Key Notes

- Analyst CasiTrades highlights $2.04 as a make-or-break level, deciding the next move for XRP price.

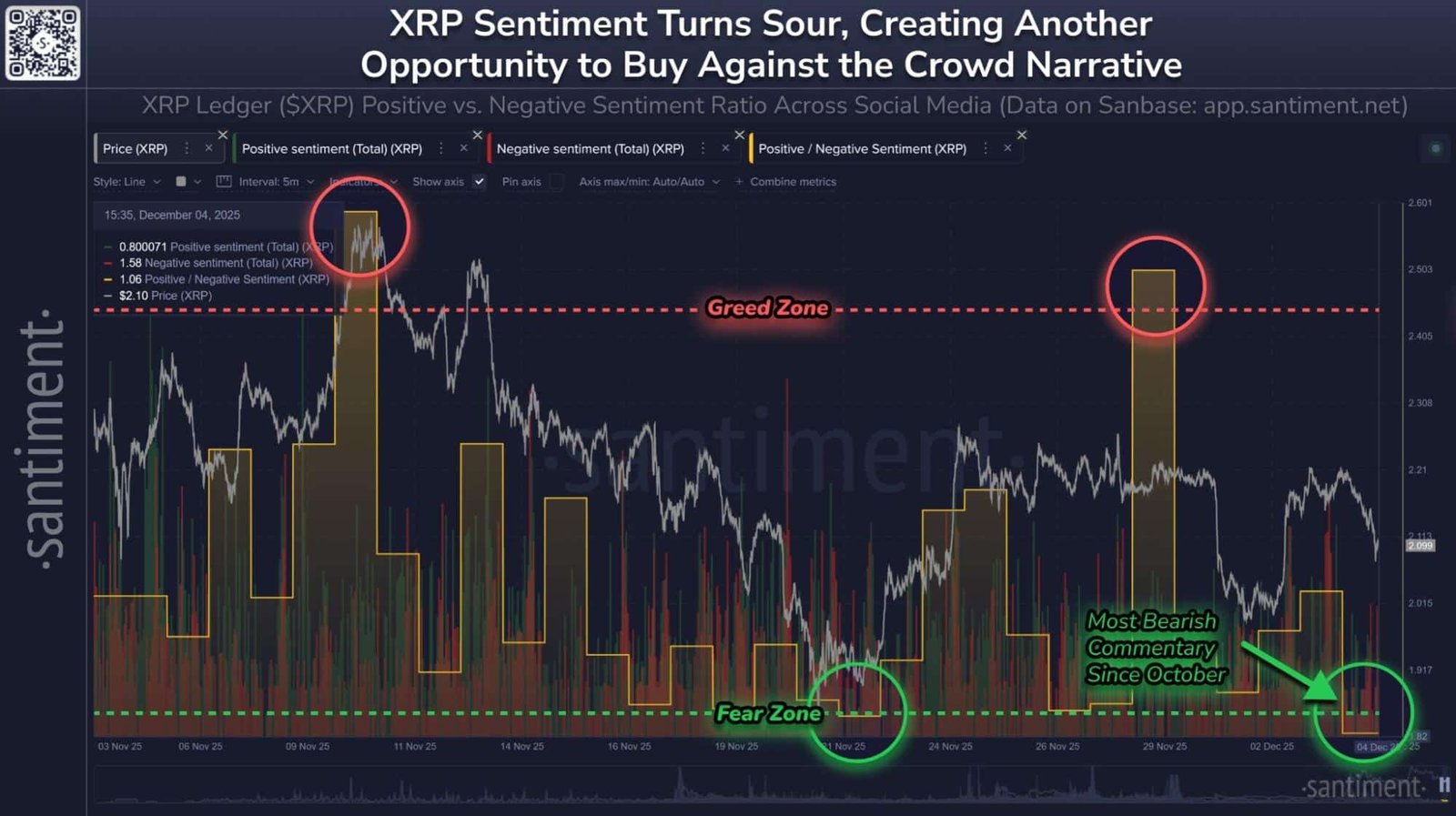

- For now, the XRP social sentiment remains the lowest since October 2025.

- Despite bearish sentiment, spot XRP ETFs have recorded 14 straight days of inflows totaling $887 million.

Ripple’s native cryptocurrency XRP

XRP

$2.04

24h volatility:

2.3%

Market cap:

$122.90 B

Vol. 24h:

$3.19 B

is once again seeing a 5.2% drop on Dec. 5 to $2.06 level as market sentiment hits October lows. This comes despite the XRP ETFs showing consistent inflows for 14 consecutive trading sessions, and now approaching $1 billion. Blockchain analytics firm Santiment noted that this fear, unrest, and doubt (FUD), provide an opportunity for an XRP price bounce back.

Will XRP Price See 22% Upside after Recent FUD?

Blockchain analytics firm Santiment has reported that XRP fear levels and social sentiment have peaked since October. XRP has faced a 31% price drop over the past two months.

The negative XRP funding rates show that shorts are dominating over the bulls.

According to data from Santiment, the bearish commentary for XRP has significantly outweighed the bullish discussion. It has moved the coin into a strong “fear zone”.

XRP sentiment drops into fear zone | Source: Santiment

The blockchain firm stated that the altcoin entered a similar fear zone on November 21. However, three days later, it led to a major upside for XRP price, coinciding with the launch of Grayscale and Franklin Templeton XRP ETFs. Santiment noted that a similar “fear zone” setup a buying opportunity here.

It’s a Make-or-Break Situation for XRP Price

Crypto market analyst CasiTrades said XRP is moving toward a critical retest of the $2.04 level. The altcoin recently bounced from a local 0.618 retracement, generating short-term bullish momentum, but broader downside risk remains.

According to the analysis, XRP price is likely returning to the macro 0.5 Fibonacci level at $2.04. A successful hold of that support could set up a move above $2.41 and potentially extend toward $2.65. This could further lead to a confirmation of a strong bullish trend, setting XRP for a long-term rally in the $7–$10 range.

XRP price chart | Source: TradingView

However, the analyst CasiTrades believes that if XRP price fails to hold the $2.04 area, it could drop all the way to $1.64 i.e. the macro 0.618 retracement level.

XRP ETFs Stage a Strong Show

Spot XRP ETFs have seen strong demand in the US market with 14 consecutive days of inflows, and zero days of outflows since launch. As per the data from SoSoValue, these ETFs saw $12.84 million in inflows on Dec. 4.

Thus, the cumulative inflows have now surged to $887 million and are approaching the $1 billion milestone. Interestingly, this development comes as Bitcoin ETFs have been struggling recently. This shows that the institutional demand for XRP remains strong.

Ethereum-Based Meme Coin PEPENODE Grabs Attention

Amid the XRP price volatility, meme coin PEPENODE is once again grabbing investor attention by approaching $2.4 million in presale raises

During the presale period, users can earn up to a hefty 570 APY (annual percentage yield). PEPENODE is first-of-its-kind project that brings mining utility to a memecoin along with immediate staking rewards. This makes it one of the best crypto presales currently in the market.

The roadmap shows a plan of expansion into infrastructure services such as RPC endpoints, bandwidth provisioning, and storage solutions.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.