TLDR

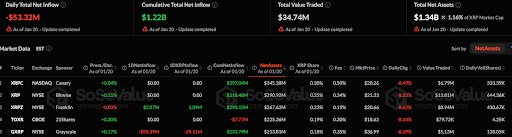

- The XRP ETFs market recorded a daily net outflow of $53.32 million, with total net assets at $1.34B.

- Grayscale’s GXRP ETF experienced the largest outflow, totaling $55.39 million.

- Franklin’s XRPZ ETF saw a net inflow of $2.07 million, with 1.09K XRP added to its assets.

- Canary’s XRPC, Bitwise’s XRP, and 21Shares’ TOXR ETFs recorded no changes in daily net flow.

- The total value traded for XRP ETFs on January 20 reached $34.74 million.

The XRP ETFs market experienced a daily net outflow of $53.32 million. This resulted in a decrease in the cumulative net inflow, which stood at $1.22 billion. The total value traded for the day was $34.74 million, while the total net assets for XRP ETFs amounted to $1.34 billion, representing 1.16% of the XRP market cap.

GXRP ETF Reports the Largest Outflow

According to the SoSoValue update, the largest outflow was recorded by Grayscale’s GXRP ETF, which saw $55.39 million in outflows, resulting in a reduction of 29.11K XRP. The XRP ETF’s total net assets were $231.79 million, and the market price fell 8.19%, closing at $36.99. The trading volume for GXRP reached 138.05K shares.

Franklin’s XRPZ ETF recorded a net inflow of $2.07 million and a total of 1.09K XRP inflows. The fund’s net assets stood at $290.15 million, and the market price dropped 8.62%, closing at $20.66. XRPZ had a daily trading volume of 430.67K shares.

XRPC, TOXR, and XRP ETFs Record No Changes in Daily Net Flow

Canary’s XRPC ETF, which had a minor premium at +0.04%, reported no changes in daily net inflow or outflow. The ETF’s net assets were valued at $397.04 million, and the market price fell 8.49% to $20.26. The trading volume for XRPC was 333.39K shares.

Bitwise’s XRP ETF (XRP) experienced no inflows or outflows, maintaining stable performance. The fund’s net assets were valued at $310.48 million, and the market price decreased by 8.53% to $21.33. The trading volume for the XRP ETF was 644.36K shares.

The TOXR ETF, listed on CBOE by 21Shares, experienced no inflows or outflows. Its market price fell by 8.14% to $18.62. Trading volume was 4.25 million shares, a notable decrease.