Bitcoin (BTC) ended February on a bearish note, dropping over 17% last month, with US Bitcoin ETFs seeing $3.5 billion of outflows last month. This marks the biggest monthly withdrawal since launch as macro uncertainties, the Trump trade war have escalated crypto market panic over the past week. Investors are curious whether March will be better or are we heading for another month of correction.

Bitcoin ETF Inflows Resume After February Bloodbath

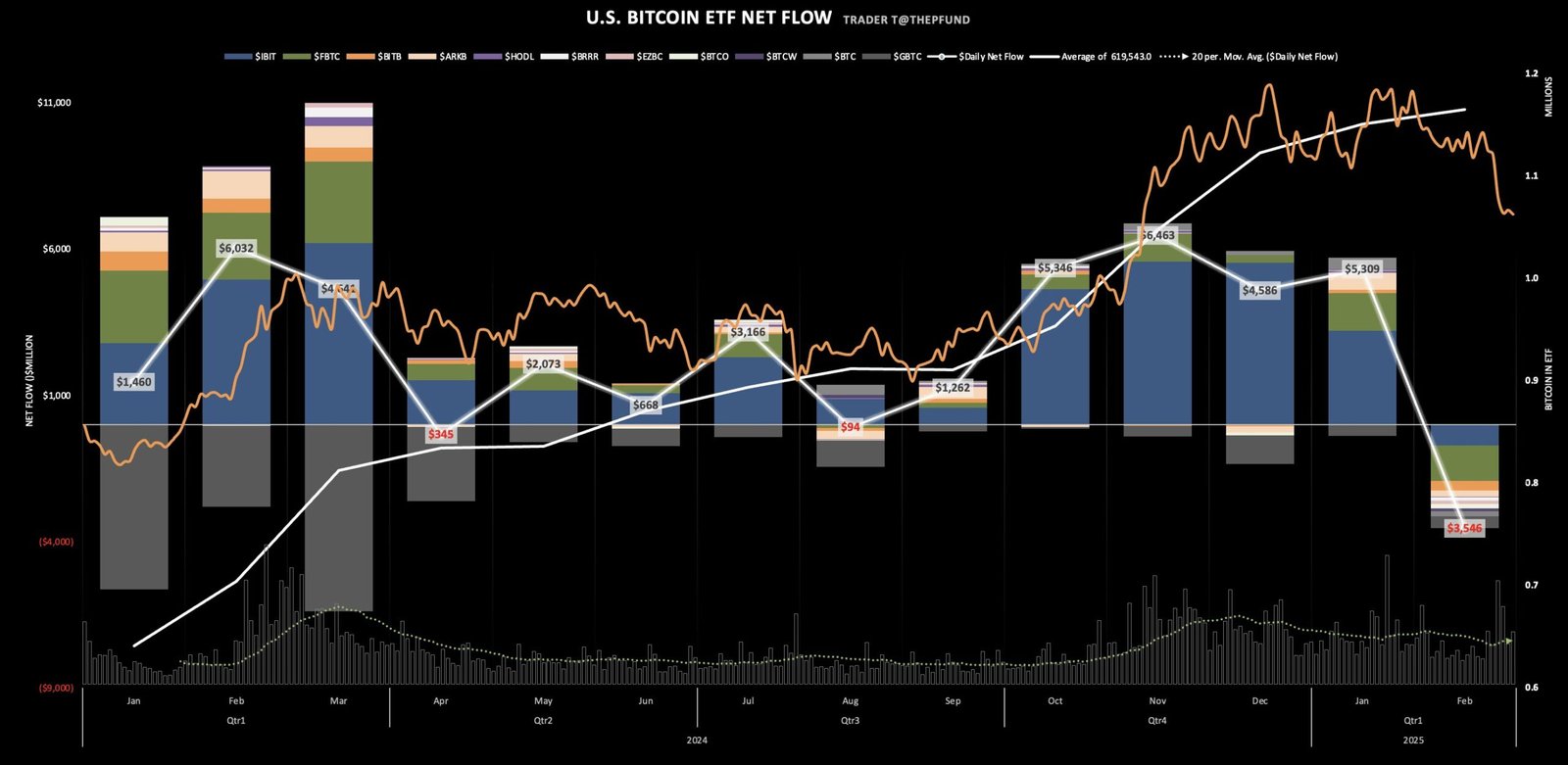

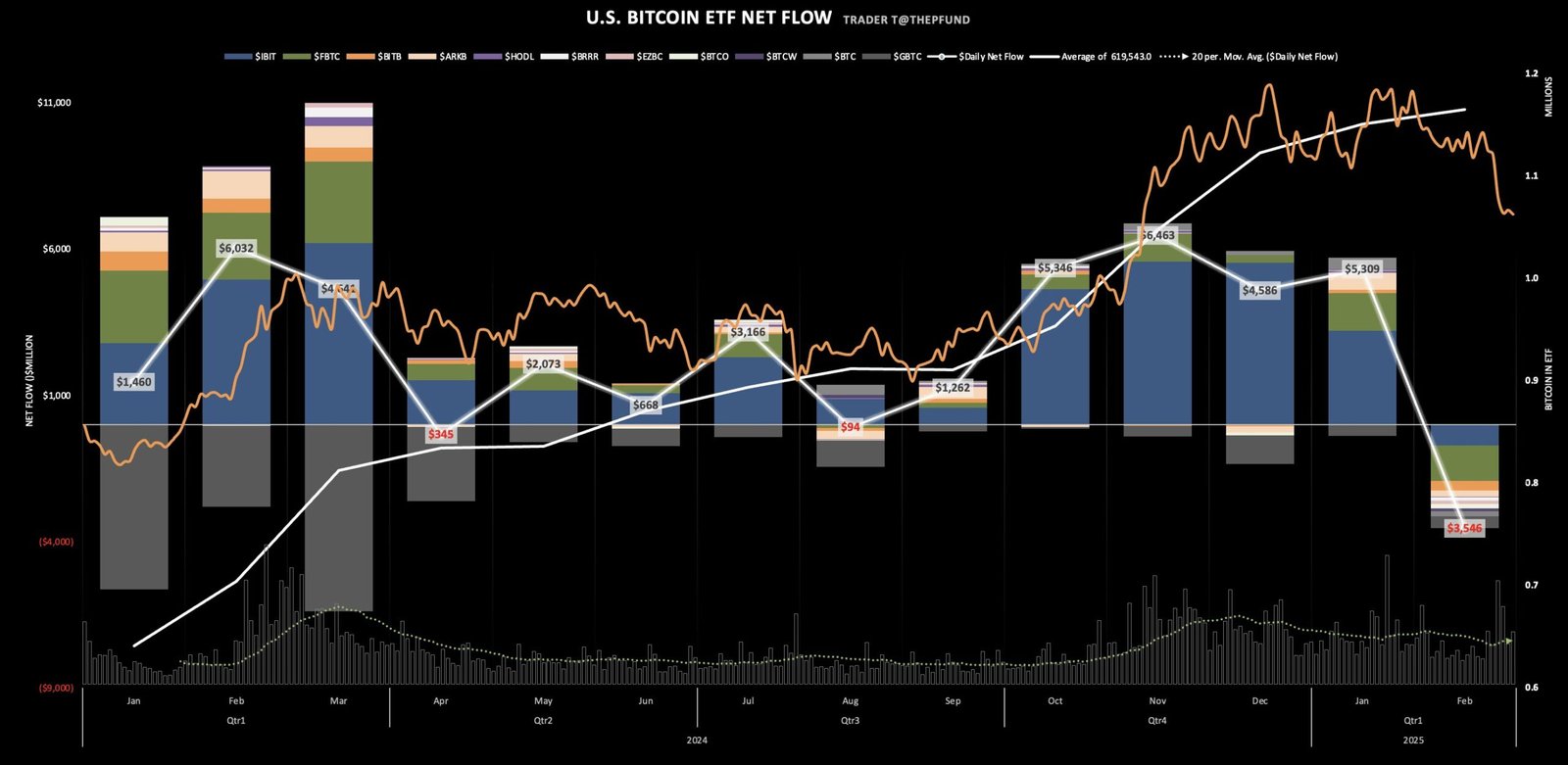

During the last month of February 2025, spot Bitcoin ETFs recorded net outflows of $3.546 billion, or 40,000 BTC, from the market. This marked the first month where every BTC ETF reported negative inflows, coinciding with an 18% drop in Bitcoin’s price from $102,400 to $84,300.

Top funds like BlackRock’s iShares Bitcoin Trust (IBIT) saw its first ever monthly outflows, shedding off 9,470 BTC worth a $721 million outflow. Now, the fund holds a total of 573,136 BTC. Similarly, the Fidelity Bitcoin ETF (FBTC) experienced a $1.202 billion outflow while Grayscale’s two Bitcoin funds – GBTC and BTC – clocked a cumulative outflow of $585 million.

After eight consecutive days of outflows, Bitcoin ETFs finally recorded net inflows on Friday. As per the data from Farside Investors, yesterday’s inflows stood at a total of $94.9 million amid the broader crypto market recovery.

While BlackRock’s IBIT continued with net outflows of over $243 million, Ark Invest’s ARKB and Fidelity’s FBTC made up for it with $193.70 million and $176.03 million worth of inflows respectively. It seems that the crypto market is finally taking a sigh of relief after key corrections in February.

Will March Be Better for Bitcoin and Altcoins?

February 2025 proved to be the toughest on record for the crypto market. Bitcoin price crashed more than 17.39% all the way to $82,000, making it the worst February performance for BTC over the past decade. However, altcoins like Ethereum (ETH) faced even steeper fall correcting 31.95%, making it its worst February since inception.

Blockchain analytics platform SpotonChain showed that historically, negative trends in February have often carried over into March, raising concerns about whether the market will rebound or if the downturn will continue. Analysts are closely watching for signs of recovery as March unfolds.

The latest Matrixport report suggested that hedge funds, and not traditional investors, have been behind the current Bitcoin sell-off. Furthermore, the report shows that the current Bitcoin price correction can continue even further until March or April, before the upward journey resumes again. Thus, it’s a wait and watch to see whether institutional inflows return to Bitcoin ETF moving ahead.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: