disclosure requirements as their listed peers, while valuations are updated infrequently and often at the discretion of the fund manager. All that makes it harder for a growing band of market participants – ETF firms, quants and alternative data providers — gunning to replicate the industry’s performance.

One key reason that fully-fledged private-asset ETFs have yet to launch in the US is that regulations only allow open-ended funds to have 15% of their holdings in illiquid assets, and most private instruments fit that bill. Apollo and State Street are seeking to work around those strictures by employing a novel trading strategy for their credit fund, which is now under review.

The private asset-themed ETFs take different approaches. Some, like BUYO and LQPE, offer indirect or synthetic exposure based on an index or theoretical investment approach similar to that of a buyout firm. Others, like the WHITEWOLF Publicly Listed Private Equity ETF (LBO), which launched in 2023, hold publicly traded stocks of companies involved in the private-markets space, like KKR & Co. Still others hold private assets capped at the current 15% limit.

SpaceX-Buying Standout

One recent standout in the last category has been the ERShares Private-Public Crossover ETF (XOVR), which has had year-to-date inflows of $130 million amid the revelation that it’s been buying shares of Elon Musk’s SpaceX. Shares of the rocket-and-satellite company don’t trade on a stock exchange, making investing in the company difficult. The ETF’s inflows suggest there’s strong investor demand — especially from the retail crowd — for direct private-asset exposure, said Bloomberg Intelligence’s Athanasios Psarofagis.

“Clearly investors want something that actually holds private companies, and XOVR does that the closest, even though it’s not fully private,” he said. Otherwise, many might just be “waiting for the real thing, if it ever happens.”

Kevin Orr, managing director and head of strategic partnerships at KraneShares, which is behind BUYO, says the fund isn’t a substitute for traditional private equity, but is a proxy for what can be held in traditional PE portfolios. The ETF can be thought of as an investment tool that charges less than what PE funds typically ask for and gives investors of all stripes — not just qualified ones — exposure “efficiently.”

On LQPE, Randy Cohen, who is the co-founder of PEO Partners, says his fund is buying “a set of publicly traded stocks that is as similar as humanly possible to the portfolio of thousands of LBO companies,” referencing leveraged buyouts.

“People will say, ‘Come on, how can you call it liquid PE, it’s not actually private equity — you’re holding public companies,’” he said in an interview. But “we’re saying we think this is as close to matching everything PE does as you can get while being in the public markets.”

Sean O’Hara, Pacer’s president, says the index underpinning PEVC is an amalgam of two benchmarks calculating private equity and venture-capital returns, both of which have been around for more than two decades and consist of more than 20,000 companies. PEVC aims to replicate the return of that PE-VC index by using a portfolio of roughly 200 publicly listed large-cap stocks with current holdings biased toward Big Tech companies.

Beef, Not Wagyu

Unlike direct private equity or venture capital investments, PEVC provides daily liquidity without tying up an investor’s money for long periods of time — and for a lower fee, O’Hara says. The fund tries to match and replicate the sector and industry allocations to the PE benchmark, then adjusts that exposure by going underweight certain sectors or uses swaps to increase return expectations.

Demand for BUYO, LQPE and PEVC has been tepid thus far: The three have combined assets of just $28 million, data compiled by Bloomberg show. BUYO has lagged the S&P 500 by nearly 5 percentage points on a total-return basis since its inception and is also slightly behind the Russell 2000. Although PEVC launched only recently, it’s up 3% since the beginning of February, outperforming the S&P 500.

Ben Johnson, head of client solutions at Morningstar, offered a note of caution, saying that “second-hand, liquid, low-cost exposure to private assets involves trade-offs.” Returns, for instance, might be lower than what private equity funds tend to offer, while volatility could be higher.

“The outcomes these funds produce will often be materially different from those delivered by direct investment in a particular corner of private markets,” he said. “Investors hoping for an A5 wagyu filet might get something more like ground-up hooves.”

–With assistance from Emily Graffeo.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.