This fund makes it easy to make dividend income.

Investing in dividend-paying stocks is an easy way to generate passive income. The only work involved is sifting through all the options to find the best dividend stocks for your portfolio. Once you do that upfront work, you can just sit back and watch the income flow into your account.

However, there’s an even easier way to collect dividend income: Invest in the Schwab U.S. Dividend Equity ETF (SCHD 0.53%). The exchange-traded fund (ETF) owns 100 of the top dividend stocks. Here’s a closer look at this dividend ETF and some of its top holdings.

A high-quality, high-yielding ETF

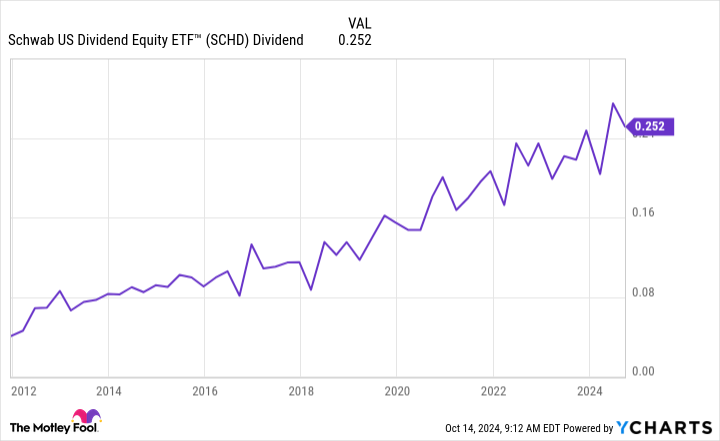

Schwab U.S. Dividend Equity ETF is a passively managed ETF that tracks the Dow Jones U.S. Dividend 100 Index. That index has a very straightforward strategy. It aims to track the performance of higher-yielding stocks with a consistent record of paying dividends and stronger financials than their peers. These companies should pay attractive and growing dividends. As such, the ETF should be able to distribute an increasing amount of income to its investors.

That has certainly been the case over the years:

SCHD Dividend data by YCharts.

The ETF currently offers a very attractive dividend yield. Over the trailing 12 months, its distribution yield has averaged around 3.6%. That’s nearly three times higher than the current dividend yield on the S&P 500 (around 1.2%).

Another great feature of this fund is its low costs. It has a 0.06% ETF expense ratio. For every $1,000 invested in this fund, an investor would only pay $0.60 of management fees each year. For comparison, some other top-dividend ETFs have expense ratios in the range of 0.33% to 0.58%, meaning investors would pay $3.30 to $5.80 in fees per year. Thanks to its lower fees, investors in Schwab U.S. Dividend Equity ETF get to keep more of the income its holdings generate.

Top-notch holdings

Schwab U.S. Dividend Equity ETF typically holds around 100 dividend stocks. The 10 largest holdings currently comprise about 40% of the fund’s assets. Among its ten-largest holdings are Home Depot (HD 0.85%), Chevron (CVX 0.24%), and Coca-Cola (KO 1.11%). Here’s a closer look at these top-notch dividend stocks.

Home Depot is a leading home improvement retailer. The company has an exceptional record of paying dividends. It has made payments for about 150 straight quarters. Meanwhile, the retailer has increased its payment level for 15 years in a row, including giving investors a 7.7% raise earlier this year. The company’s dividend currently yields around 2.2%, a level it can easily afford. In its 2024 fiscal year, Home Depot produced $21.2 billion in net cash from operating activities, which easily covered its dividend payments ($8.4 billion) and investments ($3.2 billion in capital spending and $1.5 billion in acquisitions). That enabled the company to generate excess cash to repurchase shares ($8 billion) while maintaining a strong balance sheet. The retailer’s growing sales and earnings should enable it to continue increasing its payout.

Oil giant Chevron has an elite record of paying dividends. The company delivered its 37th straight year of increasing its dividend in 2024. Chevron offers a high yield (currently 4.3%) and a solid growth rate (8% increase in 2024). While oil and gas prices can be volatile, Chevron’s dividend has been very reliable because of its low-cost operations and strong balance sheet. The company can generate enough cash at an average oil price of $50 a barrel over the next couple of years to fund its capital plans and a growing dividend with room to spare. Meanwhile, it’s taking steps to enhance and extend its ability to grow its cash flow and dividend into the next decade by seeking to acquire Hess in a needle-moving deal.

Coca-Cola is an elite dividend stock. The beverage giant has increased its dividend for 62 straight years. That qualifies it as a Dividend King, a company with 50 or more years of dividend growth. Coca-Cola most recently raised its payment in February, giving its investors a 5.4% raise. The company generates plenty of cash to cover its 2.8%-yielding payout. It’s on track to produce $9.2 billion in free cash flow this year while paying about $4.4 billion in dividends. That conservative payout level enables Coco-Cola to generate excess cash to fund growth-related investments and maintain a top-notch balance sheet. The company’s growing cash flow should enable it to continue its elite record of increasing its dividend.

All the top dividend stocks in one easy investment

You could build a portfolio of top-dividend stocks like Home Depot, Chevron, and Coca-Cola to collect a rising stream of dividend income. Or you could go the even easier route and invest in Schwab U.S. Dividend Equity ETF. It owns around 100 of the top companies known for paying high-yielding and steadily rising dividends. The fund should provide investors with a very passive income stream that should grow over time.

Matt DiLallo has positions in Chevron, Coca-Cola, and Home Depot. The Motley Fool has positions in and recommends Chevron and Home Depot. The Motley Fool has a disclosure policy.