Investing in artificial intelligence (AI) can pose a notable challenge for some investors.

Many potential shareholders might have too much of an aversion to risk buying individual stocks. Others more tolerant of risk might be leery of an Nvidia after a massive run-up or hesitant to buy a stock like Super Micro Computer, which delayed filing a report to the SEC.

Fortunately, such investors can turn to exchange-traded funds (ETF), which invest in a basket of stocks matching certain criteria and are managed by professionals. When it comes to AI investing, three specific ETFs can serve investors at all risk levels while earning shareholders significant returns in the process. Three Fool.com contributors discuss the possibilities.

Why pick one or two semiconductor stocks when this ETF offers more than two dozen?

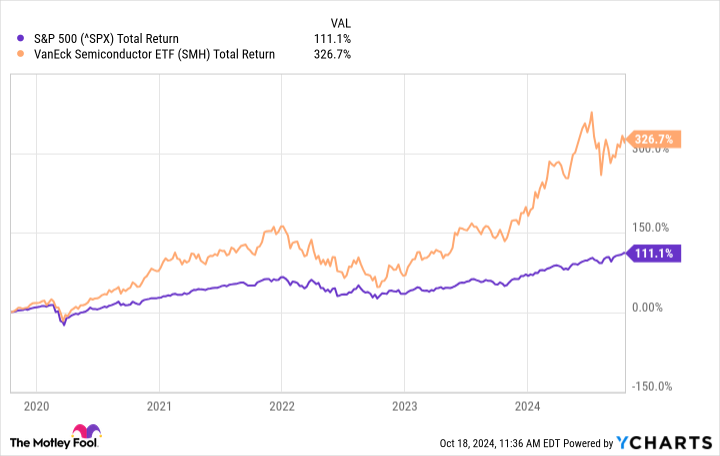

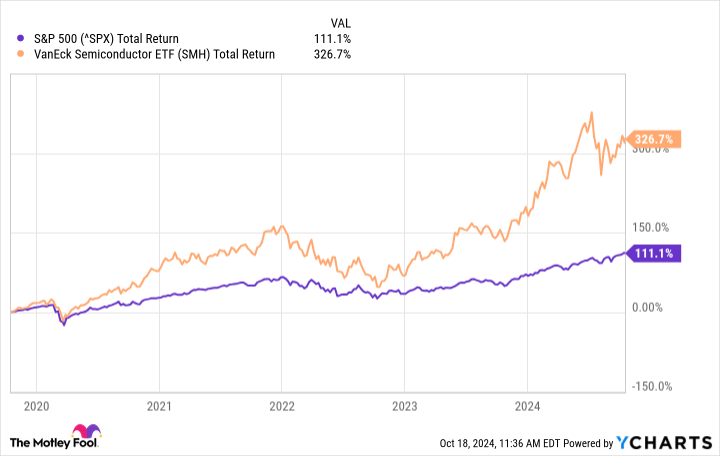

Jake Lerch (VanEck Semiconductor ETF): My choice for a safe way to invest in AI is the VanEck Semiconductor ETF (NASDAQ: SMH).

First, this fund is appealing because it is focused on the red-hot semiconductor sector. Among the fund’s top holdings are all the big-name semiconductor stocks one would expect: Nvidia, Advanced Micro Devices, Taiwan Semiconductor Manufacturing, Broadcom, etc. Yet it also contains many of the smaller players within the semiconductor value chain, such as Teradyne and Synopsys, which specialize in semiconductor testing.

Moreover, since the ETF has significant holdings across several rivals, investors in the fund are well positioned to benefit no matter which company eventually emerges victorious in the battle to develop the best AI chips. For example, suppose Nvidia eventually loses ground to competitors like AMD or Intel. In that case, investors in this fund will still have exposure to those companies.

The fund’s most considerable appeal comes from its strong link to the AI revolution. Overall, AI-powered tools are changing how we live and work — much like smartphones and personal computers did in prior decades. There is a desperate need for more — and faster — semiconductors. That is why sales and profits are skyrocketing for companies up and down the semiconductor value chain.

For those who want to invest in this technological wave — but don’t want to rest their hopes on just one or two stocks — the VanEck Semiconductor ETF is a fund worth considering.

Look to the “AI ETF” that hides in plain sight

Will Healy (Invesco QQQ Trust): Rather than choosing specific companies, one could simply invest in the top tech stocks. Indeed, such an approach may limit the gains that might come from choosing the next Nvidia. However, it also mitigates the damage that can come from unexpected turmoil within a company.

The Invesco QQQ Trust (NASDAQ: QQQ) is one of the easier ways to take such an approach. This ETF invests in the top 100 nonfinancial companies listed on the Nasdaq Composite index. Admittedly, not all of its holdings are of equal weighting or even part of the tech industry. In fact, one of the top 10 holdings is retail giant Costco Wholesale.

Nonetheless, choosing these top stocks of the Nasdaq makes the fund easier to manage. Hence, it costs investors an ETF expense ratio of just 0.2%, well below Morningstar‘s average expense ratio of 0.36% for ETFs and mutual funds.

Also, most of the top holdings are a who’s who of AI stocks. Its largest holding is Apple at an 8.7% allocation. Second is Nvidia, which makes up 8.3% of the fund, while Microsoft rounds out the top three, consisting of 7.8% of the fund’s holdings. All told, the top 10 stocks make up around 50% of the fund.

Another advantage is that the Invesco QQQ Fund gives investors exposure to comparatively smaller companies that use AI. Stocks like The Trade Desk and even the struggling Supermicro are in the index and could drive more significant returns if their massive growth resumes.

Amid such selections, the fund has returned nearly 35% over the last year, slightly ahead of the S&P 500‘s pace.

Still, the best reason to hold it is the greater potential for long-term gains. The five-year returns of around 155% increase the likelihood that its shareholders will benefit from AI without some of the risks that can come with a sometimes volatile industry. That in itself is an excellent reason for many investors to simply outsource the risk and stay with the top Nasdaq stocks.

Looking for AI upside and peace of mind? Don’t sleep on the good ol’ S&P 500.

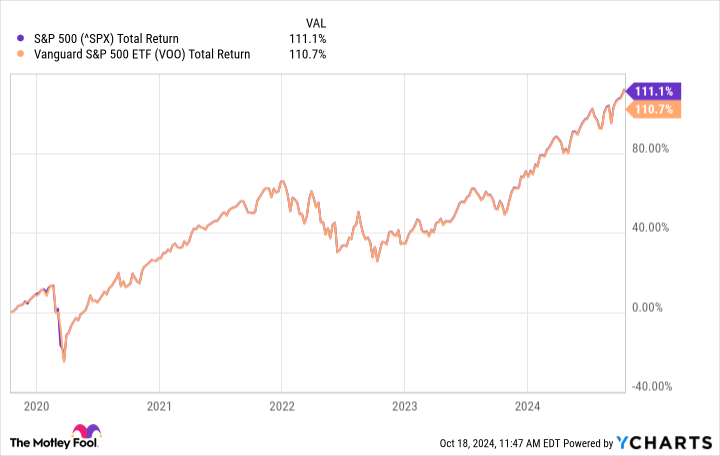

Justin Pope (Vanguard S&P 500 ETF): It might be a bit unconventional, but the S&P 500 is a great way to invest in AI safely. A handful of big technology companies, known as the “Magnificent Seven,” have numerous AI opportunities.

For example, Nvidia is the leading manufacturer of AI chips. Microsoft, Amazon, and Alphabet control most of the public cloud services market, crucial to deploying AI software. Tesla is developing AI technologies, such as autonomous driving and humanoid robotics. Apple is deploying AI technology in its electronic devices, and Meta Platforms is weaving AI into social media platforms like Facebook, Instagram, and WhatsApp.

The Magnificent Seven collectively represent over 31% of the S&P 500 index because it’s market cap-weighted, and these companies are worth trillions of dollars. If up-and-coming AI companies do well enough, they’ll also wind up in the index. Market darling Palantir Technologies just recently joined the index. The index has strict criteria, so you know a company is probably a winner if it makes it in. It takes the guesswork out of trying to own the right companies in an AI industry that’s still nascent and bound to evolve significantly over the coming years.

Did I mention that the S&P 500 is probably your safest AI bet? The index features 500 prominent U.S. companies across all corners of the economy, so it automatically diversifies your investments beyond AI and technology stocks. Plus, the index has proven remarkably resilient. It has continually risen for decades–it’s at all-time highs today! Just remember that not even the S&P 500 is immune to downturns and volatility.

You can’t invest directly in the S&P 500, but the Vanguard S&P 500 ETF (NYSEMKT: VOO) follows the index and charges a negligible 0.03% expense ratio. The S&P 500 isn’t a pure play on AI, so it’s not as flashy. However, the market’s most famous index offers a combination of AI exposure and safety that’s tough to beat.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, Invesco QQQ Trust, Nvidia, Tesla, The Trade Desk, and VanEck ETF Trust – VanEck Semiconductor ETF. Justin Pope has no position in any of the stocks mentioned. Will Healy has positions in Advanced Micro Devices, Intel, Palantir Technologies, Super Micro Computer, and The Trade Desk. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, Synopsys, Taiwan Semiconductor Manufacturing, Tesla, The Trade Desk, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom, Intel, Nasdaq, and Teradyne and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Want to Invest in Artificial Intelligence (AI) Safely? Buy These 3 ETFs was originally published by The Motley Fool