Investors wanting exposure to the S&P 500 without the concentration risk should consider this ETF.

After 2022 saw many major U.S. stock market indexes decline significantly, the past year-and-a-half has seen a much-needed bounceback. Unfortunately, the sentiment around the U.S. stock market and economy has changed over the past month or so, with recession fear talk seemingly popping up with each passing day.

Whether these recession fears are warranted remains to be seen, but the best thing you can do as an investor is to be as prepared as possible for what may come. Exchange-traded funds (ETFs) are good investment options at any time, but they can be especially useful during times of uncertainty because they reduce risks.

An S&P 500 ETF could be a staple in almost anybody’s portfolio, but people wanting to hedge a little against possible future events should consider the Invesco S&P 500 Equal Weight ETF (RSP 0.21%).

The same companies, but less dependence

This ETF mirrors the S&P 500, an index that tracks the largest 500 American companies on the stock market. In most cases, an S&P 500 ETF is market-cap-weighted, meaning larger companies account for more of the ETF than smaller companies. If you invest in one, more of the money will be put into companies like Microsoft and Apple than Etsy and Southwest Airlines.

However, since this ETF is equally weighted, all companies account for roughly the same amount. For perspective, here are its top 10 holdings, compared to SPDR S&P 500 Trust ETF (SPY 0.44%).

| Invesco S&P 500 Equal Weight ETF | SPDR S&P 500 Trust ETF |

|---|---|

| Mohawk Industries (0.27%) | Microsoft (7.25%) |

| Charter Communications (0.26%) | Nvidia (6.63%) |

| CBRE Group (0.25%) | Apple (6.62%) |

| D.R. Horton (0.24%) | Amazon (3.86%) |

| 3M (0.24%) | Meta Platforms (2.41%) |

| Tyler Technologies (0.24%) | Alphabet Class A (2.33%) |

| Iron Mountain (0.24%) | Alphabet Class C (1.96%) |

| Lockheed Martin (0.23%) | Berkshire Hathaway (1.61%) |

| Bio-Rad Laboratories (0.23%) | Eli Lilly (1.57%) |

| American Tower (0.23%) | Broadcom (1.53%) |

Data source: Invesco.

There’s a noticeable difference between the two, although they both mirror the S&P 500.

A history of outperformance during rocky times

The concentration of a standard S&P 500 ETF can be great when the companies and sectors leading the way (in this case, tech) are flourishing, as has been the case in recent times. However, the same companies and sectors responsible for its growth can also be responsible for its decline.

Investing in an equal-weight S&P 500 ETF can be the best of both worlds. On one hand, you’re still investing in the S&P 500, which many consider to be an investment in the U.S. economy. On the other, you’re not as reliant on too few companies or the tech sector’s success to drive the ETF’s gains.

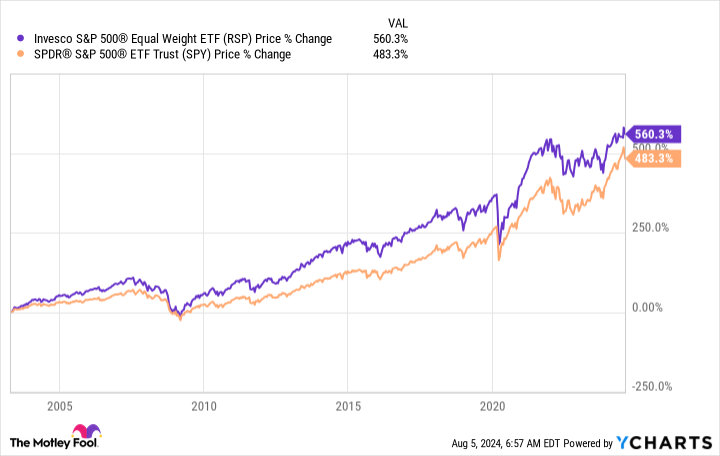

Despite the success of huge tech companies and the tech sector over the past couple of decades, the equal-weight approach has proven to be more efficient. Here’s how the equal-weight and standard S&P 500 ETFs have performed since the Invesco S&P 500 Equal Weight ETF’s April 2003 inception.

You never want to use past results to predict future performance, but there have been numerous down or recovery periods when investing in the equal-weight ETF proved to be a better choice than a standard S&P 500 ETF.

For example, when the S&P 500 declined by over 19% in 2022, the equal-weight S&P 500 “only” declined by just over 13%. After the market crashed in March 2020 because of the COVID-19 pandemic, the S&P 500 gained around 52% from April to December, while the equal-weight S&P 500 gained close to 60%.

Therefore, this ETF is a great option if you want exposure to the S&P 500 without worrying about the correction of megacap tech stocks.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, American Tower, Apple, Berkshire Hathaway, Etsy, Iron Mountain, Meta Platforms, Microsoft, Nvidia, and Tyler Technologies. The Motley Fool recommends 3M, Broadcom, Lockheed Martin, and Southwest Airlines and recommends the following options: long January 2026 $180 calls on American Tower, long January 2026 $395 calls on Microsoft, short January 2026 $185 calls on American Tower, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.