Small-cap funds can rise fast and fall just as quickly. The last year has been difficult for the category, with several schemes posting weak or negative returns. That does not change the broader picture. Small-caps need time to deliver. While the category can carry a higher risk, those who stay invested tend to be rewarded. A five-year view gives a truer sense of how a fund performs across cycles.

Look beyond the past 12 months, and the numbers improve sharply. Several small-cap schemes have generated annualised returns between 31% and 36% over five years, well above their benchmarks. Such compounding can meaningfully lift long-term returns.

How to choose the best small-cap mutual fund in 2025

Small-cap funds move through cycles. To assess them properly, you can focus on a few core metrics. One-year returns show how a fund behaves in volatile markets, while five-year CAGR captures long-term consistency. Expense ratio also matters because a relatively high ratio can eat into returns, while a moderate one balances cost and scope for active management. Comparing these numbers with benchmark returns helps gauge true performance.

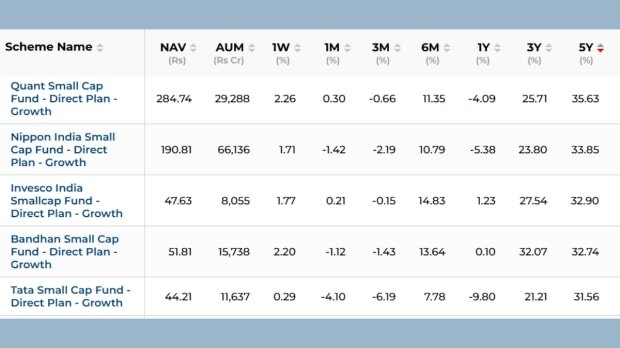

Based on data from the Financial Express Mutual Fund Screener, five schemes stand out for delivering more than 30% annualised returns over the past five years while beating their respective benchmarks: Quant Small Cap Fund, Nippon India Small Cap Fund, Invesco India Smallcap Fund, Bandhan Small Cap Fund, and Tata Small Cap Fund.

The selection is based on three factors: one-year return, five-year CAG,R and expense ratio.

Top small-cap funds with strong 5-year track records and high growth potential in 2025

#1 Quant Small Cap Fund

Quant Small Cap Fund has been one of the better performers in the category in recent years. It invests across emerging and fast-growing companies and adjusts exposure actively across sectors. The fund’s NAV is Rs 284.74 and AUM is Rs 29,288 crore.

The expense ratio is 0.71%. This is around the category average and implies investors pay a reasonable cost for active management. Small-cap funds often carry higher costs than large-cap funds due to deeper research and liquidity needs. At this level, the fee does not weigh heavily on long-term returns. The fund is tagged as “very high risk.”

In the past year, the fund dropped by 4.09%. On the contrary, over five years, it has compounded at 35.63%, ahead of the Nifty Smallcap 250 TRI’s 27.6%.

#2 Nippon India Small Cap Fund

Nippon India Small Cap Fund is among the largest in its segment. The fund’s NAV is Rs 190.81, and it manages Rs 66,136 crore.

The expense ratio is 0.64%, lower than the category average, helping investors retain a greater share of returns. The fund is rated in the “very high risk” category.

Over the past year, the scheme gave a negative return of 5.38%. Across five years, however, it has delivered 33.85% CAGR versus 27.6% for the Nifty Smallcap 250 TRI.

#3 Invesco India Smallcap Fund

Invesco India Smallcap Fund manages Rs 8,055 crore with an NAV of Rs 47.63.

The expense ratio is 0.40%, low for an actively managed small-cap fund and a plus for cost efficiency. The scheme is categorised as “very high risk.”

In the past 12 months, the fund gained 1.23%. But when looked at from a five-year horizon, it has compounded at 32.90% against 27.1% for the BSE 250 SmallCap Index, beating its benchmark.

#4 Bandhan Small Cap Fund

Bandhan Small Cap Fund has an NAV of Rs 51.81 and AUM of Rs 15,738 crore.

The expense ratio is 0.41%, moderate for this category and well within the range that supports active management. The fund is tagged as “very high risk.”

Over the past year, the scheme has barely given a mere return of 0.10%. Its five-year CAGR is 32.74% versus 28.15% for the BSE 250 SmallCap TRI, its benchmark.

#5 Tata Small Cap Fund

Tata Small Cap Fund has an NAV of Rs 44.21 and assets of Rs 11,637 crore.

The expense ratio for the fund is 0.33%, among the lowest in the peer set, a clear cost advantage for long-term investors. The fund is classified as “very high risk.”

In the past 12 months, the fund gave a negative return of 9.80%. However, the same fund in the span of five years has compounded at 31.56% compared with 25.0% for the Nifty Smallcap 100 TRI.

Here’s a snapshot from the Screener:

The investor’s takeaway

Short-term returns can be misleading in small-caps. These funds show that time and discipline matter more than short bursts of performance. Evaluate small-cap schemes over longer horizons and ensure they fit your risk profile and asset allocation.

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.