AI leader NVIDIA (NVDA – Free Report) is set to release its fiscal second-quarter 2025 results after the market’s close on Aug. 28. The chipmaker has risen 18.7% over the past three months, outperforming the industry’s growth of 14.9%. The strong trend will continue if NVIDIA beats earnings estimates.

ETFs having the largest allocation to NVIDIA will be in focus ahead of its earnings report. These include Strive U.S. Semiconductor ETF (SHOC – Free Report) , VanEck Vectors Semiconductor ETF (SMH – Free Report) , Technology Select Sector SPDR Fund (XLK – Free Report) , Grizzle Growth ETF (DARP) and TrueShares Technology, AI and Deep Learning ETF (LRNZ – Free Report) .

Earnings Whispers

NVIDIA currently has an Earnings ESP of -2.25% and a Zacks Rank #3 (Hold). According to our methodology, the combination of a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The world’s largest chipmaker saw a negative earnings estimate revision of a penny over the past 30 days for the second quarter of fiscal 2025. However, NVIDIA is expected to post triple-digit earnings (33.3%) and revenue (109%) growth for the to-be-reported quarter. NVIDIA’s earnings surprise history is good, as it delivered an earnings surprise of 18.43%, on average, in the last four quarters (read: Here’s How You Can Play NVIDIA’s Earnings).

Analysts’ View on NVDA Stock

Many analysts are bullish on the stock ahead of NVIDIA’s earnings release. Wedbush expects the chipmaker to deliver another “drop the mic performance,” citing signs of “massive enterprise AI demand” and spending by cloud giants such as Amazon (AMZN) and Alphabet’s Google (GOOGL), all trends that would benefit the chipmaker. Analysts from Raymond James and KeyBanc also stated they expect a strong quarter from the chipmaker despite concerns about a reported delay in NVIDIA’s Blackwell AI chip.

NVIDIA currently has an average brokerage recommendation (ABR) of 1.20 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 40 brokerage firms. The current ABR compares to an ABR of 1.25 a month ago based on 40 recommendations. Of the 40 recommendations, 35 are Strong Buy and two are Buy. Strong Buy and Buy account for 87.5% and 5%, respectively, compared to 85% and 5% a month ago.

Based on short-term price targets offered by 40 analysts, the average price target for NVIDIA comes to $141.90. The forecasts range from a low of $90.00 to a high of $200.00.

Data Center Growth Seems Solid

NVIDIA has been at the forefront of technology companies’ race to build AI into their products and services. Its success is largely attributed to its leadership in developing advanced graphics processing units (GPUs), which are unmatched in producing processors that power artificial intelligence systems, including generative AI, the technology backing OpenAI’s ChatGPT that can create text, images and other media.

Major cloud service providers rely on NVIDIA’s GPUs to train and run AI applications. The company’s clients include around 20,000 start-ups, along with big names like Microsoft, Alphabet and Amazon. The company holds an 80% market share in AI chips for data centers (read: Are Semiconductor ETFs Better Bets on AI Boom Than Big Techs?).

Demand for NVIDIA’s H100 accelerators has been on a surge. Its next-generation GPU chip is expected to drive another round of massive growth. For the second quarter of fiscal 2025, the graphics chipmaker expects revenues of around $28 billion, plus or minus 2%.

Meanwhile, investors will be keen on watching updates on Blackwell chips, which have been rumored to be delayed by up to three months or more.

NVIDIA’s Valuation

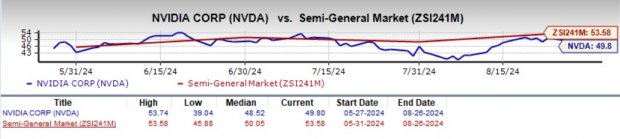

NVDA’s expensive valuation has been a cause for concern in recent months. But given the astounding surge the stock has enjoyed since the end of 2022, its valuation does not seem overstretched. NVIDIA is currently trading at a P/E ratio of 49.8 versus 53.58 for the industry.

Image Source: Zacks Investment Research

Further, the stock is currently trading at a PEG ratio of 1.25, much lower than the industry average of 4.13, suggesting that it is a better value stock in the industry. The lower the PEG ratio, the better the value, as investors would be paying less for each unit of earnings.

ETFs in Focus

Strive U.S. Semiconductor ETF (SHOC – Free Report) – NVIDIA occupies the top position with 29.5% of assets (read: Semiconductor ETFs Bear the Brunt of Market Rout).

VanEck Vectors Semiconductor ETF (SMH – Free Report) – NVIDIA is the top firm, accounting for 21.9% share.

Technology Select Sector SPDR Fund (XLK – Free Report) – NVIDIA occupies the top position with a 21.3% share in the basket.

Grizzle Growth ETF (DARP) – NVIDIA occupies the top position with 20.3% of the assets.

TrueShares Technology, AI and Deep Learning ETF (LRNZ – Free Report) – NVIDIA takes the top spot at 14.9% share.

Single Stock ETFs

T-REX 2X Long NVIDIA Daily Target ETF (NVDX) – NVIDIA exposure: 200%

GraniteShares 2x Long NVDA Daily ETF (NVDL) – NVIDIA exposure: 200%