The Indian equity market has been under pressure for the past one year. Benchmark indices – Sensex and Nifty – have lost about 5% dragged by weak corporate results, sluggish domestic consumption, adverse tariff decisions, and a weakening currency. This has impacted mutual funds as well.

Looking at the different categories of equity mutual funds, the picture is disappointing across the board. The story of flexi-cap funds is no different. Out of 41 funds in this category, only 3 have delivered positive returns to investors over the past year. All other funds have delivered negative returns up to 19%.

Which flexi-cap funds have generated positive returns?

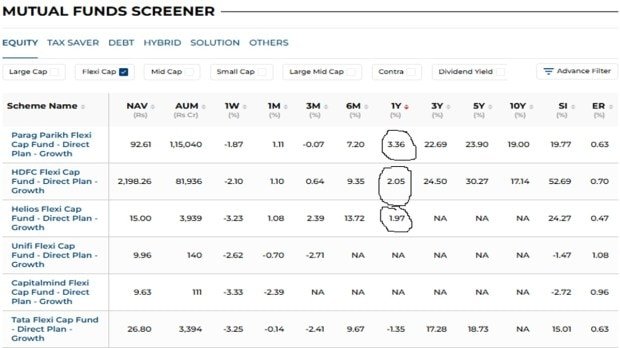

The average return of the flexi-cap category over the past one year has been (-)6.68%. Despite this, some funds (direct plans) held promise –

1. Parag Parikh Flexi Cap Fund

1-year return: 3.36%

2. HDFC Flexi Cap Fund

1-year return: 2.05%

3. Helios Flexi Cap Fund

1-year return: 1.97%

Out of 41 flexi-cap funds, only these three funds were able to deliver positive returns to investors.

(Source: Financialexpress.com)

Other MF categories are faring even worse

Not just flexi caps, other categories of equity mutual funds have also faced difficult times.

Large-cap funds → Only 1 fund is positive

Mid-cap funds → 2 funds are positive

Small-cap funds → 1 fund is positive

Large- and mid-cap funds → 2 funds are positive

That is, with the exception of banking and some international-themed funds, almost every sub-category in equity space has suffered losses. Large- and mid-cap funds have average returns of (-)10.72% over the past year.

Flexi-cap funds: Long-term picture is different

Although the flexi-cap category has shown weakness over the past year, its long-term performance offers some solace to investors.

The Parag Parikh Flexi Cap Fund and the HDFC Flexi Cap Fund have delivered annualized returns of over 20% over 3-year and 5-year periods.

The third fund reviewed, Helios Flexi Cap Fund, has a tenure of only 1 year and 10 months, so its long-term returns are not available.

Lessons for investors

When investing in mutual funds, it’s not wise to base decisions solely on recent returns. Returns reflect past performance, but they don’t guarantee future performance. Therefore, when choosing a fund, it’s crucial to consider its strategy, fund management, risk profiles and your investment goals.

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.